VettaFi editor-in-chief Lara Crigger appeared in Sowing Seeds: The Popularity of Agricultural Commodities ETFs to discuss commodities for The Money Show’s ETF Investing Virtual Expo.

Agricultural commodities have had a big year as inflation surged and scarcity issues brought about by supply chain strain and geopolitical conflict have inspired investors to explore agricultural commodities ETFs. Agricultural funds, such as the Invesco DB Agriculture Fund (DBA) and the Teucrium Corn Fund (CORN) represent just a tiny pocket of the commodities ETF landscape. Crigger noted that “at the same time, however, assets in this sleepy corner of the ETF land have grown tremendously lately. Over $1 billion in new net cash has gone into these ETFs year-to-date.”

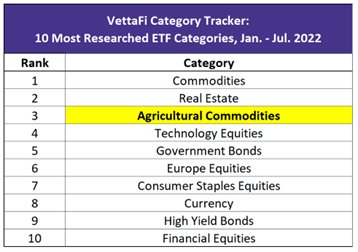

On the VettaFi Category Tracker, agricultural commodities have seen a huge spike of interest and research in the first half of the year, becoming the third most popular category behind only broader commodities and real estate.

The Russian invasion of Ukraine has been a big catalyst for agricultural performance, as both countries account for 15% of the world’s corn production, 30% of the world’s wheat production, and 80% of its sunflower oil. Crigger noted that “while the Russia-Ukraine war was a significant part of the story behind agricultural commodities ETFs’ recent performance, it’s not the whole story.” Crigger pointed to DBA’s performance, which had a compelling upward trajectory before the war started.

Crigger explained that “the pandemic wasn’t the only driver here. But it was a stone in the lake, causing ripples outward. The pandemic led to lockdowns — one ripple — which led to disruptions in energy production and supply, including in oil and oil byproducts, another ripple. Disruptions in oil supply led to a reduced supply of petroleum-based fertilizer — yet another ripple. Less fertilizer means fertilizer becomes more expensive, which leads to rising cost of production for growing pretty much every crop on the planet, which in turn leads to rising food prices, and of course inflation. Ripple, ripple, ripple.”

In the past few months, there has been some relief, with food prices slipping 8.6% in July, but the United Nations is anticipating that this price won’t hold.

Reasons to Get Into Agricultural Commodities

It could be easy for investors to believe that they’ve missed the window on commodities, but Crigger noted several reasons that agricultural commodities are worth considering. “Data shows that agricultural commodities possess low correlations to stocks and bonds — and even to other commodities,” Crigger said, noting their value as a diversification tool. Crigger also pointed out that Teucrium’s research shows that four of the last five major market corrections of greater than 10% have resulted in agricultural commodities outperforming broad large-cap stocks.

Another factor to consider is inflation. Though many people think we might have hit peak inflation, according to Crigger food prices are likely to remain elevated due to the weather. “The roots of the high food prices that we’re currently seeing start not with the Russia-Ukraine war or even with supply chain challenges that kept barges locked in port for the better part of two years, but with the 2019-2020 growing season. That was the first year of the La Nina weather phenomenon.”

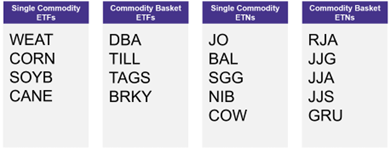

Between changing global climates and geopolitical tensions, Crigger sees agricultural commodities as being a compelling investment in the medium term. There is a range of options investors can explore, from single commodity ETFs to commodity basket ETFs, to ETNs.

For more news, information, and strategy, visit the Commodities Channel.