By Rod Smyth, RiverFront Investment Group

Non-US stock markets have now outperformed the US for three consecutive quarters. The following questions dominate those we are being asked:

- After a strong year, are we due a correction and if I have cash, should I invest now or wait?

- Is it too late to allocate more money to international?

Taking the second question first, let’s look at the relative performance of Developed and Emerging stock markets to the US.

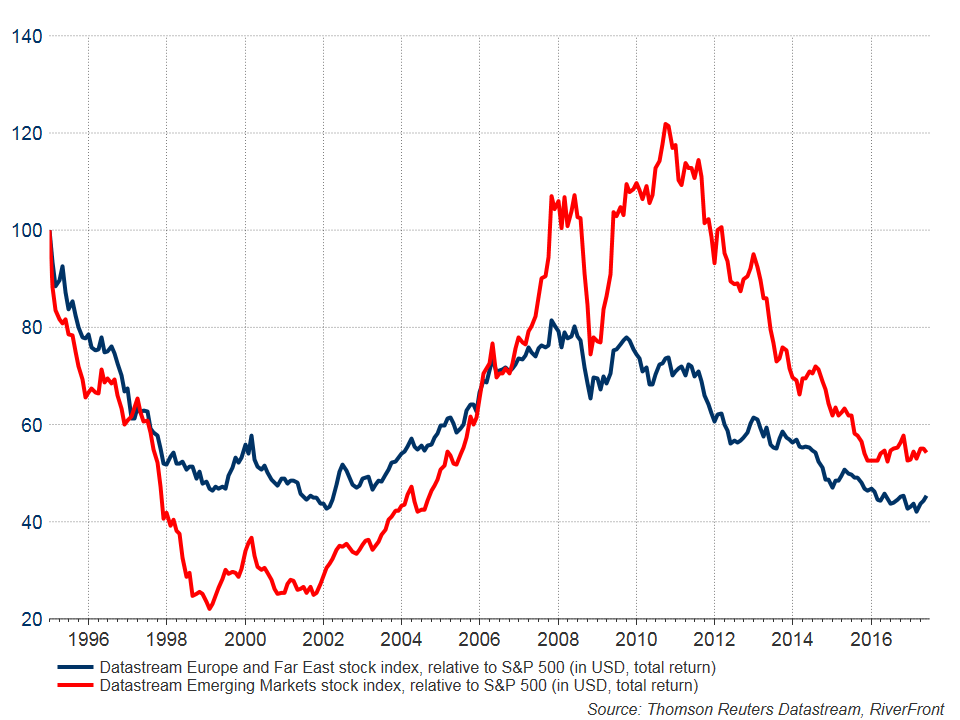

In the chart below, we show the relative performance of Developed markets outside North America relative to the US (the blue line) and the same for Emerging Markets (the red line) over the last 20 years. You can immediately see that there have been long cycles of out and underperformance. The last five years have seen the US lead global markets higher, significantly outperforming.

If international markets are going to outperform the US in the coming years, the chart below indicates that it has barely begun. In our opinion, investors who have not diversified their stock portfolios globally are being presented with an attractive opportunity to switch from the US to International.

After a strong year, are we due a correction? If I have cash, should I invest now or wait?

It has been a good year for many stock investors; the MSCI World Index is up almost 20% over the last twelve months, and the returns have been evenly distributed, with the US a slight laggard. The S&P 500 is about 100 points (4%) above its rising one year moving average, which it last tested just before the election last November. The S&P 500 has more than doubled over the last five years, with its worst period being a 12% decline from May 2015 to February 2016. From a technical perspective, this is a healthy picture and a pullback of 4-5% sometime in the 3rd quarter might present a good entry point in our view. That said, market timing is a precarious business and we strongly believe deploying cash in installments over several months is one way to take the emotion and market timing out of the decision.

Unlike the US, overseas markets, as represented by the MSCI World ex US index, have been range-bound over the last five years having peaked in April 2011 and June 2014. The index is once again approaching the top end of the range. Again, a pullback from current levels would not be surprising, but we believe this advance will make it through to new highs and eventually exceed the 2007 peak over the next few years so we again suggest a process of adding incrementally.

Fear and Greed have always dominated investor emotions, but since the 2008 stock market collapse, fear and caution have been most prevalent in our view. We believe this is a positive thing. There is an old adage that a bull market climbs a “wall of worry”. Two things would cause us to be strategically concerned:

- Excess optimism expressed in excessive valuations, which for Riverfront would mean stocks moving significantly above their long-term trends. This is not currently the case for the majority of stock indexes we follow.

- An impending global economic downturn that would cause earnings to fall. We do not foresee this over the next year, rather we see mildly accelerating economic momentum and no increase in inflation expectations.

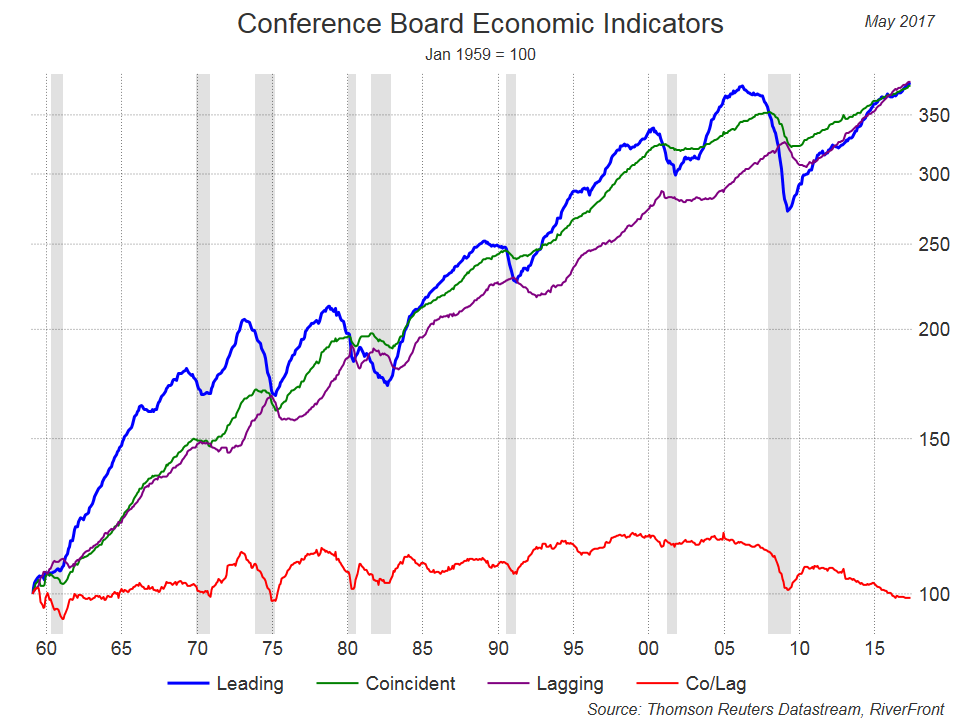

The chart above shows the Conference Board’s leading, coincident and lagging indicators through May. All are currently rising and stable. The bottom line measures the difference between the coincident and lagging indicators. When the lagging indicator is doing better than the coincident indicator it has traditionally been a warning sign, but the recent gradual decline has been the lagging indicator catching up with the others and so does not concern us. Once the leading indicator has made a new high (it made one in March) it has been six years (on average) before the next recession (recessions shaded in grey on chart). Past performance is no guarantee of future results.

Conclusion: In our asset allocation portfolios, we remain invested in line with our strategic benchmarks, which prefer stocks to bonds. We lowered portfolio risk slightly in our shorter time-frame models in 2017 to reflect the substantial gains in US stocks, but currently remain constructive on stock markets, especially overseas.

Rod Smyth is the Chief Investment Strategist at RiverFront Investment Group, a participant in the ETF Strategist Channel.

Important Disclosure Information:

Past results are no guarantee of future results and no representation is made that a client will or is likely to achieve positive returns, avoid losses, or experience returns similar to those shown or experienced in the past.