The war in Ukraine has disrupted the country’s planting and agricultural production. Given that Ukraine is one of the world’s leading exporters of wheat, corn, and other grains, the interruption in the country’s supply should cause an additional rise in agricultural commodity prices in the months ahead.

Invesco’s head of fixed income and alternative ETF strategy Jason Bloom told the Wall Street Journal that the war in Ukraine is a major factor causing supply scarcity for grains and other agricultural commodities.

“The phenomenon should persist at least through year-end, so the outlook for commodity investments is strong,” Aniket Ullal, vice president and head of ETF data and analytics at markets research and analytics firm CFRA, also told the Journal. “Even if the conflict in Ukraine ends, there are so many implications that need to be resolved that will keep commodity prices elevated.”

According to the S&P Dow Jones Indices, the S&P GSCI Agriculture gained 5.8% over the month, driven up by strong performance across the grains and oilseeds complex. Corn was the stand-out performer for the month, with the S&P GSCI Corn rallying 9.6%. Meanwhile, the S&P GSCI Soybean Oil rose to record levels in April, ending the month up 23%. The S&P GSCI gained an additional 5.1% in April, buoyed by another higher inflation reading.

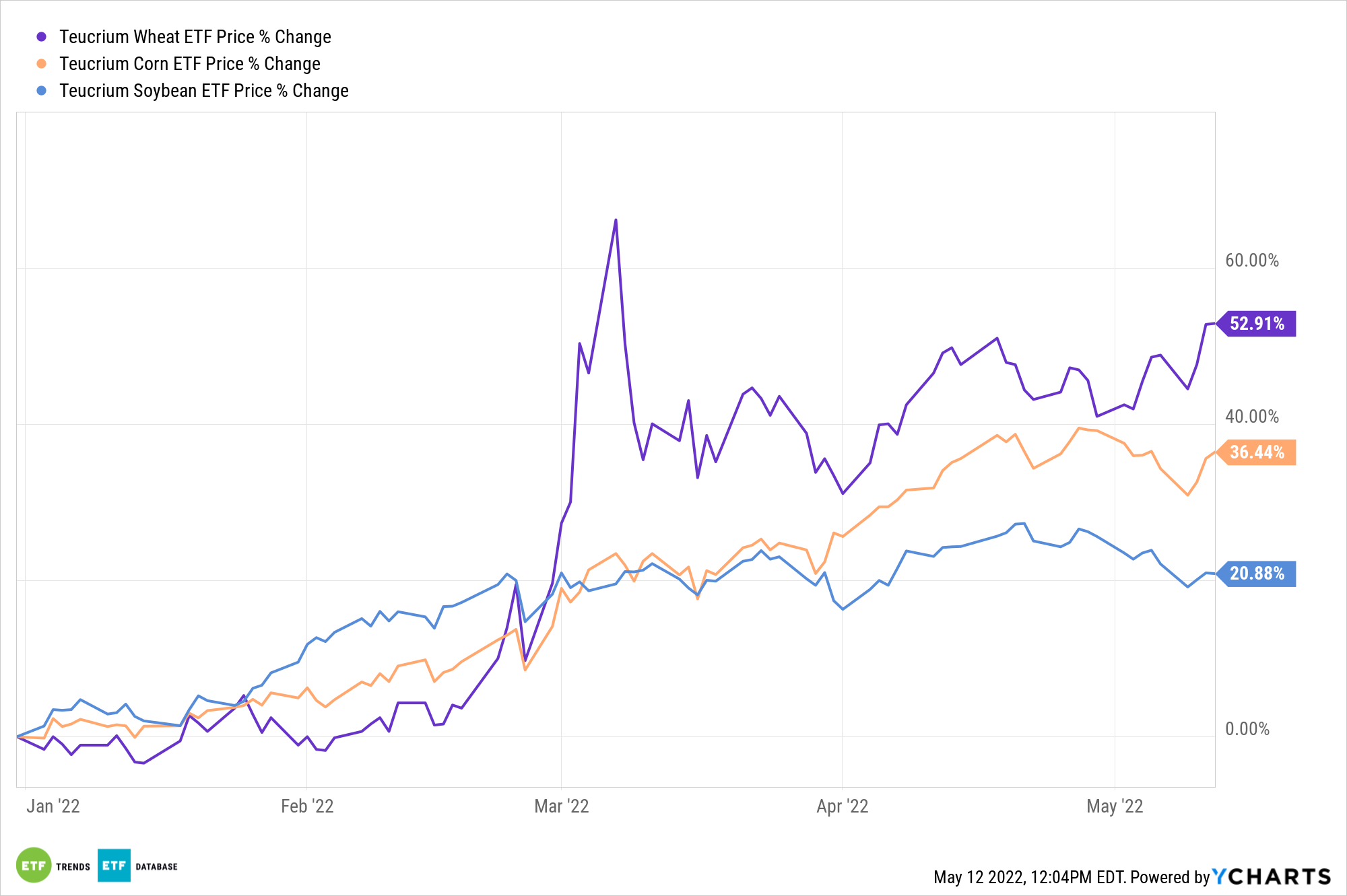

The rise in agricultural commodities has been extremely positive for agricultural ETFs, such as the Teucrium Corn Fund (CORN), the Teucrium Wheat Fund (NYSEArca: WEAT), and the Teucrium Soybean Fund (NYSEArca: SOYB), which have gone up 36%, 53%, and 21% year-to-date, respectively.

“Advisors are increasingly seeking out commodity ETFs to provide diversification benefits as stock and bond funds decline in value,” says ETF Trends’ head of research, Todd Rosenbluth.

For investors looking to buffer inflation, experts believe that commodities may also be beneficial for inflationary periods, making them a valuable hedge against the recent surge in the prices of goods and services over the last year.

It should be noted, however, that futures are volatile. Agricultural ETFs may offer better opportunities as short-term plays for savvy investors with the proper risk profile.

For more news, information, and strategy, visit the Commodities Channel.