Small-cap stocks may be in the midst of a much-discussed rebound. While that may surprise some, given the challenges posed for small-caps by high interest rates, there is good reason for it. Small caps remain much cheaper than they have been historically. That presents an intriguing opportunity to get into small-caps, especially if a rate cut hits next year. An active ETF like TMSL, particularly, can offer investors a route into some intriguing firms that other strategies might miss out on.

See more: “What the End of Cheap Money Means for Active Investing”

The T. Rowe Price Small-Mid Cap ETF (TMSL) has seen some strong returns as small and midcaps have performed. Its active approach looks for firms that meet either growth or value characteristics, assessed with a bottom-up approach.

The strategy’s managers consider factors like stability, earnings quality, and projected growth rates, among other important attributes. With small caps still facing those high rates, an active approach can help find resilient firms proving their worth in tougher conditions.

Examples of Small-Cap Stocks in TMSL

Dentsply Sirona Inc (XRAY)

For example, TMSL currently holds Dentsply Sirona Inc (XRAY), per VettaFi data. XRAY works in third-party and direct distribution to labs, offices, dentist, orthodontic, and endodontic offices. The firm has returned 9.1% YTD with a forward P/E ratio of 18.86, a sold option found in TMSL.

Tidewater Inc (TDW)

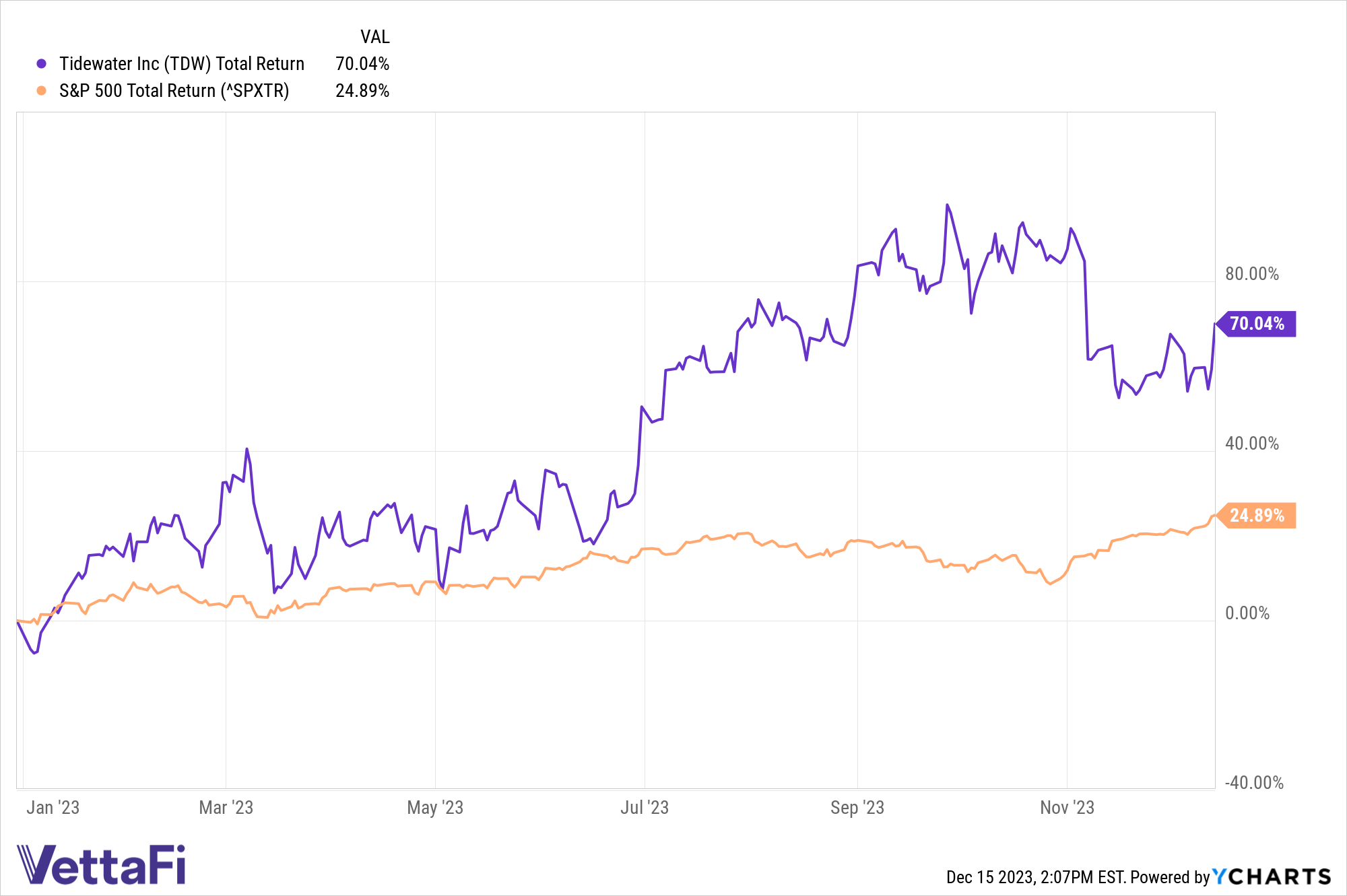

Tidewater Inc (TDW) has significantly outpaced XRAY, returning 70% in that time as of December 15. That more than doubles the performance of the S&P 500 Total Return Index (SPXTR). The firm supports global offshore energy work through service and support vessels.

Small-cap stocks like TDW can appeal in an ETF like TMSL.

OneMain Holdings (OMF)

Finally, TMSL also holds OneMain Holdings (OMF). The company offers personal loans, noncredit insurance, and loan support for acquisitions. A firm that falls in the value category of small-cap stocks, OMF has returned nearly 60% YTD.

Taken together, the above represent just a few examples of the small cap stocks available in TMSL. The strategy, which also invests in mid-cap stocks, has returned 14.3% over the last month. That return outperforms its ETF Database Category and FactSet Segment Averages since its launch in June. For investors intrigued by smaller firms but looking for a strategy that finds durable options amid high rates, TMSL may appeal.

For more news, information, and analysis, visit the Active ETF Channel.