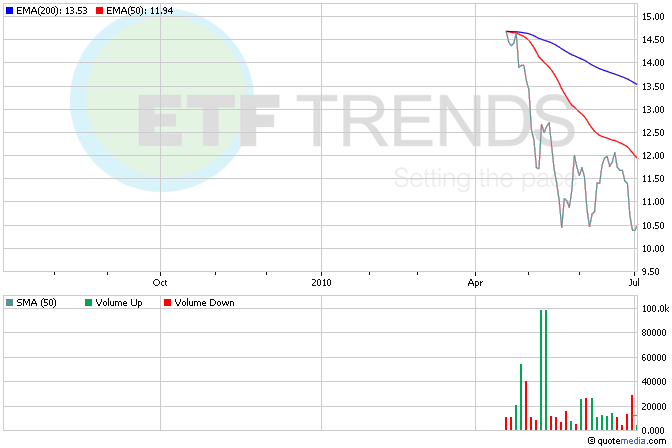

Copper exchange traded funds (ETFs) got a boost on Friday after the unemployment numbers were released, giving the metal a reprieve after losing 17% in the second quarter. But was this jump a blip on the radar or the turning of a new leaf?

This isn’t the first time recently that copper has gotten a short-term lift.

After China announced that it would allow the yuan to float, copper traders perceived the news as bullish and prices increased, comments Julian Murdoch for Hard Asset Investor. This would be a bullish sign for copper; if the yuan were to appreciate, China would be able to buy more copper per yuan. [Steel and Copper ETFs Benefit As Demand Surpasses Pre-Crisis Levels.]

However, the copper’s spot price as compared to the actual available copper in London Metals Exchange inventories still show a difference of almost 10%, calculates Murdoch. Before the yuan announcement, some analysts argued that demand was poor and producers may need to slow production. [Copper ETFs Come Back to Life.]

In analyzing the available copper ETF and ETN options available, Murdoch has concluded that the funds have been more volatile than the underlying metal or the metal’s front-month futures.

For more information on copper, visit our copper category. iPath DJ-UBS AIG Copper ETN (NYSEArca: JJC) is an exchange traded note (ETN) that gives exposure to copper. Otherwise, there are two ETFs that allow investors to play the copper mining sector:

- First Trust ISE Global Copper (NASDAQ: CU). The $20 billion Mexican mining giant Grupo Mexico isn’t included in CU. CU has an expense ratio of 0.70%.

- Global X Copper Miners ETF (NYSEArca: COPX). Rio Tinto (NYSE: RTP), the $111 billion mining giant, isn’t included in this fund’s holdings. COPX has some currency overlay, with 4.78% investment directly in Canadian dollars and small investments in the Mexican peso, British pound and even some short U.S. dollar exposure. COPX has an expense ratio of 0.65%.

Max Chen contributed to this article.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.