By Nyle Bayer, Helios Quantitative Research

Over the past few days, the world has been hit with terrifying news, a viral outbreak has killed at least 80 people and has closed transportation of Wuhan, China, a city of 11 million people. For comparison, consider the population size of New York City or London, then add an additional 20% to that figure, and you will have a better understanding of the magnitude of the lockdown occurring in China. Even if you have little understanding of various viruses and their potential threats on a person’s health, just knowing that an order as huge as shutting down a city of that size has been executed is enough to take the threat of the coronavirus very seriously.

Globalization has not only intertwined economics, but health, communication, travel, culture, and many other facets of everyday life. Therefore, when it comes to emotional investing, you would be hard-pressed to find a more compelling example than the potential of a deadly virus spreading from one corner of the world to another. Many investors can close their panicked eyes and quickly imagine a world in deadlock, rapidly changing the logistics of entire supply chains as well as the daily life of a parent coordinating their child’s afterschool pickup line. While the short-term implications can quickly lead our imaginations down a slippery slope, a quick glance at the previous outbreaks of the 21st century can provide a helpful reference point.

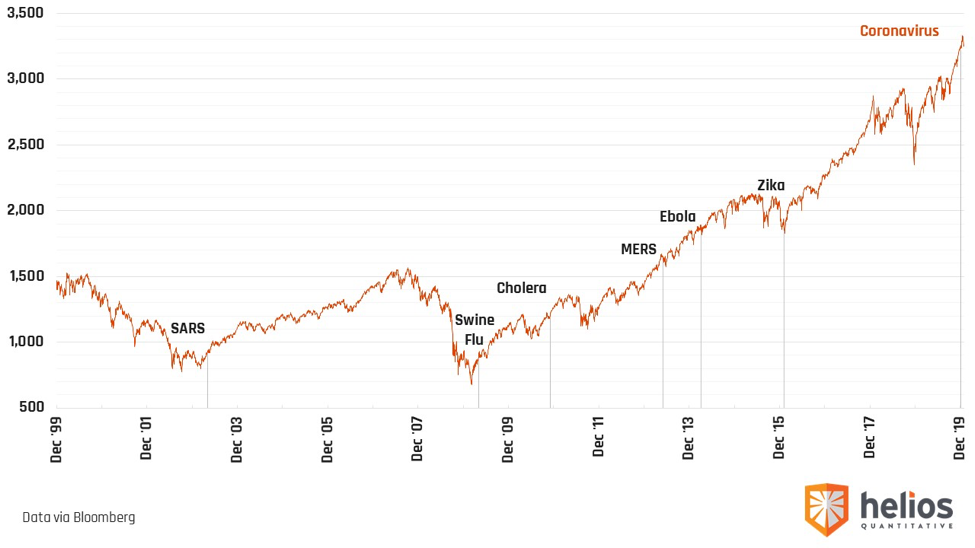

Below you will find a chart of the S&P 500 with a mark designating the first report of each major outbreak. As you can see, while each outbreak was very serious, the impact on large companies in aggregate has not proven to be negative. Furthermore, attempting to sidestep an outbreak by selling stocks and waiting for a selloff to reenter the market has been an even more challenging endeavor as the selloffs tend to be quick and short-lived.

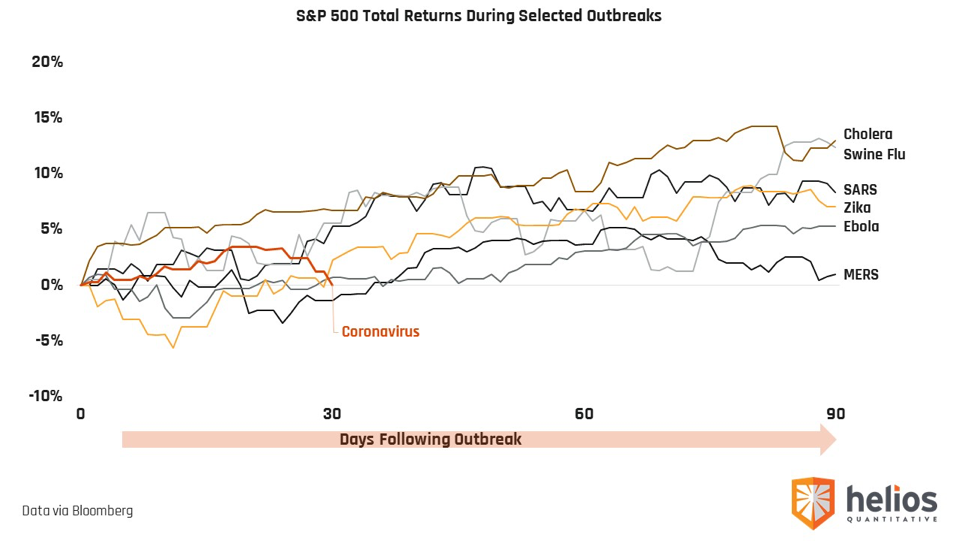

When looking greater than 90 days following the first reported case of a virus, we see that attempting to time the market based on fears of viral contagion has not been a successful strategy.

Of course, past performance does not indicate future results, and although previous outbreaks weren’t able to stagnate forward returns of the stock market, it doesn’t mean that they are not capable of doing so. However, simply looking at the headline is not how to invest during times like these. As we discussed a few weeks ago, when we wrote about investing during military conflicts, the important information to pay attention to is the data sets you predetermine to be the most valuable to your decision-making process. If you do a quick google search for any economists 2020 market outlook, you are not going to see “viral outbreak” as an input on any of their dashboards. It’s not easy to operate in a world where information is distributed in real-time from one portion of the globe to another and creating a rules-based system gives us the tools to focus on what matters most with the majority of our time, such as buying a hazmat suit on Amazon Prime and creating a complex cave-like system of password protected bunkers and basements.

Nyle Bayer, follow me on Twitter @nylebayer

This article was written by Nyle Bayer of Helios Quantitative Research, a participant in the ETF Strategist Channel.

Learn more about us here – https://heliosdriven.com/welcome/helios-quick-intro

Helios Quantitative Research provides financial advisors with the ability to offer state-of-the-art, algorithm-driven asset management solutions to their clients on any platform. This allows advisors to:

Provide clients a better asset management experience

Reduce client fees by up to 30%

Drive higher revenues by up to 50%