After financial industry experts and advisors finished a week at the SALT Conference in Las Vegas that ran May 16-19, some of the top hedge fund managers revealed growing interest for foreign investments and lessening appeal for potentially overvalued domestic assets.

For example, DoubleLine Chief Investment Officer Jeffrey Gundlach urged other asset managers to look abroad, following up on endorsement of emerging market investments, like iShares MSCI Emerging Markets ETF (NYSEArca: EEM), earlier this month.

Investors have stuck with what they know, and the U.S. markets are what many investors are most comfortable with. However, a U.S.-centric portfolio may leave an investor open to potential risks and even cause some to miss out on overseas opportunities.

Many other hedge fund speakers also pointed to European equities for their attractive valuations and as a means to diversify away from American equities, especially in light of recent misgivings with President Donald Trump’s ability to push through his pro-growth agenda. Moreover, Europe is enjoying improving economic and earnings growth and offers more attractive yield opportunities than the income generated here at home.

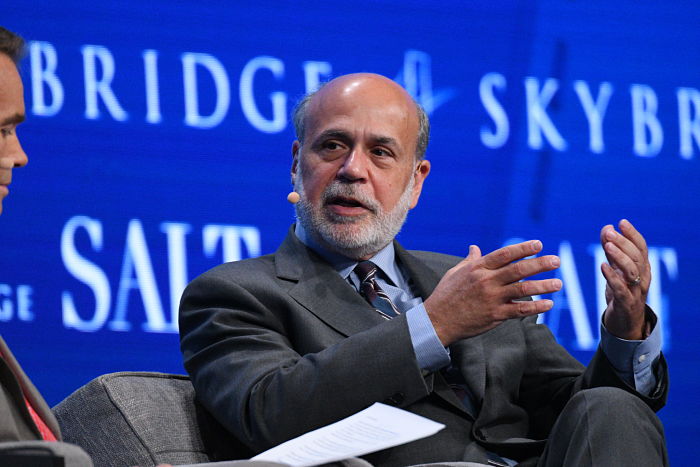

Former Federal Reserve Chairman Ben Bernanke. Photo: 2017 SALT Conference