WTI crude oil rocketed past $27 a barrel after plunging below $20 recently, on news that Saudis and Russia will mitigate pressure on oil, terminating a price war that has contributed to crude’s incredible crash.

West Texas Intermediate crude futures surged more than 35% or $7 a barrel and are still up 22%, or $4.51 to trade at $24.82 per barrel. International benchmark Brent crude popped 18%, or $4.56, to trade at $29.30 per barrel.

The president later tweeted that a production cut would be “great for the oil & gas industry!” His comments came before a meeting with energy industry executives scheduled for Friday and sent oil markets and ETFs soaring higher.

Just spoke to my friend MBS (Crown Prince) of Saudi Arabia, who spoke with President Putin of Russia, & I expect & hope that they will be cutting back approximately 10 Million Barrels, and maybe substantially more which, if it happens, will be GREAT for the oil & gas industry!

— Donald J. Trump (@realDonaldTrump) April 2, 2020

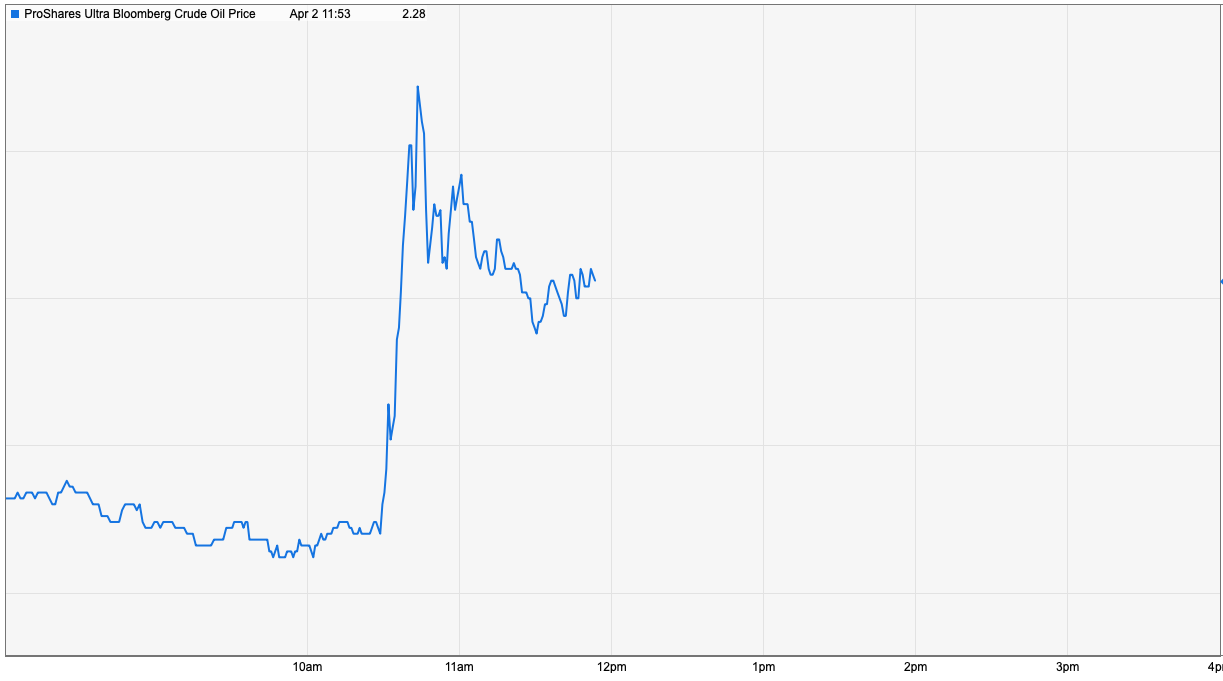

Rocketing crude oil futures sent crude ETFs higher as well, with the United States Oil Fund LP (USO) blasting up 17%, while leveraged fund, ProShares Ultra Bloomberg Crude Oil (UCO) is up a staggering 37%.

Until now, crude oil had continued its barreling downdraft as Saudi Arabia was not backing down from the oil price war with Russia for market share, threatening another increase in its crude oil exports beginning in May, despite a growing global glut amid crashing demand.

“[T]he Kingdom intends to increase its crude oil exports, starting from May, by about 600 thousand barrels per day, bringing the total of Saudi petroleum exports to 10.6 million barrels per day,” an official at the Saudi Arabian Energy Ministry said on Monday, as carried by the official Saudi Press Agency.

“This increase came as a result of displacing crude with natural gas from the Al-Fadhili gas plant, as a fuel for generating electricity, and from the decrease in local demand for petroleum products due to the decrease in transportation from the precautionary measures in place to limit the coronavirus outbreak,” said Saudi Arabia, OPEC’s top producer, and the world’s top oil exporter, which continues to signal an aggressive supply surge amid profoundly depressed global demand.

Earlier last month, the Kingdom said it was planning on releasing the expansion of crude oil volumes on the market, targeting a boost of its crude oil exports to more than 10 million BPD in May, which would set new records.

For more market trends, visit ETF Trends.