As the world works to meet the demands of the Paris Agreement and achieve net-zero emissions, challenges abound. There is going to be no magic bullet for the US to reach a 50% reduction in greenhouse gases by 2030, and a variety of innovations and solutions will be required. As the world evolves towards sustainability and growth, a surprising number of sectors will require innovation and leadership to keep up.

The infrastructure bill contains an ambitious plan to build a network of charging stations to boost and enable electronic vehicle (EV) usage. The prospect of boosted investment and capital has supercharged companies that work directly in the EV space, but it is important to remember that the scale of the pivot to renewable resources is going to reach far beyond the obvious companies. Of course, companies like Tesla will benefit, as will companies that build the charging stations and deal with that technology directly.

But the threads of innovation go even deeper than that. EV charging stations will be useless if the grid can’t handle the demand. With fires, droughts, and severe weather a more commonplace occurrence, this also puts an extra demand on companies that mitigate disasters and rebuild with an eye toward future-proofing. Then there are the companies that focus on alternative energy, which are also going to need to grow and expand to meet increasing demand. With commercial fleets and city buses making the leap to using hybrid or EV fleets, that’s even more pressure on the grid.

As these technologies are implemented, the materials necessary for them to be built need to be extracted and shaped. Then they need to be shipped through supply chains that are also in the process of adapting and evolving. Going back to the infrastructure bill, that $7.5 billion for charging stations is just the tip of the iceberg on what’s going to be needed in the future.

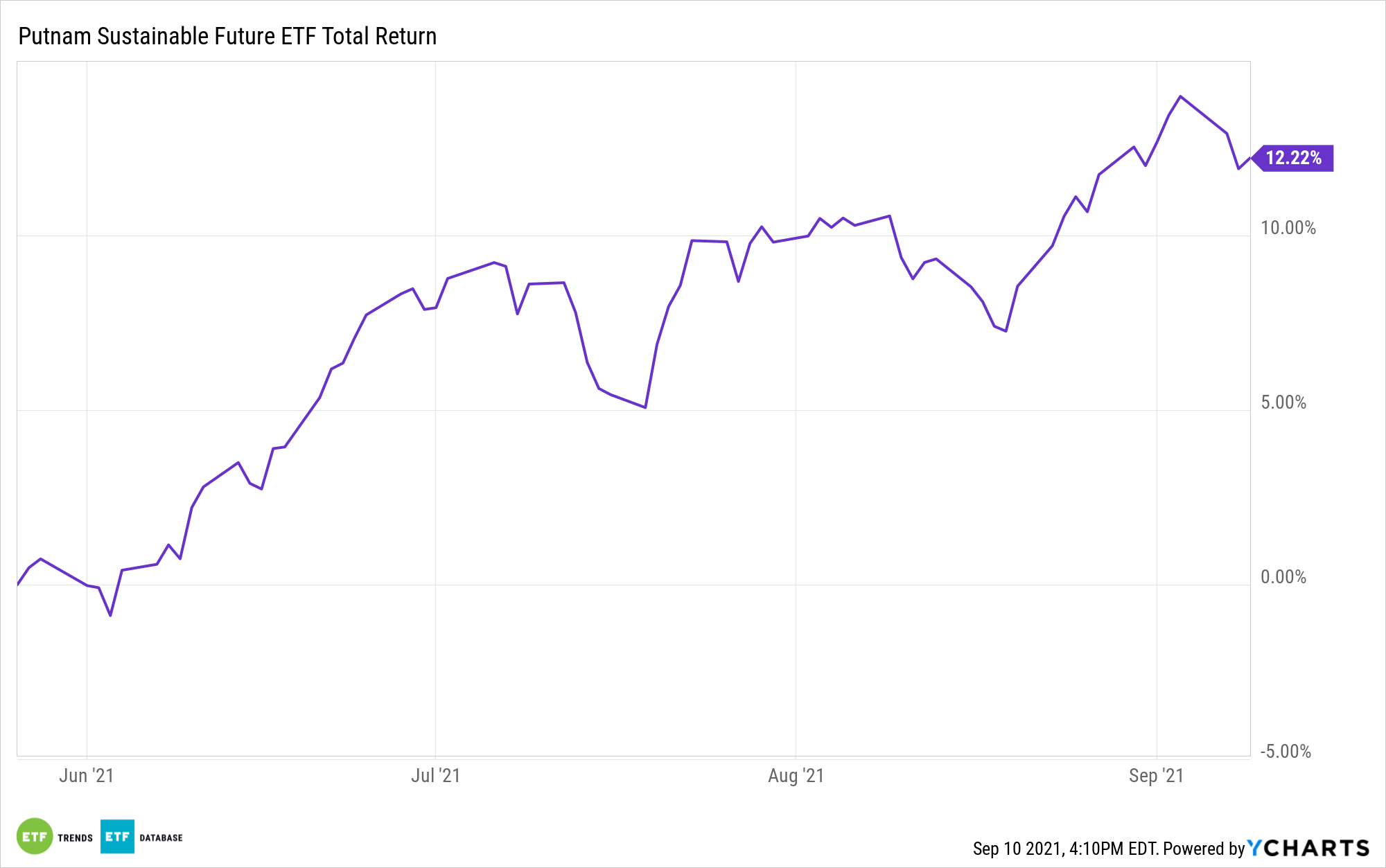

The companies that rise to meet the demands of the post-climate change world present an unprecedented opportunity for growth. Actively managed, future forward funds like Putnam’s Sustainable Future ETF (PFUT) stand to grow tremendously in the coming years. PFUT screens for companies that have sustainability as a key factor in their business. The fund looks at companies that provide health and wellness, companies with egalitarian values, and companies that work towards a healthy, thriving planet.

The infrastructure bill could help sustain a bull market for ESG-focused funds for a long time — but even if the bill were to hit a hurdle before implementation, and even well after the $7.5 billion earmarked for charging stations dries up, the demand for ESG will remain existential. Even if all of the goals of the Paris Agreement are met, the world is still going to face dire climate conditions. The companies that see the problems coming and are already working to solve them are going to continue to have demand and opportunity for a long time.

For more news, information, and strategy, visit the Big Ideas Channel.