Alternatives hit their stride in the chaos of 2022’s markets, often capitalizing on volatility and a changing market regime. Managed futures were some of the best-performing alternatives of 2022 and these were the most-read articles by advisors in a year of equity and bond underperformance and prolonged volatility.

Hedge Against Market Volatility With This Managed Futures Fund

This was the most popular article regarding strategies that invest in futures in 2022. Written at the beginning of May in the middle of the S&P 500’s weeklong drop that resulted in an 8% loss and the sharpest decline since 2020 and one day after the first 0.50% interest rate increase that would catapult to 0.75% in subsequent FOMC meetings, advisors were in full research mode for volatility mitigation strategies.

That volatility has persisted throughout the year and is something that managed futures and funds that invest in the futures market — where knowledgeable investors have the ability to short underperforming asset classes — have capitalized on.

This Managed Futures ETF Becomes First to Be Rated Five Stars

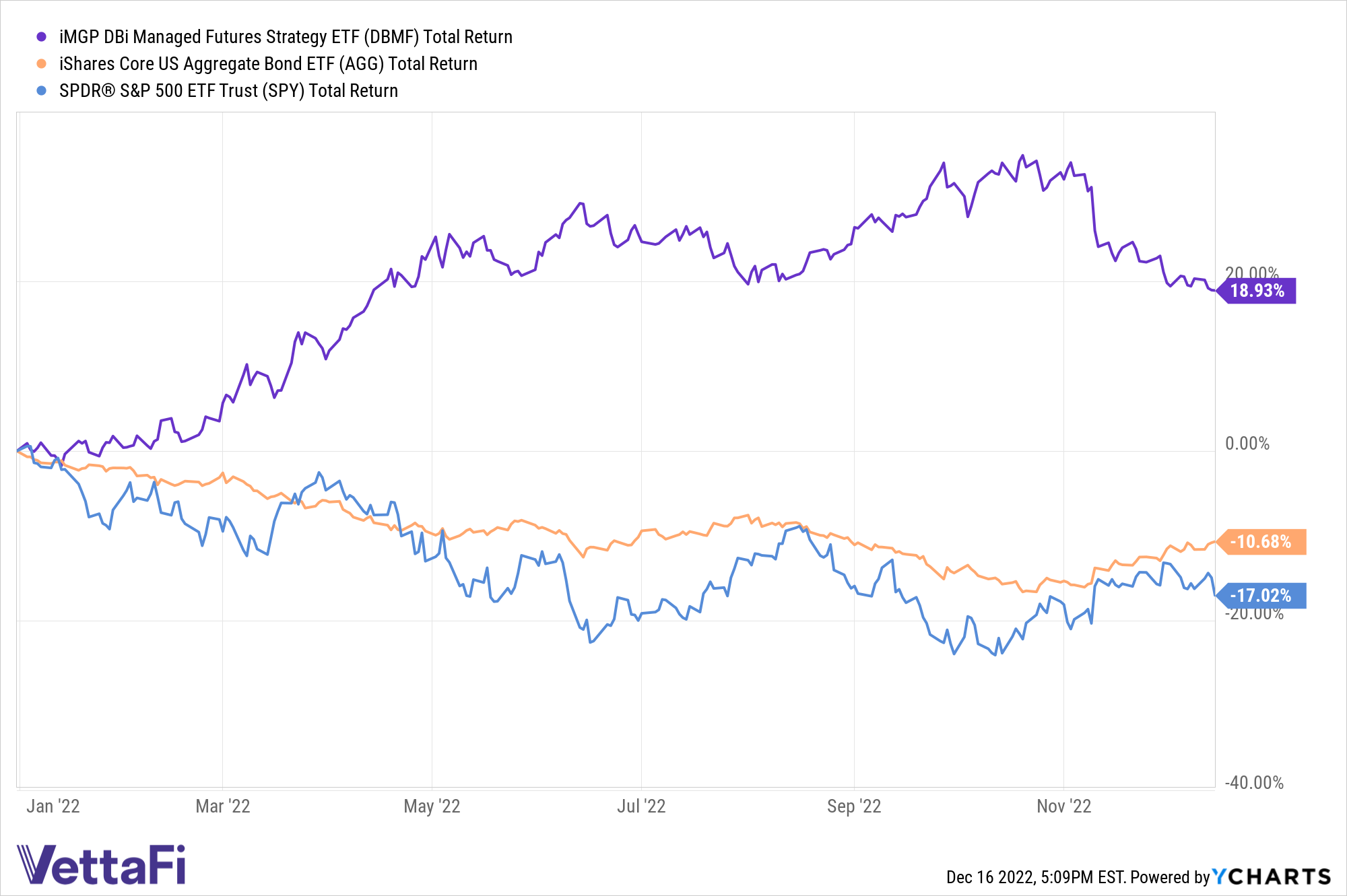

This article tells the story of the incredible performance and success of the iMGP Dbi Managed Futures Strategy ETF (DBMF) in 2022. The fund that began the year with an AUM of around $60 million brought in $1 billion in new inflows in 2022 and when it gained its five-star rating from Morningstar, it was one of only two alternatives ETFs to have done so.

DBMF is a fund that’s designed to capture the performance of markets regardless of which direction they’re moving in and seeks to replicate the average performance of the 20 largest Commodity Trading Advisor (CTA) hedge funds. It’s the ultimate trend-following strategy that uses quantitative analysis and modeling to determine how asset classes are actually trading and often captures trends of changing market regimes before investors respond.

Why Managed Futures Are the Crisis Alpha Generators

This was the third most popular managed futures story in 2022 on the VettaFi platform and it isn’t a stretch to understand why. Managed futures as a recognized, distinct strategy got their start around the time of the Financial Crisis of 2008 when their ability to offer standout performance during the market dislocation earned them their reputation as crisis alpha generators.

In the long lull of relative quiet for markets since 2008, these strategies offered dependable but middling performance compared to the strong performance of equities over the same period that flourished in a low-rate environment with little volatility. Most advisors and investors, therefore, had little familiarity with the strategy coming into 2022 but the outperformance of managed futures funds this year when equities and bonds have suffered as well as their extremely low correlation to both asset classes have pulled the strategy into the spotlight for much of the year.

This particular piece was written in May, at the beginning of the Fed’s ramped-up, aggressive rate hiking cycle and shortly after Russia invaded Ukraine when global and domestic markets were in turmoil with little clarity. Advisors were looking to understand not just what managed futures were (futures investing remains a murky morass of complexity for most investors), as well as the why’s of their performance potential and hedging opportunity for portfolios.

For more news, information, and analysis, visit the Managed Futures Channel.