![]()

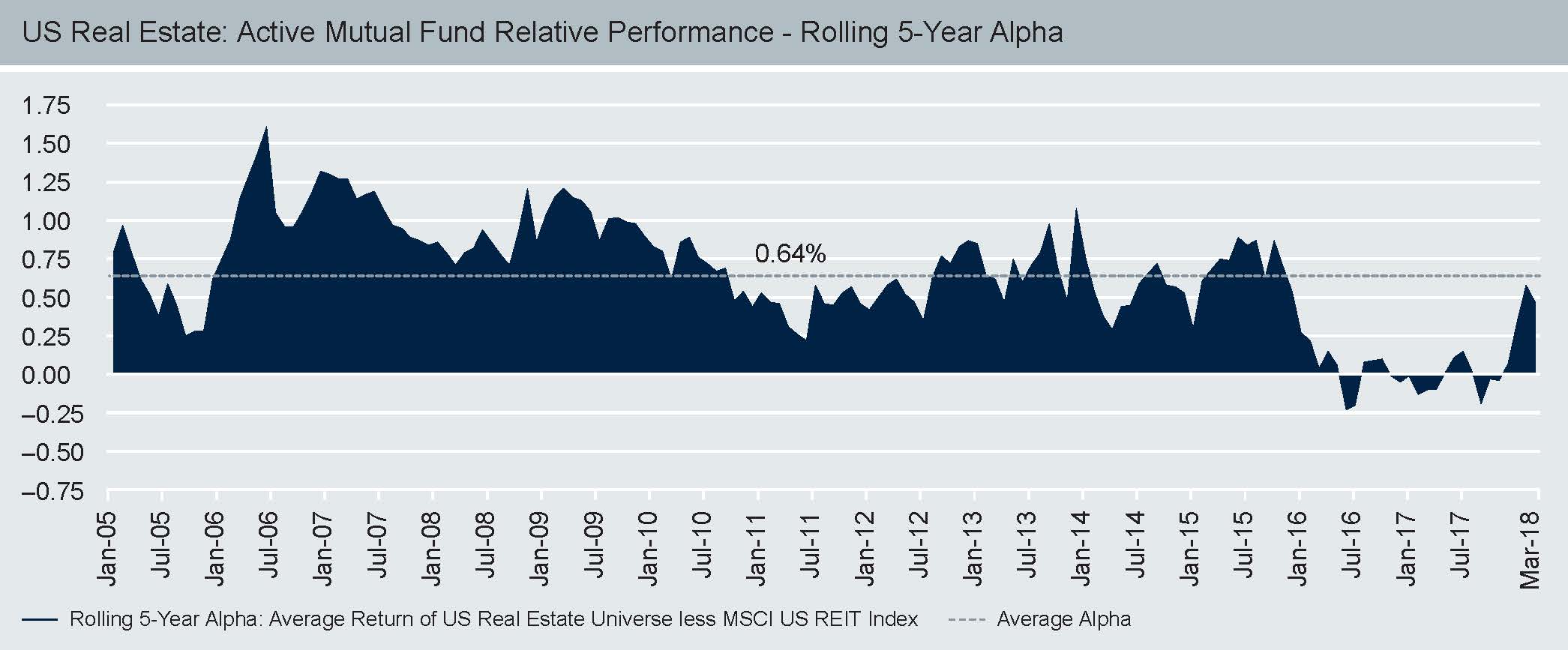

Since the GFC, active REIT funds as a group have generally failed to generate returns in excess of the market after fees. As such, this has made it easy for investors to bypass conducting due diligence on active managers as “consistency” of outperformance has been the biggest issue plaguing the active management realm recently. However, as witnessed in more recent periods (e.g. during the past 6-12 months) we have seen active REIT managers more consistently add value over passive solutions as fundamentals are playing a greater role in security and sector level returns.

Case Against Passive REIT Investing

The unique return drivers of real estate affords capable active REIT managers the potential to add value over passive alternatives, specifically those managers with the dedication and experience of investing in alternative asset classes such as real estate, infrastructure, or commodities.

The rolling 5-year alpha for active managers shown above compares favorably to passive US REIT funds which are designed to track a broad-based index, such as the MSCI US REIT Index. Given the relatively concentrated nature of the REIT market compared to broader equity markets, active management can be important in the REIT space.

Passive investments remain indifferent to risk throughout an economic cycle, while active REIT managers have tools to manage risk exposures at different points of the cycle. Prior to the GFC, active REIT funds consistently beat the broader REIT market, but recent market events have had a notable impact on rolling 5-year returns over the past couple years. Importantly, the trend appears to be reversing course back in favor of active management.

The Long-Term Case for Investing in REITs

We believe REITs should be viewed as a long-term strategic investment within an overall portfolio. While active management has been challenged in recent years, we believe active managers can add significant value for long-term strategic REIT investors. The tide of the “active versus passive” debate we believe turns to favor active management when asset class correlations fall, stock performance dispersion rises, and company fundamentals ultimately dictates returns over time.

Fundamental property market and company factors is ultimately what active managers attempt to exploit in order to add value in excess of passive mandates and fees. While the past several years has been challenging for active management in the REIT space, we maintain our view that there is greater potential for active managers to gain an information advantage when dealing with specialty assets classes, such as real estate.

REITs may represent an essential asset class that have, historically, improved the risk/return aspect of a well-diversified portfolio. REITs also seek to offer lower correlation to more traditional stock/bond investments, a higher correlation to ‘private’ real estate markets, attractive dividend yields, a hedge against inflation, liquidity and flexibility. While there are no guarantees that this historical relationship will hold up in the future, we believe that immediate access to expert real estate management teams and stable cash flows from rental-based income structure can offer investors a possible avenue for diversification and return potential over the long-term that could be tough to match outside of the real estate world.

Tyler Wilton, CFA, is an Investment Specialist for Liquid Real Assets at DWS.