By: Brendan Ryan, CFA

The top question we are being asked from advisors right now: “Is there data that can help me anticipate stock market returns in an election year?” While we have outlined some key data worth examining, our takeaway is we would caution against making any significant investment decisions based on these trends.

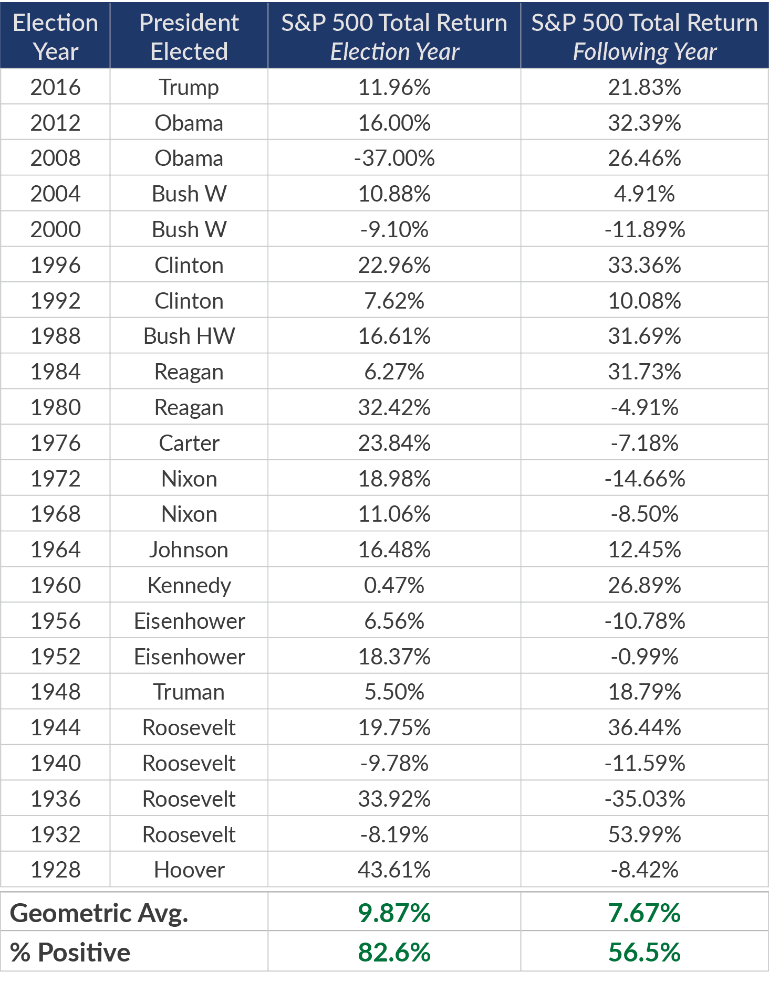

From a historical standpoint, equity markets usually rise in an election year. Since 1928, equity markets (as represented by the S&P 500® Index) have increased in almost 83% of election years. This corresponds to an average annual return of nearly 10%, close to the average return of the S&P 500 during that time. In the year after an election, the market has done a bit worse. However, there is likely little to draw from this as simply removing 1928 and the following year—i.e. the start of the Great Depression—from the analysis results in nearly identical performance for election years and the following year at 8.5%.

Additionally, there is some evidence that markets do a bit better towards the end of a presidential term than near the beginning. However, given that markets are forward looking and election years historically have performed similarly to a random year in the market, we wouldn’t anchor to any sort of election estimate or strategy. In fact, it is likely that the market has a bigger impact on the election than the election does on the market.

Source: Bloomberg, Beaumont Capital Management (BCM). Index returns are gross of fees. One cannot invest directly in an index.

It is important to remember that none of the above results occurred in the vacuum. Exogenous events have always impacted markets in or around election years such as the Great Recession in 2008, 9/11 in 2001, the oil embargo in 1973, and both the Great Depression and WWII in the 1930’s and 40’s to name a few.

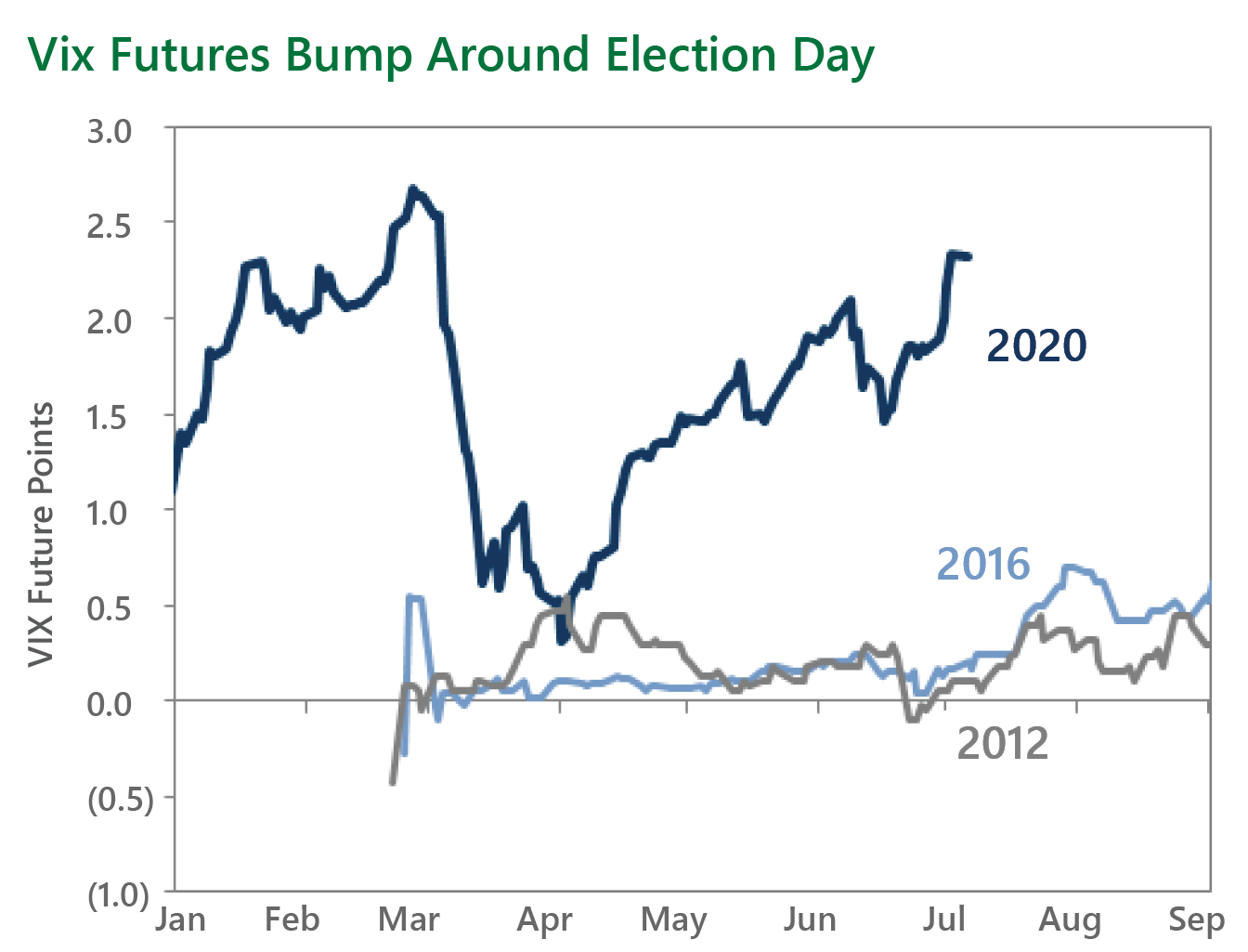

Similarly, 2020 is anything but “normal.” Although the coronavirus has had a far bigger impact on the market’s volatility (and perhaps the election itself), there is evidence that investors believe this election is “riskier” than a normal one. The below chart shows the difference in the implied volatility for options expiring around the election. This is a decent measure for how much additional risk investors are expecting during that particular time period. There is a noticeable increase, specific to the election, that we haven’t seen in other years. Implied volatility has increased 2-3% around this year’s election compared to a more minuscule—sub 1%—increase in the prior two elections.

Source: FactSet, Goldman Sachs Investment Research, from 7/7/20. The chart shows the October VIX future minus the average of the September and November VIX futures.

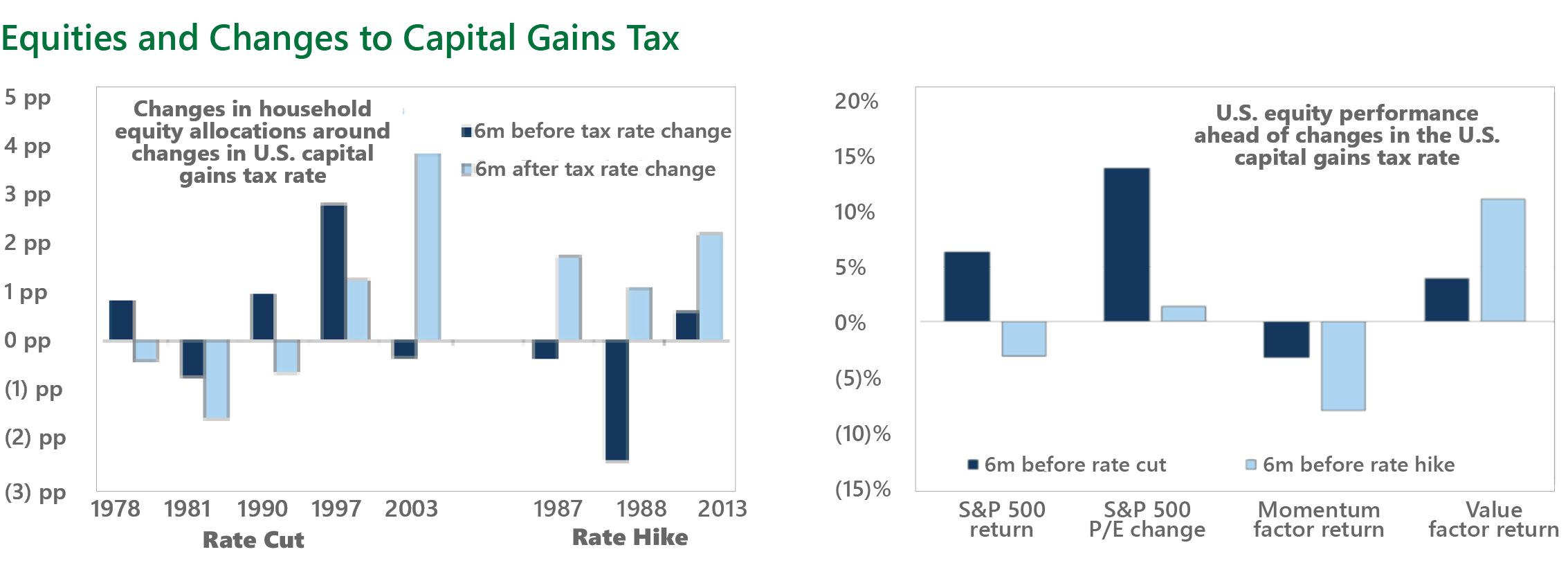

Some of the obvious reasons for this are the large policy changes that could occur if Joe Biden were to be elected, as well as uncertainty surrounding voting procedures due to coronavirus. One key aspect of Biden’s proposed tax plan that could have a direct impact on equity markets is an increase in the capital gains tax. There is some historical precedent that investors will reduce their exposure to equities prior to a capital gains tax increase, which has had a short-term negative impact on market performance in the past. However, typically that impact is short lived and given how low interest rates are at the moment, it seems unlikely investors would permanently change their asset allocations even in the face of increased capital gains—but it is definitely a narrative to monitor.

Source: (left) FRB, Goldman Sachs Investment Research, from 7/7/20; (right) Goldman Sachs Investment Research 7/7/20

One potential off-setting positive is that both Trump and Biden appear in favor of infrastructure spending, which should boost growth in the economy and benefit a large array of equities.

We believe our strategies, which are attuned to how investors behave, should be able to navigate any type of situation even if there is not a clear historical parallel, and we view the potential volatility as an opportunistic environment for our strategies to exploit. As the market continues to incorporate different potential outcomes into its pricing, it will provide our strategies with an indirect view of what may happen, and we expect the systems to reposition accordingly.

This article was contributed by Brendan Ryan, Portfolio Manager at Beaumont Capital Management, a participant in the ETF Strategist Channel.

For more insights like these, visit BCM’s blog at blog.investbcm.com.

Disclosures

Copyright © 2020 Beaumont Capital Management (BCM). All rights reserved.

The views and opinions expressed throughout this paper are those of the author as of August 2020. The opinions and outlooks may change over time with changing market conditions or other relevant variables. The information presented in this report is based on data obtained from third party sources. Although it is believed to be accurate, no representation or warranty is made as to its accuracy or completeness.

This material is provided for informational purposes only and does not in any sense constitute a solicitation or offer for the purchase or sale of securities nor should it be construed as investment advice. Past performance is no guarantee of future results. An investment cannot be made directly in an index. Index returns are gross. “S&P 500®” is a registered trademark of Standard & Poor’s, Inc., a division of S&P Global Inc.

As with all investments, there are associated inherent risks including loss of principal.