By Tyler Wilton, DWS

Over the past several years, specifically after the Global Financial Crisis (GFC), passive investing has garnered significant attention from the investment community which has translated into increasing flows away from active management across the majority of asset classes in favor of passive. Even more nuanced and niche asset classes, including Real Estate Investment Trusts (REITs), have not been immune from the “active to passive shift”.

However, the real estate asset class itself has historically proven to be an effective area of the market for stock picking, with several tools for active managers to potentially “beat” the broader REIT market. Real estate securities are an inefficient asset class and this inefficiency may provide an opportunity for experienced active managers to identify and exploit value-add opportunities.

Active REIT managers seek to exploit inefficient pricing characteristics inherent within the REIT market. Pricing inefficiencies may arise for several reasons, including the fact that REITs often see less coverage from traditional “sell-side” Wall Street firms. Less institutional coverage may lead to inefficiently valued publicly-traded securities. Furthermore, active REIT managers are able to utilize several “market-beating” methods, such as stock and sector selection decisions, understanding local property cycles, managing asset quality exposure, positioning according to a specific theme or style, and adjusting duration exposure through deep fundamental analysis.

US REIT Investing – Looking at Active Management

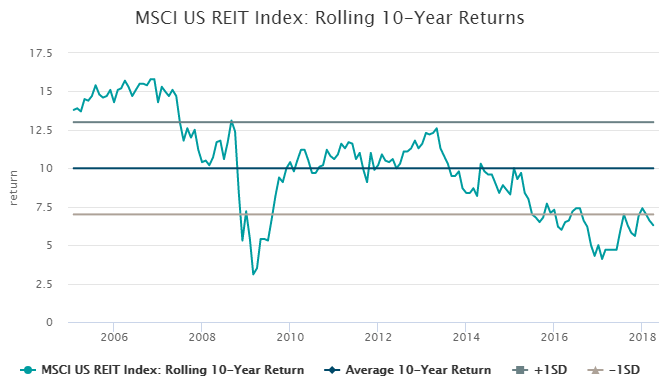

First of all, a long-term strategic allocation to US REITs has historically provided attractive nominal returns as seen by the rolling 10-year return chart below for the MSCI US REIT Index. As depicted, the average 10-year return since 12/31/2000 for the US REIT market has been roughly +10%, importantly not falling into negative territory once over this period. Currently, the nominal 10-year return is at the low end of its historical average and below 1-standard deviation from the mean.

![]()

Active REIT funds have historically benefitted investors over the long-run, however, recent market turbulence and broader macro factors has made it increasingly challenging for active managers to outpace their respective benchmark over the short-run.

The simple fact of paying lower fees is one of the easier arguments against active managers, which may be further amplified during environments where equity markets are more heavily influenced by macroeconomic drivers and/or geopolitical issues.

The market environment subsequent to the GFC has prompted a sizable number of investors to shift away from active management in favor of passive solutions. Over the long-run, as seen in the chart below, the active US REIT manager universe* has consistently outpaced the MSCI US REIT Index by an average excess return of +64 basis points (“bps”) on a rolling 5-year basis since the start of 2000, net of fees. The chart below highlights “Rolling 5-Year Excess Returns” (orange shaded area) for the active US REIT universe relative to the MSCI US REIT Index.