At a recent board of trustees meeting, the Teacher Retirement System of Texas in Austin got the green light to add an ESG policy into its overall investment approach as ESG continues to become a central focus for individuals, investors, and businesses across the U.S.

Staff of the $193.1 billion retirement system for Texas teachers found that 70% of large pension funds within the U.S. either have an independent ESG policy that is linked to the pension fund, or they have an ESG overlay that includes ESG language within the governing documents, reported Pensions and Investments.

“TRS will consider ESG factors as it makes decisions consistent with its fiduciary duty to control risk and achieve a long-term rate of return,” said TRS’ CIO Jase Auby in an email. “Recognizing that the understanding of ESG’s potential impact changes dramatically over time, the (ESG) statement also requires an annual report to the board on the trust’s ESG efforts.”

The policy will go into effect on October 1st but is complicated by a recent state law that prevents investments in and requires divestment from businesses that either boycott or cut ties with fossil fuel companies. The governor signed the bill, Senate Bill 13, into law on June 14th, but as of yet the Texas Comptroller has failed to release a list of companies that the law applies to.

TRS believes that there is a work-around available to it, though, as an agent of the government. “A state governmental entity is not subject to the requirements of the bill if the entity determines that the requirement would be inconsistent with its fiduciary responsibility with respect to the investment of entity assets or other duties imposed by law related to the investment of entity assets,” as described in a legislative report on July 16th delivered to the board trustees.

PLDR Invests in Companies With ESG as a Fundamental Practice

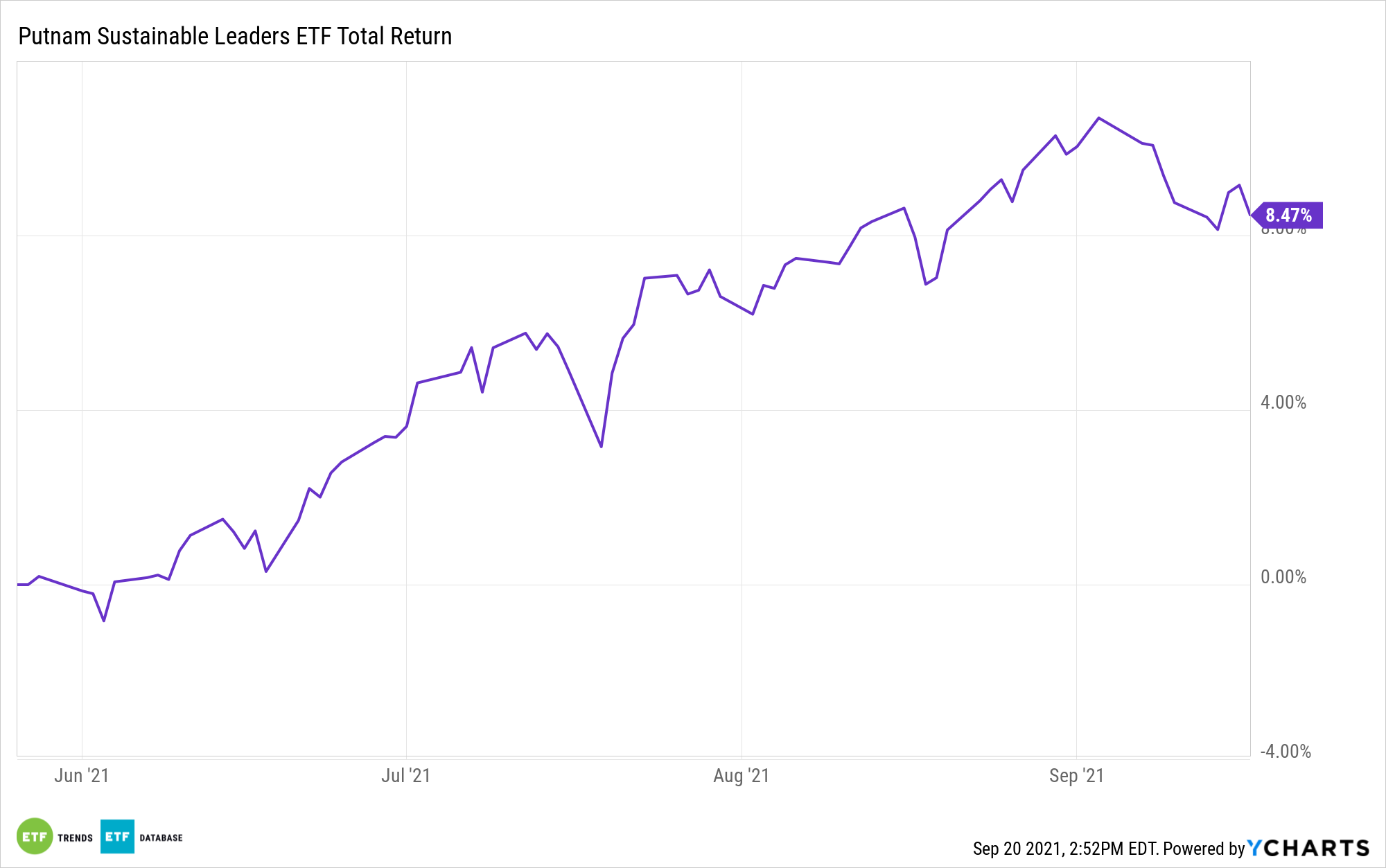

Putnam believes in sustainability and holds ESG practices as a core aspect of its investment approach as ESG becomes an increasing focus for investors, as reflected in the TRS pension fund addition. It’s a trend that is playing out across all sectors and industries, as well as all manner of investment funds.

Putnam’s ESG-focused active sustainability managers are a fundamental part of its work to align shareholder ESG values with investment practices by engaging directly with the companies invested in as to their ESG fundamentals and practices.

The Putnam Sustainable Leaders ETF (PLDR) invests in companies whose focus on ESG issues goes well beyond just basic compliance and for whom ESG is an integral part of their long-term success. These companies have transparent goals and provide consistent, measurable progress updates.

As a semi-transparent fund using the Fidelity model, PLDR does not disclose its current holdings on a daily basis. Instead, it publishes a tracking basket of previously disclosed holdings, liquid ETFs that mirror the portfolio’s investment strategy, and cash and cash equivalents. The tracking portfolio is designed to closely track the actual fund portfolio’s overall performance, and actual portfolio reports are released monthly.

Holdings as of the end of August included Microsoft Corp. at 8.28%, Apple at 7.38%, and Amazon.com at 5.01%. The fund was heavily allocated to information technology stocks (32.41%), followed by healthcare at 15.91% and consumer discretionary at 14.61%.

PLDR has an expense ratio of 0.59% and has 60 holdings as of the end of August.

For more news, information, and strategy, visit the Big Ideas Channel.