The view of copper has turned bullish, as analysts are calling for a turn in the global economy to help support the long term view of the metal. The related exchange traded fund(ETF) can help investors gain exposure.

Credit Suisse just got very, very bullish on copper. Stuart for Ag Metal Miner reports that some analysts say that China will step up its demand for copper in 2011, while a return to normal demand by other countries will push prices up even higher. For that reason, Credit Suisse analysts believe that copper could soar to $10,000 a ton by 2012.

The forecast is backed by supply and demand: inventory has been declining nearly all year, even though right now should be the re-stocking period for copper. [Will the Copper ETF Spike Stick?]

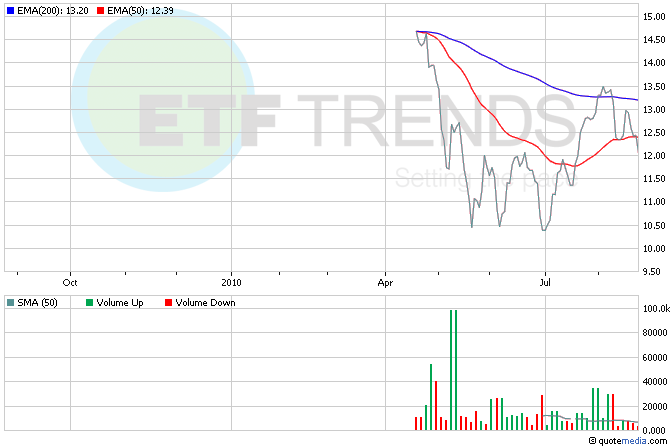

Visit our copper page for more stories about the metal. There is no physically-backed copper ETF, but in addition to the iPath DJ-UBS Copper (NYSEArca: JJC) exchange traded note (ETN), there are two copper miner ETFs. These both can be researched further by clicking on the ticker symbol and viewing the ETF Resume:

- First Trust ISE Global Copper (NASDAQ: CU)

- Global X Copper Miners ETF (NYSEArca: COPX)

Tisha Guerrero contributed to this article.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.