As the municipal bond market absorbs more inflows. assets like the IQ MacKay Municipal Intermediate ETF (MMIT) are worth considering.

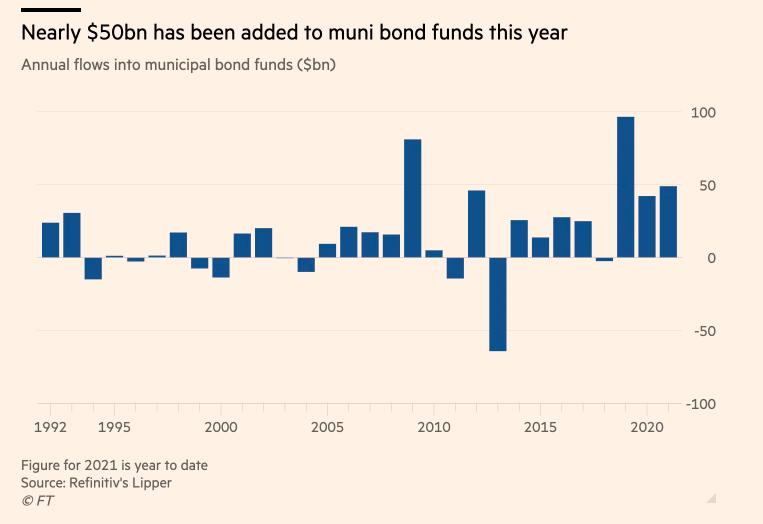

Per a Financial Times article, more investors are “pouring into the $4tn US municipal bond market, pushing yields on debt issued by state and local governments across the country to the lowest level on record. The voracious investor appetite has helped state agencies and governments lock in low borrowing costs and at times raise more money than bankers working on the projects initially anticipated.”

Per the fund description, MMIT seeks current income exempt from federal income tax. The fund is an actively managed ETF and thus does not seek to replicate the performance of a specific index.

Instead, the ETF uses an active management strategy to meet its investment objective. The fund, under normal circumstances, invests at least 80% of its assets (net assets plus borrowings for investment purposes) in debt securities whose interest is, in the opinion of bond counsel for the issuer at the time of issuance, exempt from federal income tax.

The fund does not intend to invest in municipal bonds whose interest is subject to the federal alternative minimum tax. The fund comes with an expense ratio of 0.30%.

Highlights of MMIT:

-

- Active Management: Access ETF structure benefits, while actively managing the unique municipal market characteristics that result from its fragmented and inefficient nature.

- Relative Value Strategy: The team relies on credit analysis, yield curve positioning, and sector rotation to uncover compelling opportunities.

- Tenured Team: The co-heads have worked together for over 20 years and leverage their long-term relationships with municipal dealers to help drive success.

An “Incredible Market” for Muni Issuers

The movement into municipal bonds has been nothing short of incredible, according to certain market experts. A number of reasons such as relative credit stability and tax advantages could be fueling the inflows.

With MMIT, ETF investors can get active exposure to a dynamic fund that can flex with the ebbs and flows of the muni market.

“It is such an incredible market for the issuers,” said Eve Lando, a portfolio manager at Thornburg Investment Management. “Interest rates are so low and the demand is so high.”

For more news, information, and strategy, visit the Alternative ETFs Channel.