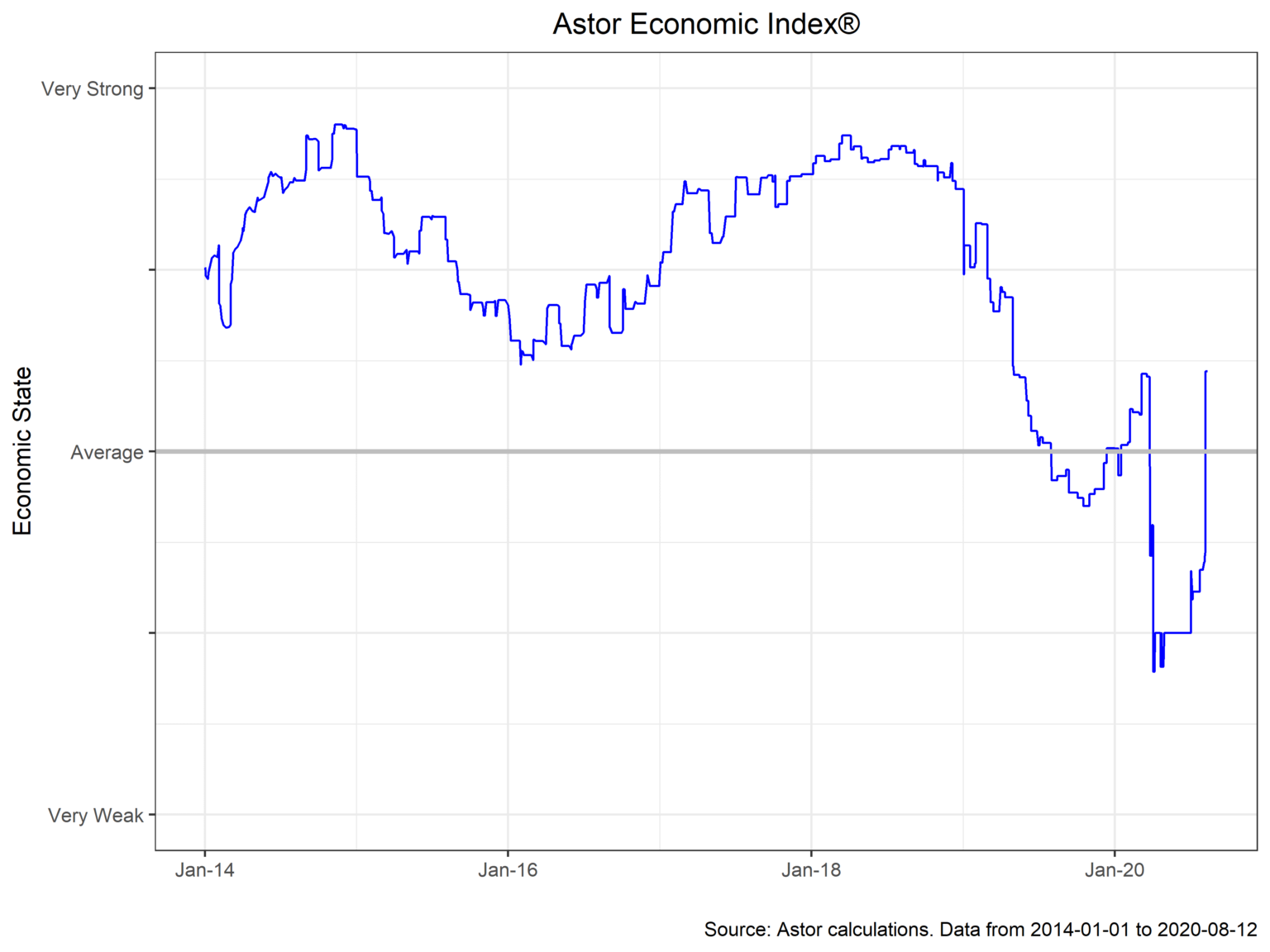

The Astor Economic Index® has had a substantial improvement since the previous nonfarm payrolls report and is now at a level consistent with about average U.S. economic strength. Remarkably, this reading coincides with the AEI’s pre-COVID levels. As the chart below depicts, the AEI has effectively captured the twists and turns of the economy during the pandemic: the AEI fell rapidly during shutdown and has risen quickly during reopening, and the index’s gain on the August 7th payroll report was its largest ever in a one-day period.

The AEI’s recovery has been largely driven by the positive change (rather than the outright level) in the trajectory of the U.S. economy and it would be overly optimistic to conclude the AEI is showing the end of economic contraction.

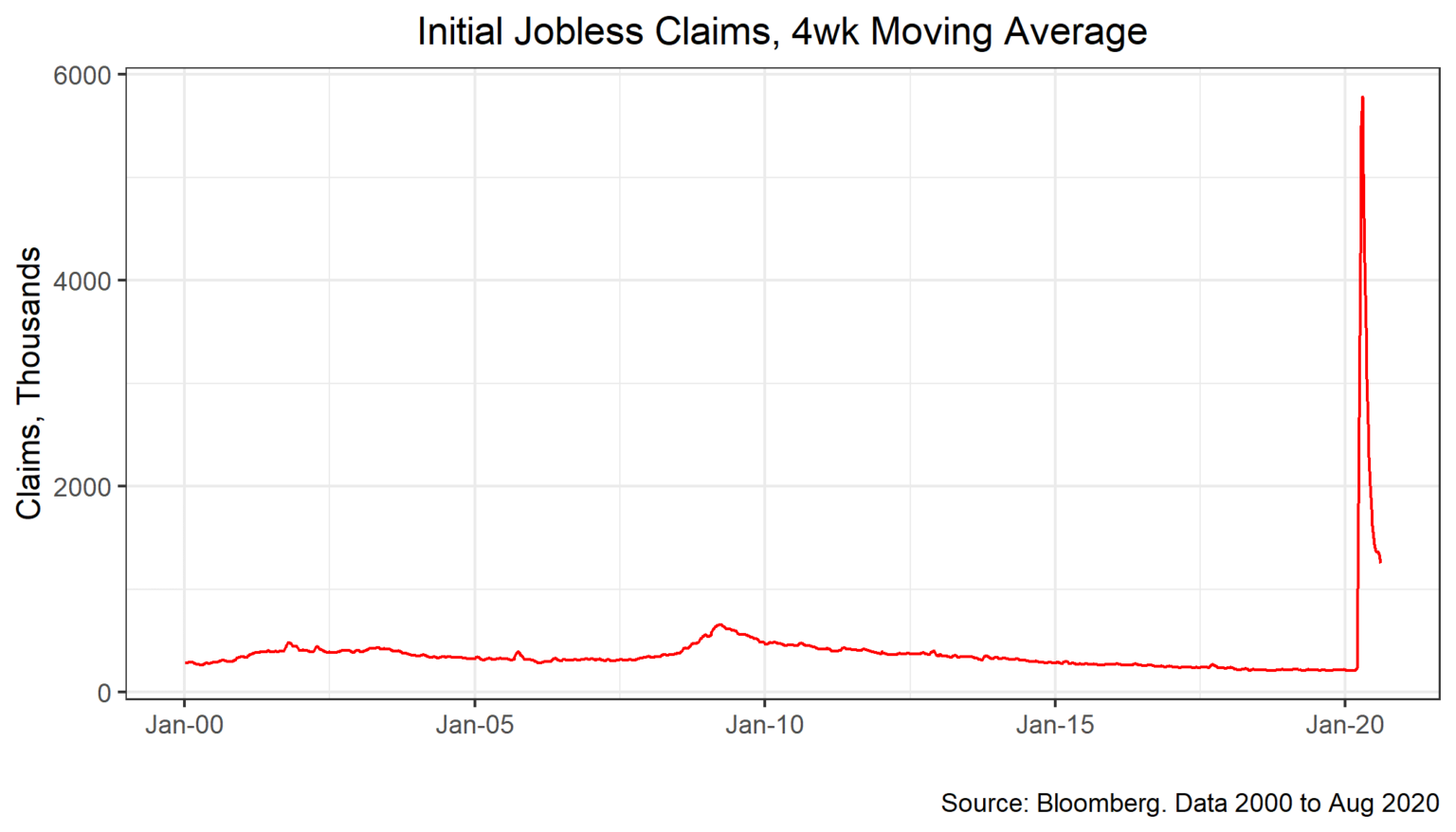

Clearly, the data underpinning the AEI have seen an improvement with the direction of output. While Jobless Claims, our highest frequency picture of the U.S. labor market, has continued its slide downwards. Initial claims (excluding federal PUA claims) most recently printed at 963,000, its first time below 1 million since the pandemic began in earnest. Continuing claims for unemployment benefits also ticked to 15.5m. While both numbers are encouraging, there are abundant reasons to be cautious: initial claims are likely lower than they would otherwise be had federal supplements been renewed by Congress and of course both numbers are historically elevated.

Nonfarm payrolls sustained gains with a rise of 1.76m, slightly above consensus estimates and the third straight month of improvement. With the bulk of the United States continuing to reopen, restaurants and retail workers led the rise, and other sectors booked more tepid gains. This composition also highlights the fragile nature of the recovery – in areas were COVID-19 resurges, many of these gains will be quickly reversed. In aggregate, unemployment remains extremely elevated at 10.3% headline unemployment.

The ISM manufacturing purchasing manager’s index was in expansion territory for a second month at 54.2, and ISM services printed at a blockbuster 58.1. ISM manufacturing was led by gains in orders, but little gains have been seen in the employment subcomponent. In ISM services, the gains previously enjoyed by retailers have now expanded to other sectors like entertainment.