Since their creation almost two years ago, semi-transparent ETFs have proliferated the market at a significantly faster rate than ETFs did when they were first introduced, according to data from the New York Stock Exchange.

Considering their rapid growth within a relatively short period of time, the NYSE decided to look at the early successes of semi-transparent ETFs, including the market’s increase in assets under management, early product diversity, well-functioning secondary markets, and what’s on the horizon.

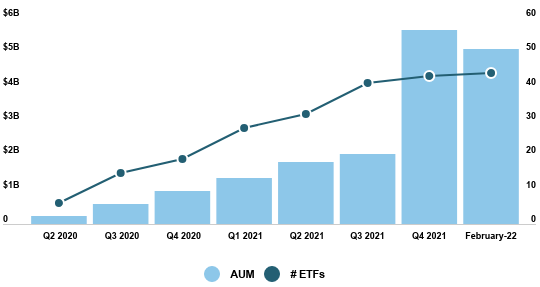

To date, the market includes 44 ETFs from 14 asset managers with total combined assets of $5.1 billion. By comparison, on the two-year anniversary (November 2010) of the fully transparent domestic equity ETF market, there were just five ETFs from four asset managers with total combined assets of $46 million. While the industry has evolved over the last 15 years, it’s remarkable how quickly both issuers and investors have embraced these innovative new structures.

Growth of Active Semi-Transparent ETFs

Source: FactSet, 2/14/2022

Over the last six months, seven new ETFs have launched across four managers. An additional 15 asset managers or so have made public filings announcing their plan to enter the market. This activity continues despite the current limitation that these ETFs invest only in U.S. exchange-listed equity securities.

The most recent active ETF launches include Gabelli launching the Gabelli Asset ETF (NYSE Arca: GAST) on January 5, Schwab launching the Schwab Ariel ESG ETF (NYSE Arca: SAEF) on November 16, 2021, and Hartford launching Hartford Large Cap Growth ETF (HFGO) on November 9, 2021.

Other new market entry and product announcements include Principal filing for the Principal Real Estate Active Opportunities ETF in February, IndexIQ filing for the IQ Winslow Large Cap Growth ETF & IQ Winslow Ultra Large Cap Growth ETF in December, Columbia filing for the Columbia Seligman Semiconductor and Technology ETF in December, Thrivent filing for the Thrivent Small-Mid Cap ESG ETF in December, and DoubleLine filing for the DoubleLine Shiller CAPE U.S. Equities ETF in October.

Two years in, and “asset managers are poised to take advantage of their additional flexibility to shield alpha techniques when desired, and investors and allocators are showing that they continue to value the accessibility and efficiency these ETFs provide,” according to the NYSE.

The NYSE poses two questions it hopes to see answered in 2022: when will the SEC approve structures like the NYSE Active Proxy Structure to invest in non-U.S. securities, and when will the first asset manager complete a mutual fund to ETF conversion?

For more news, information, and strategy, visit our Active ETF Channel.