This week, the VettaFi Voices gathered around the water cooler to talk about fixed income. With so many different options in the “40” side of portfolios that range from CLOs to bank loans, and advisors looking for the best options in the world of debt and bonds, the Voices dig into the areas they see as overlooked in fixed income right now.

Dave Nadig, financial futurist: I’ll kick it off. We’re seeing many advisors focus on duration — and that’s completely legit when you consider the volatility in bonds and the wild swings we’re seeing in the yield curve. It’s also legitimate to be concerned about liquidity in the face of the mini-bank crisis we’ve been enjoying. But meanwhile, without a lot of fanfare, the senior loan market — the senior loan market has delivered.

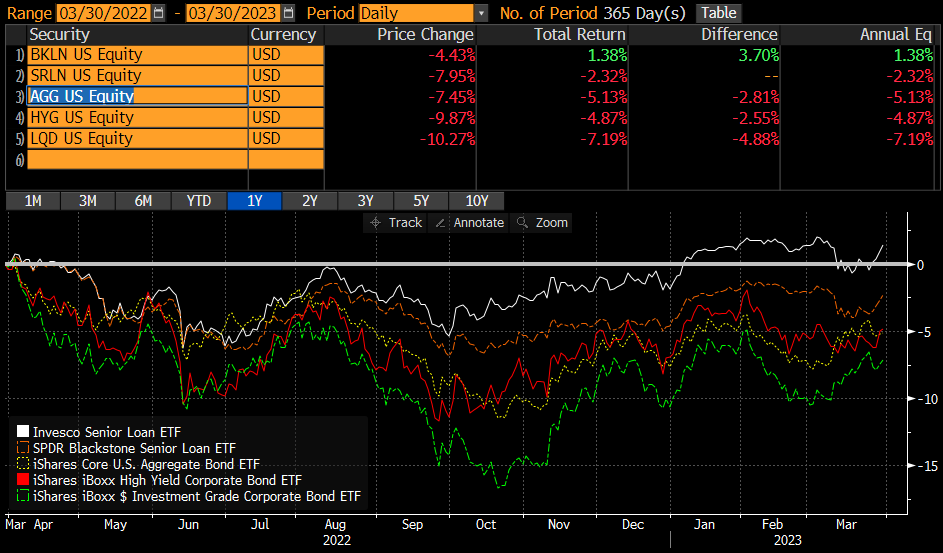

Here’s a quick chart of the two big ETFs (the Invesco Senior Loan ETF (BKLN), and the Blackstone Senior Loan ETF (SRLN) vs. the agg, junk bonds, and investment grade corporates over the last year:

It’s a pretty definitive outperformance, but the fund hasn’t had significant inflows since last fall. There’s reason to be afraid — in the previous banking crisis, senior loans did NOT hold up all that well. But we live in a very different world right now. Still, holdings tend to hang around in the “B” credit range, making this more comparable to a junk ETF than any treasury allocation! But it’s one of those sectors I think could get “oversold” quite quickly and generate real yields for the brave.

It’s also an interesting addition to a group of more traditional bonds because it’s extremely uncorrelated to the iShares Core U.S. Aggregate Bond ETF (AGG) or regular corporates. This is the three-year matrix:

So buyer beware, but real diversification exists.

Todd Rosenbluth, director of ETF research: That’s a good investment style that is under the radar this year. The floating rate nature of senior loans seems helpful compared to high yield corporate bond ETFs like HYG, where the duration is around four years. Senior loan ETFs are also a place where advisors can potentially turn to active management with ETFs like SRLN, which you list above, or the PIMCO Senior Loan Active Exchange-Traded Fund (LONZ).

We have seen sentiment toward high yield fixed income improve, but uncertainty remains. So focusing on BB-rated bonds could be a good way to go. I wrote about this recently, too, focused on the iShares Fallen Angels USD Bond ETF (FALN) and the VanEck Fallen Angel High Yield Bond ETF (ANGL), which own the bonds that were recently downgraded to BB from investment grade status — lower risk than traditional high yield and still appealing 7% plus yields. The BondBloxx BB-Rated USD High Yield Corporate Bond ETF (XBB) is just BB bonds, not only the ones that were downgraded but the new issuance ones too. ETF innovation has made advisors more targeted with their fixed income exposure.

I just published a piece that looked at the benefits of diversification bond ETFs provide; I love using target maturity ETFs as the example. For example, the Invesco BulletShares 2025 Corporate Bond ETF (BSCP) and the iShares iBonds Dec 2025 Term Corporate Bond ETF (IBDQ) invest in more than 400 high-quality bonds issued by companies like Goldman Sachs, Microsoft, and Visa. The risk to your client’s portfolio of a downgrade to junk status before 2025 is notably diminished with a broader approach. iShares and Invesco offer these for high yield, which is so much better than building a bond ladder as they cost just 0.10% in fees. That’s nothing compared to selecting the bonds and managing the income directly.

Nadig: Todd, one of the key things to note is that BKLN, SRLN, and LONZ have VERY different approaches. BKLN is indexed, the other two are active, and at least recently, indexing seems to have won out.

Rosenbluth: Dave, yes, you as an advisor would have to believe in active management for the loans space to consider those funds and then look inside to understand what you get. While BKLN has outperformed SRLN in 2023, SRLN was the stronger performer over three years annualized (6.7% vs. 5.9%) and five years (2.4% vs. 2.2%). LONZ is a newer PIMCO fund and, as a pioneer in active fixed income ETFs, is likely worth a look too.

Nadig: They absolutely are going to have their moments, each approach. Playing in the senior loan market differs greatly from rolling up treasuries.

Rosenbluth: Dave, do you have a view on whether there’s white space for more ETF innovation like the targeted approaches BondBloxx has focused on and that I touched on above?

Nadig: I do, however, think the white space is almost necessarily going to be active. The biggest challenge in fixed income is under the hood — there is no “bond market,” there’s a network of dealers and platforms and hundreds of thousands of individual issues worldwide. As soon as you get too narrow, there are a lot of implied choices. BondBloxx and other issuers have done a good job slicing just about as thin as they can with index-based products. I suspect most new innovations will be in active approaches, “smart beta” style quant approaches (although not historically a big winner in bonds), or multi-asset income products.

Rosenbluth: Right, the opportunity for active fixed income ETFs is to pivot to those unloved but appealing areas of the bond market in a more liquid and better structure for price discovery.

Roxanna Islam, associate director of research: Finally catching up on this, and I have to agree about senior loan ETFs! I’ve mentioned senior loans briefly a few months ago when discussing an ETF of closed-end funds called the Invesco CEF Income Composite ETF (PCEF)! Todd mentions them as being “under the radar,” and I think that’s true for retail investors, but it’s been a popular topic among some analysts since the Fed started their rate hikes. But in real life, people are afraid of the word “bank” right now, so not sure how much traction those will gain. The flows show that investors are just looking for safety within fixed income which has been away from corporates and into treasuries.

Rosenbluth: Yes, the under-the-radar phrase was for ETF investors, as BKLN has seen net outflows in the past year and the first quarter of 2023 despite a total return of around 3% YTD.

For more news, information, and analysis, visit the Beyond Basic Beta Channel.