Summary:

- Concerns for the global economy and risk-off sentiment related to bank troubles sent oil prices and energy stocks lower last week.

- In a tough start to the year for energy, MLPs and midstream stand out for their resilience, supported by attractive dividends and fee-based business models.

- Whether bullish or cautious, investors can adjust their energy exposure to align with their macro outlook.

As a banking crisis unfolded, investors may have been surprised by the weakness seen in the energy space, particularly on March 14 and 15 when oil prices fell by approximately 5% each day. The commodity selloff and a general risk-off sentiment pressured energy stocks broadly, but some subsectors of energy weathered the volatility better than others. If you are using energy stocks or midstream for income, yields have become more enticing. This note discusses the recent weakness in oil prices and energy stocks and what may lie ahead. For a more in-depth discussion of recent events, please join our webcast on Wednesday, March 22, at 2 p.m. ET (register here).

Banks disturb the relative peace in oil markets and send energy stocks lower.

Up until last week, West Texas Intermediate (WTI) oil prices had mostly been trading in a relatively narrow range since mid-November between $75 to $80 per barrel (bbl). The stability was particularly striking after the volatility seen for much of 2022 as shown below. However, concerns for the global economy and risk-off sentiment related to bank troubles quickly disturbed the relative peace in oil markets seen for much of the last five months and sent prices spiraling in short order to lows last seen in December 2021.

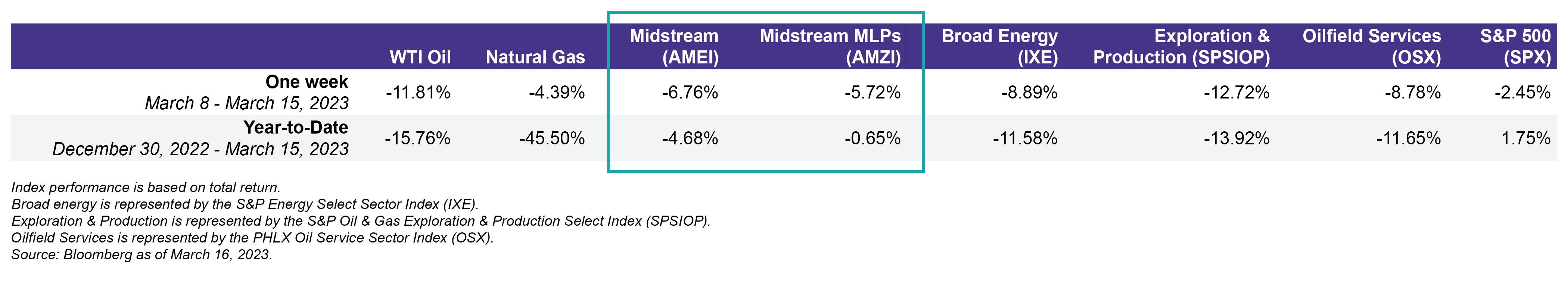

Oil prices can be very sensitive to the outlook for the global economy given the implications for demand, and as a volatile commodity, oil can take a hit when there is a degree of panic in financial markets. Pressure on oil and other energy commodities and a risk-off environment often translates to weakness for energy stocks. The table below shows performance for oil, natural gas, and energy benchmarks compared to the S&P 500 for the week ended March 15 and year-to-date. While all energy indexes are outperforming oil prices YTD, MLPs and midstream stand out for their resilience this year and during a very volatile week. MLPs are only barely negative this year on a total-return basis. MLPs are represented by the Alerian MLP Infrastructure Index (AMZI), and midstream is represented by the Alerian Midstream Energy Select Index (AMEI). Admittedly, past performance is water under the bridge, so the question for investors is what to do now.

Is it time to buy riskier energy stocks or time to get defensive?

For energy investors, recent events have perhaps created some opportunities or have provided motivation to shift towards defensive investments. There are admittedly some challenges facing broad energy this year, particularly producers, including lower commodity prices and generally worsening financial metrics after a banner 2022 (read more). Investors likely need to be more selective with their energy exposure this year after practically everything in oil and gas outperformed last year.

From a commodity price perspective, early 2023 was expected to be a more vulnerable time for oil prices as Russian supplies remain largely resilient and demand from China slowly ramps. In short, oil supply is outpacing demand in the first half of this year. However, the International Energy Agency forecasts that global oil demand will increase by 3.2 million barrels per day (MMBpd) from 1Q23 to 4Q23 to reach record levels, largely driven by China. This could provide more fundamental support for oil later in the year – especially if Russian supplies start to fall more meaningfully. Natural gas prices have struggled for months, and it seems like the downside risk at this point should be relatively modest (read more). An improvement in commodity prices would likely be supportive for energy stocks.

Whether you are bullish or cautious, below are a few scenarios and prescriptions. Clearly, these are simplified examples and should be weighed against an investor’s time horizon, risk tolerance, and other individual considerations.

- You are concerned about the economy, commodity prices, or recession risk and want to position defensively. Within energy, midstream MLPs and corporations tend to be more defensive because they provide services for fees and are less exposed to commodity prices. This has clearly been displayed so far in 2023 and in past recessions (read more). The integrated majors like Exxon (XOM) and Chevron (CVX) also tend to be more defensive, but the attractive yields from energy infrastructure can add to their defensiveness by boosting total return. As of March 17, AMZI and AMEI were yielding 8.4% and 7.0%, respectively.

- You think energy is still in a broad upcycle and have been looking for an entry point. If you can weather volatility in the near term and are constructive over a longer time horizon, then it may be a good time to add energy exposure following the recent weakness. If wanting more commodity price exposure, an investor may favor Exploration and Production companies (i.e., oil and gas producers) over a broad energy allocation.

- If you are looking to enhance the yield of an income portfolio, MLPs/midstream are attractive. With recent price weakness, energy infrastructure yields are sitting above their ten-year averages. The events of the past week or so do not threaten the positive trends seen for midstream/MLP dividends and the strong bias towards dividend growth that has been driven by solid free cash flow generation. Midstream’s fee-based business model results in stable cash flows. In the case of AMZI, a yield above 8% from an index with a 76.0% weighting to investment-grade companies as of March 17 is pretty compelling.

Bottom Line:

The banking crisis sent a shockwave through energy markets last week. Whether investors see it as a temporary overreaction or a sign of more pain to come, energy allocations can be adjusted to align with one’s outlook. For midstream/MLP investors, the space remains well positioned to provide both attractive income and defensive energy exposure – desirable characteristics in a tough tape.

For more news, information, and analysis, visit the Energy Infrastructure Channel.

AMZI is the underlying index for the Alerian MLP ETF (AMLP) and the ETRACS Alerian MLP Infrastructure Index ETN Series B (MLPB). AMEI is the underlying index for the Alerian Energy Infrastructure ETF (ENFR) and the ALPS Alerian Energy Infrastructure Portfolio (ALEFX).

Related Research:

4Q22 Midstream/MLP Dividends: Growth Continues

Still Plenty to Like About Midstream/MLPs in 2023

Unhappy Holidays for Natural Gas Prices May Not Last

Recession Fears Roil Energy: What Investors Should Know

vettafi.com is owned by VettaFi LLC (“VettaFi”). VettaFi is the index provider for AMLP, MLPB, ENFR, and ALEFX, for which it receives an index licensing fee. However, AMLP, MLPB, ENFR, and ALEFX are not issued, sponsored, endorsed, or sold by VettaFi, and VettaFi has no obligation or liability in connection with the issuance, administration, marketing, or trading of AMLP, MLPB, ENFR, and ALEFX.