Active investing advocates often tout the ability of active strategies to outperform slower-moving, indexed strategies. That contains some common sense, to be sure, with the adaptability of active strategies empowering them to adjust weekly or even daily. However, advisors rightly look to data and the numbers before making allocations. In this case, a new 20-year study from T. Rowe Price shows that their active funds have outperformed comparable passive strategies on average.

See more: “Slowing Hiring Adds to Active Investing Case”

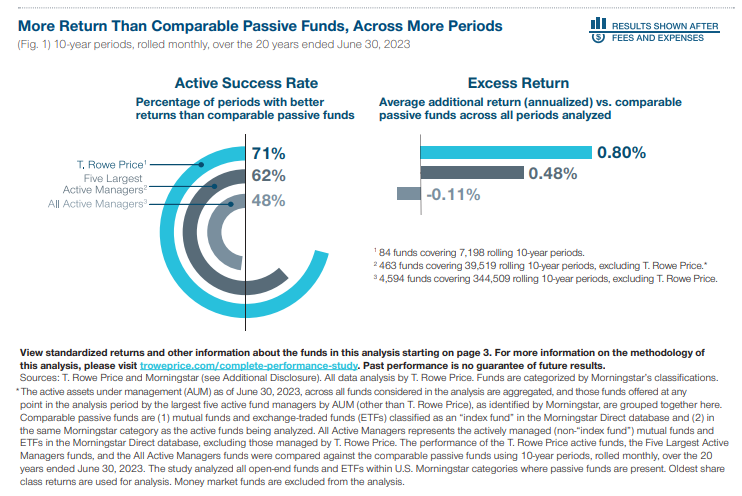

Those strategies outperformed their passive counterparts over 10-year periods when rolled monthly. That finding would contest a common misperception among investors that all active managers cannot outperform passive funds. Not only does the study cite outperformance for active versus passive funds, it also points out that T. Rowe Price’s active funds outperformed passives more often than rival active managers’ strategies.

T. Rowe Price’s research into active investing shows broad outperformance over ten-year rolling periods vs. passives and some rivals.

T. Rowe Price Active Study

Methodology (PDF)

The study defined excess returns as each fund’s performance versus the passive returns average. Active success rate, meanwhile, records the percentage of rolling periods in which an active fund beats its relevant passive returns. The analysis also included fees and expenses to craft a more realistic picture of the report. In summary, T. Rowe Price’s success rate stood out, at 71%, even after fees and expenses.

Consider, for example, the T. Rowe Price Equity Income ETF (TEQI). The research shows that the fund has produced a 14.6% return since inception. It actively invests with a global large-cap view, looking for low price-to-earnings ratios and strong dividend yields. Per its prospectus, it compares itself to the Russell 1000 Value Index, as TEQI also has a value lean.

Per YCharts, based on total return, TEQI has outperformed the Russell 1000 Value Index by 43.2% to 35.3% since TEQI’s launch. The above research looks more in-depth, of course, but one thing is clear: It’s hard to say that active funds don’t outperform passives to a significant degree because the data says otherwise for some managers like T. Rowe Price. With 2023 being a strong year for active, investors may want to revisit their active allocations.

For more news, information, and analysis, visit the Active ETF Channel.