By Rob Glownia, RiverFront Investment Group

The Federal Reserve recently surprised the market with a very accommodative message. In summary, they communicated a willingness to hold off on future interest rate hikes and to exhibit patience regarding the size of their balance sheet. Since that communication, the S&P 500 has rallied about 3% and the yield on the 10-year UST dropped to 2.65% (yields fall when prices rise). To understand the pretty drastic change in tone, we should remind ourselves of the Federal Reserve’s primary objectives, which are to:

- Maximize employment

- Stabilize prices

- Moderate long-term interest rates

Often, the first two objectives are referred to the Fed’s “dual mandate”, which we’ll review below.

Maximize Employment

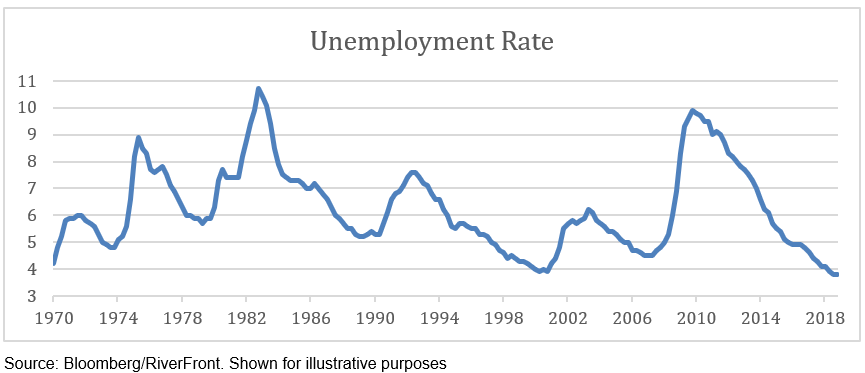

As you might have heard from our President, unemployment is near an all-time low. Equally impressive, is that unemployment has steadily dropped from about 10% in 2010 to below 4% today.

Past performance is no guarantee of future results. Not indicative of RiverFront performance. You cannot invest directly in an index.

Not only is unemployment low relative to US history, it’s also extremely low when compared to other developed nations. For example, unemployment is over 10% in Italy and it’s about 14% in Spain. By most measures, the Federal Reserve has achieved their full employment objective.

STABILIZED PRICES

Price stability has been a much more difficult objective for the Federal Reserve. Although there is not a quantitative definition of the Fed’s mandate of “price stability,” they have tried to target a steady increase in prices (inflation) of about 2%. Specifically, the Fed monitors core Personal Consumption Expenditures (PCE), which have been measured since 1959, and tracks the costs of various goods and services consumed by individuals. In that time, prices have risen about 3.25% a year, on average. In the 1970s and 80s, inflation measured nearly 10%, while most of the last decade core PCE has measured below 2%.

The Fed targets a modest level of inflation because the alternative (deflation) can lead to significant economic problems. When prices are declining, consumers typically stop spending because they expect prices to drop even more in the future. As demand drops and sales begin to slow, companies become less profitable. As companies become less profitable, wages drop, and lenders face more default risk on their loans. Often, economists use the term “deflationary spiral,” to describe the compounding negative effects of lower prices.

The inability for the Federal Reserve to create and sustain inflation through monetary policy has been concerning as well as surprising. However, the low inflation phenomenon for the past 10 years has also been prevalent in many other major economies, such as Europe and Japan. We believe that the Fed is up against a couple key headwinds for achieving higher prices:

1. Advances in Technology: Advances in technology have drastically reduced the cost of many things. For example, most of us now have photography capabilities in our pocket that would rival the greatest camera technology from 10 years ago, not to mention at a fraction of the cost. This is just a microcosm of the tech-driven price pressures that have contributed to the lack of inflation.

2. Increased Labor Productivity: Workers are accomplishing more with the assistance of robotics, online information, and Big Data. As a result, it takes fewer workers to oversee larger amounts of production using such technology. Therefore, the overall costs of production have decreased, and prices have followed.

3. Globalization: One of the reasons that the US imports so many goods and services is because consumers are attracted to lower prices. Countries that have cheaper labor (and cheaper currencies), can undercut prices for certain goods generated in the US. As such, prices have not been rising and inflation has been muted.

THE BOTTOM LINE

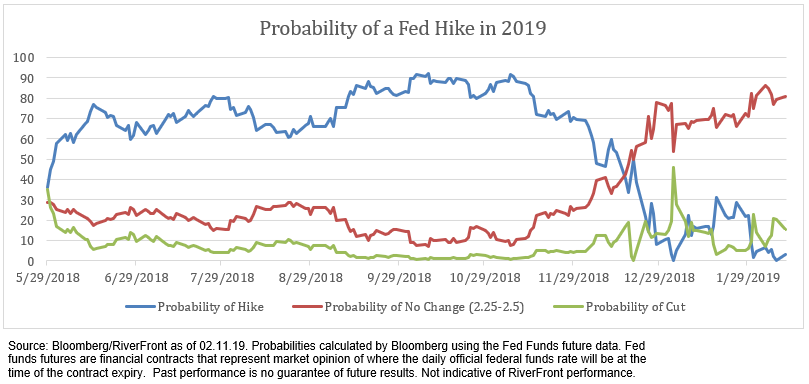

The Federal Reserve has met its employment objective but has struggled to maintain their 2% inflation target. As such, they’ve paused their interest rate hiking cycle until economic data warrants higher rates. To put some perspective on the magnitude of change in market expectations for future hikes, consider the chart below, which measures the probability of a Fed hike in 2019:

As shown above, investors were putting more than a 90% probability of a 2019 rate hike (blue line) as recent as last November. Today, investors only put about a 3% probability on the Fed raising rates again this year.