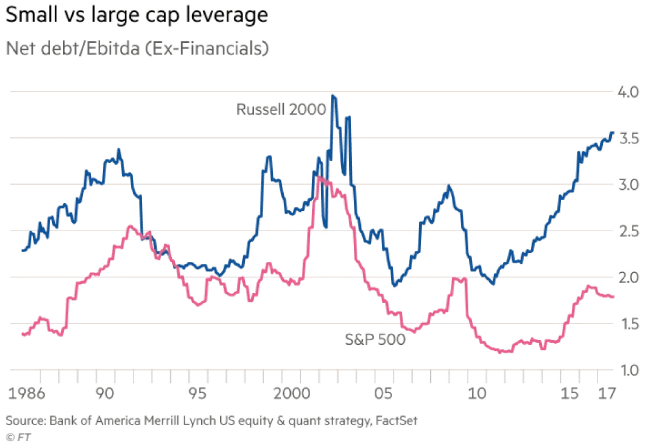

These debt levels indicate Russell 2000 companies are depending on the “kindness of strangers;” that is, if lenders become spooked by trade-war rhetoric or worsening economic conditions, the companies in the Russell 2000 will either have difficulty funding themselves or they’ll fund themselves at a much higher cost. And since small-cap profit margins are the lowest by market capitalization, as the chart below reveals, they are far less resilient in times of trouble.

For the sake of argument, if we take an optimistic view and imagine a scenario in which the economy continues to do well, and the Fed steadily returns to normal interest rates, it would also hurt small capitalization stocks disproportionately. This is because about 40% of small-cap debt is floating. If the Fed continues to raise rates as planned, it will naturally and quite immediately levy higher interest costs to small-cap firms. And if the current economy, operating with a tight labor market, were to surprise us with a hotter-than-expected inflation number at any point, such that the Fed felt obligated to be more aggressive, that could speed up those costs beyond what investors are expecting today.

Many of these red flags have been flapping for a while. Yet, investors continue to see safety in small capitalization stocks. Most of these investors have made extraordinary gains in the asset class over the last nine years and have become complacent. I’m reminded of a Buffett quote: “Nothing sedates rationality like large doses of effortless money…but a pin lies in wait for every bubble.”3

Bottom line: If you are looking for a “safe” asset class to invest your capital during what looks to be an increasingly troubling future, look somewhere else.

Disclosures: The author has used ProShares Short Russell 2000 as a small hedge to his equity portfolios.

The prices of small company stocks generally are more volatile than those of large company stocks.

The performance of an unmanaged index is not indicative of the performance of any particular investment. The performance of an index assumes no transaction costs, taxes, management fees or other expenses. Past performance does not guarantee future results.

Loic LeMener, CFA®, MBA, CFP® is a registered representative of Lincoln Financial Advisors Corp.

Securities and investment advisory services offered through Lincoln Financial Advisors Corp., a broker-dealer (member SIPC) and registered investment advisor. Insurance offered through Lincoln affiliates and other fine companies CRN-2155499-061918

Opus Wealth Management is not an affiliate of Lincoln Financial Advisors Corp.

Sources:

- Wall Street Journal, 8/28/18

- The Royce Funds, 5/2018

- Marketwatch, 8/18/18

- Research Affiliates

- BofAML, US Equity, & Quant Strategy, FactSet

- Bank of America, Merrill Lynch, US Equity, & Quant Strategy, FactSet

- Bloomberg, Cresset Wealth Advisors

- Heisenberg Report, 8/6/18