By LoicLeMener

With a suite of global trade conflicts seeming to worsen by the day, investors are acknowledging that we could be heading into a period of serious disruption, and by this, they are scouring their portfolios for opportunities to protect themselves. One area that has received attention is Small Capitalization U.S. stocks.

Some think it’s a safe bet, but the data tell us otherwise.

The attraction to small-cap stocks is simple and seductive, the rationale being that because smaller companies have less exposure to international markets, they are better able to withstand fluctuations in global trade. Small capitalization stocks usually have less revenue coming from abroad and depend less on global logistics and supply chains. Therefore, the logic goes, they are a safe harbor for investors during times of trade uncertainty.

While that thinking has some merit, it ignores some critical facts, not least that small capitalization stocks actually import more as a percentage of sales than large-caps. And when we break open this investment strategy and look closely at the Russell 2000 (the main U.S. small-cap index of about 2,000 stocks), we find two primary reasons for prudence: over-valuation and debt.

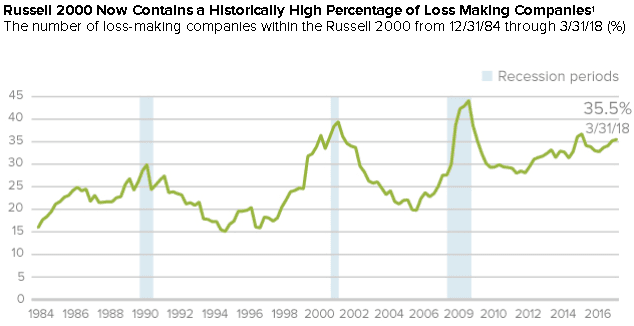

As of late 2017, more than one-third of Russell 2000 firms didn’t have any earnings at all; they actually lost money. That number may have improved with the recent changes to U.S. tax law, but it’s still a staggering amount that calls into question the health of a large number of these companies, and by extension, what they are actually worth.

Source: The Royce Funds

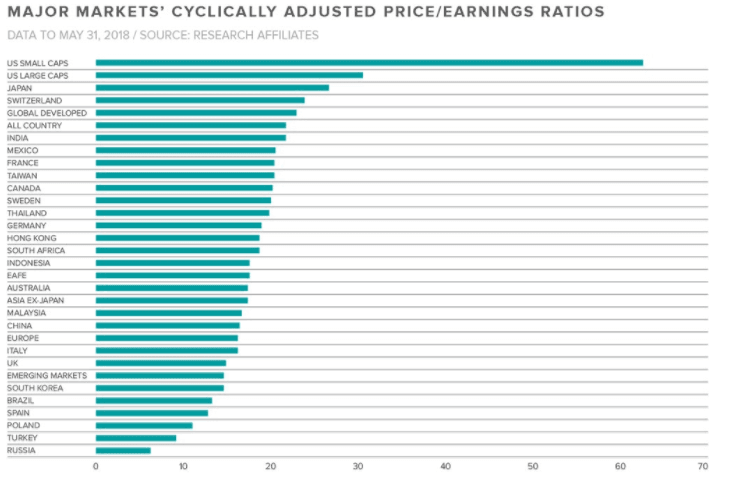

If investing is about comparing the price you’re paying for the value you’re getting, the Russell 2000 is extremely expensive. The current price-to-earnings ratio (P/E) is a whopping 72.96x earnings. If we think of that number as a single business, the market is asking us to pay almost $73 million dollars for a company that generates $1 million a year. To be sure, some businesses historically have grown so fast that they might be worth the super-rich price tag, but we’re talking about 2000 companies and so the law of averages plays out. The following chart compares U.S. small-cap’s cyclically adjusted P/E relative to other U.S. stocks and international stocks. Nothing else even comes close.

Source: Research Affiliates

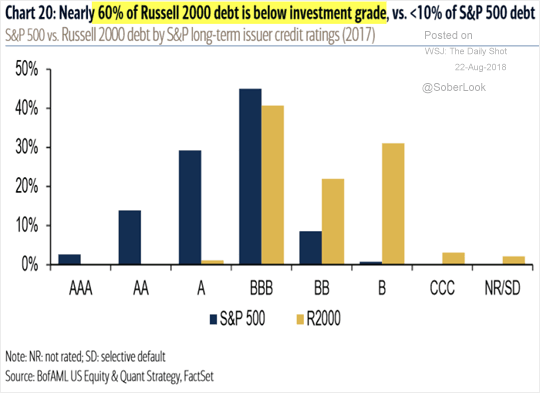

The second issue with the Russell 2000 is the foundation upon which it’s built, and the current amount and type of small-cap debt is worrisome. Nearly 60% of small-cap debt is graded as junk, and almost all other small-caps in the Russell 2000 are rated BBB, which is one notch above junk. The chart below shows there are virtually no “high quality” firms in the Russell 2000.

But it’s not just the low quality of debt that is concerning; it’s also the volume. Consider this chart demonstrating how much debt Russell 2000 firms have relative to EBITDA (a popular measure of cash flow). As you can see, small capitalization stocks have almost double the debt of S&P 500 firms.