Volatility has been the market keyword for 2022 so far, with stocks rising and falling on each new headline; whether it’s inflation, Federal Reserve meetings, or earnings, markets remain choppy. The most recent Fed meeting this month saw many advisors and investors eyeing the potential for recession in the long-term, and markets plummeted as investors digested the reality of an aggressive Fed gearing up to fight inflation.

Crisis alpha is still a newer concept in the financial world, created by Kathryn Kaminski, Ph.D., CAIA, current chief research strategist at AlphaSimplex Group, shortly after the financial crisis of 2008–2009. Crisis alpha strategies are investment opportunities that are able to find the pockets of profit during times of severe market stress and dislocations, including within fixed income, currencies, equities, commodities, and more.

These types of strategies are unique in that they are “exploiting the persistent trends that occur across markets during times of crisis,” wrote Kaminski in a paper, “In Search of Crisis Alpha: A Short Guide to Investing in Managed Futures.”

What is important to note is the focus on trends that happen specifically in crisis markets, trends that managed futures are particularly well-equipped to capture and profit from. Most investors are typically long on equities, so when equity markets go down, investors will exit positions in some asset classes while entering positions in others, creating persistent trends as they seek liquidity. This exiting can either be done on a voluntary basis or involuntarily as risk limits and leverage mechanisms force investors out of positions and exposures; the greater the drawdown, the higher the number of positions exited.

What Managed Futures Are and Why They Work in Volatility

Managed futures operate, as their name implies, in the futures market, where they take long or short positions on a variety of asset classes, both through futures investing and through options that allow for targeted positioning specific to the current market environment and trends.

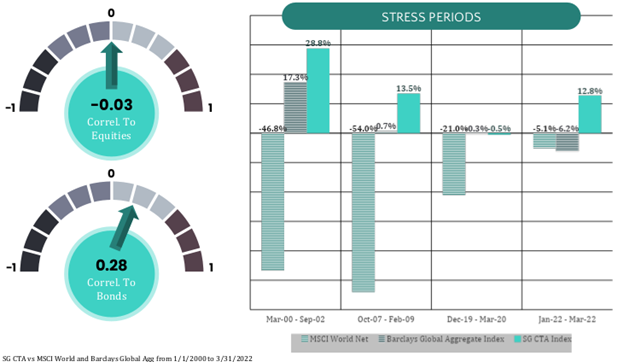

The futures market is one of the most liquid markets with high credit solvency, even in times of market crisis, and managed futures have extremely low correlations to equities and bonds as a whole. As investors reduce their exposures to equities during market volatility and drawdowns, it introduces illiquidity to the equity market; it’s also easy for investors to fall into so-called credit traps during market downturns and volatility as more companies are likely to experience credit solvency issues in times of economic hardship.

Image source: Dynamic Beta Investments

The iMGP DBi Managed Futures Strategy ETF (DBMF) is a managed futures fund designed to capture performance no matter how equity markets are moving. The fund seeks long-term capital appreciation by investing in some of the most liquid U.S.-based futures contracts in a strategy utilized by hedge funds.

DBMF allows for the diversification of portfolios across asset classes that are uncorrelated to traditional equities or bonds. It is an actively managed fund that uses long and short positions within derivatives, mostly futures contracts, and forward contracts. These contracts span across domestic equities, fixed income, currencies, and commodities (via its Cayman Islands subsidiary).

The position that the fund takes within domestic managed futures and forward contracts is determined by the Dynamic Beta Engine. This proprietary, quantitative model attempts to ascertain how the largest commodity-trading advisor hedge funds have their allocations. It does so by analyzing the trailing 60-day performance of CTA hedge funds and then determining a portfolio of liquid contracts that would mimic the hedge funds’ performance (not the positions).

DBMF takes long positions in derivatives with exposures to asset classes, sectors, or markets that are anticipated to grow in value and takes short positions in derivatives with exposures expected to fall in value. Under normal market conditions, the fund seeks to maintain volatility between 8%–10% annually.

DBMF has a management fee of 0.85% and an additional 10 bps for other expenses listed in the prospectus.

For more news, information, and strategy, visit the Managed Futures Channel.