By Gary Stringer, Kim Escue and Chad Keller, Stringer Asset Management

Our outlook continues to be constructive, though we think that the post-election rally has priced in a lot of good news. As a result of the rally, some areas of the market are potentially overdone. Meanwhile, we are finding other areas of the markets that we think have been overlooked.

While we anticipate first quarter U.S. GDP will be soft, we think that GDP growth will accelerate towards 3% during the second quarter and we are maintaining our expectation for 2.2% calendar year 2017 real GDP Growth. We are maintaining this level of expected growth despite what appears to be a delay in fiscal stimulus, regulatory changes, and tax reform coming out of Washington. The good news to us is that old-fashioned private sector growth appears to be taking hold.

We are finding pockets of opportunity domestically, though we think that the broad U.S. equity market is fairly-valued. Equity valuations in Europe and Japan look more interesting, though emerging markets appear to be unattractive from a risk/reward standpoint to us.

We think the U.S. Federal Reserve (Fed) will tighten monetary policy by both raising interest rates more quickly and more persistently than the market expects, and by pas-sively letting its balance sheet shrink. As global growth and inflation pick up, the natural level of interest rates in-creases as well. As long as the Fed simply follows the natural rate higher, the economy can continue to grow.

We think that short-term interest rates will move significantly higher from here, along with Fed policy, while long-term interest rates should be range bound at a rate a bit higher than the current level. As the Fed lets its balance sheet shrink, we expect some areas of the fixed income market, such as mortgage-backed securities, to underperform the broad fixed income market as that space adjusts to the new reality. We are finding more attractive investment opportunities elsewhere in fixed income.

We expect volatility to increase as the Fed tightens monetary policy and the markets realize that other areas of policy change, such as regulatory and tax reform, may come more slowly than some would hope. As a result, we have made adjustments in our alternative allocations that should help dampen overall portfolio risk, while potentially generating return from increased market volatility.

In summary, with an eye towards risk management, we are positioned to benefit from solid global economic growth, rising short-term interest rates, and a strengthening U.S. dollar. We expect volatility and market dips. So long as fundamentals remain solid, we see potential dips as buying opportunities.

Our outlook continues to be constructive, though we think that the post-election rally has priced in a lot of good news. As a result of the rally, some areas of the market are potentially overdone. Meanwhile, we are finding other areas of the markets that we think have been overlooked.

While we anticipate first quarter U.S. GDP will be soft, we think that GDP growth will accelerate towards 3% during the second quarter and we are maintaining our expectation for 2.2% calendar year 2017 real GDP Growth. We are maintaining this level of expected growth despite what appears to be a delay in fiscal stimulus, regulatory changes, and tax reform coming out of Washington. The good news to us is that old-fashioned private sector growth appears to be taking hold.

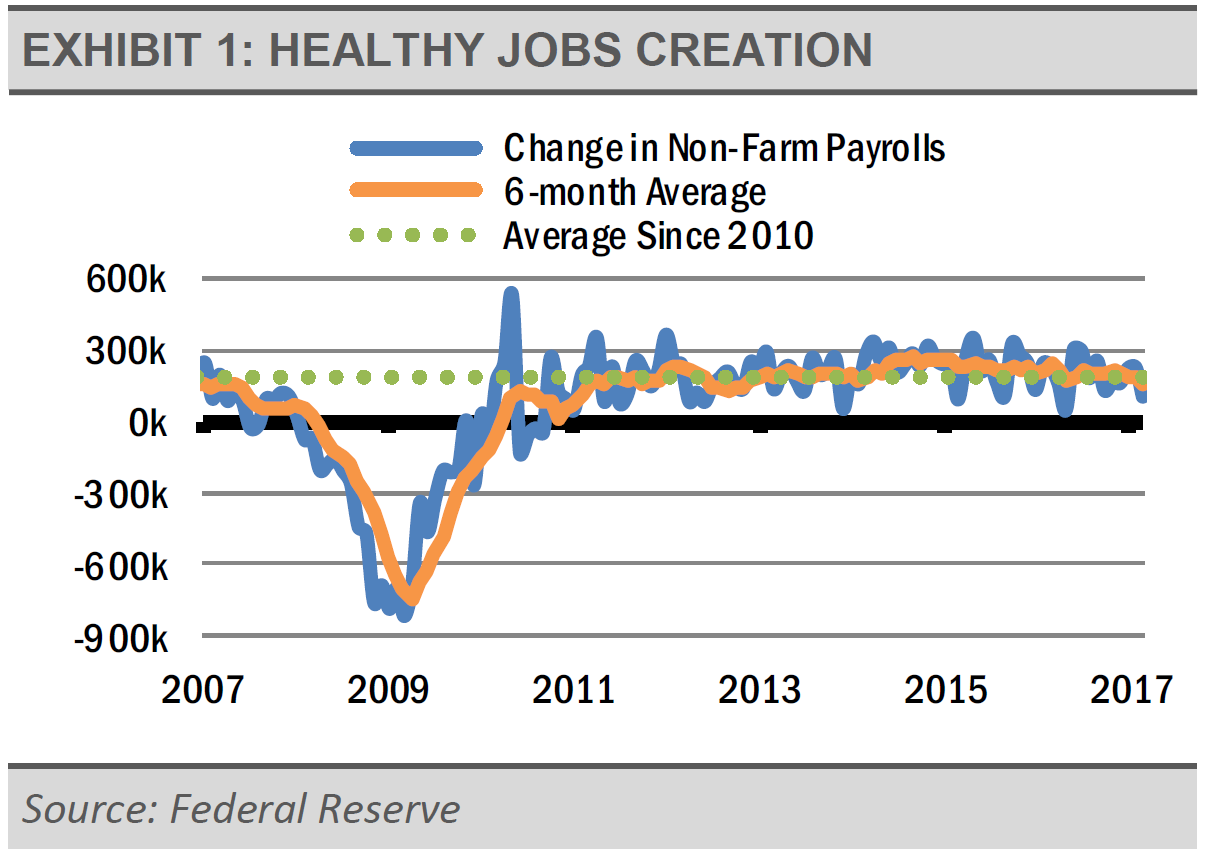

The labor market is key to the health of the U.S. economy and monthly jobs creation can be volatile, so we prefer to look at the 6-month moving average. As exhibit 1 shows, jobs creation remains healthy despite the dip in March. As the unemployment rate continues to fall with the economy at full employment, we should expect monthly jobs creation to taper, but remain at a healthy level.

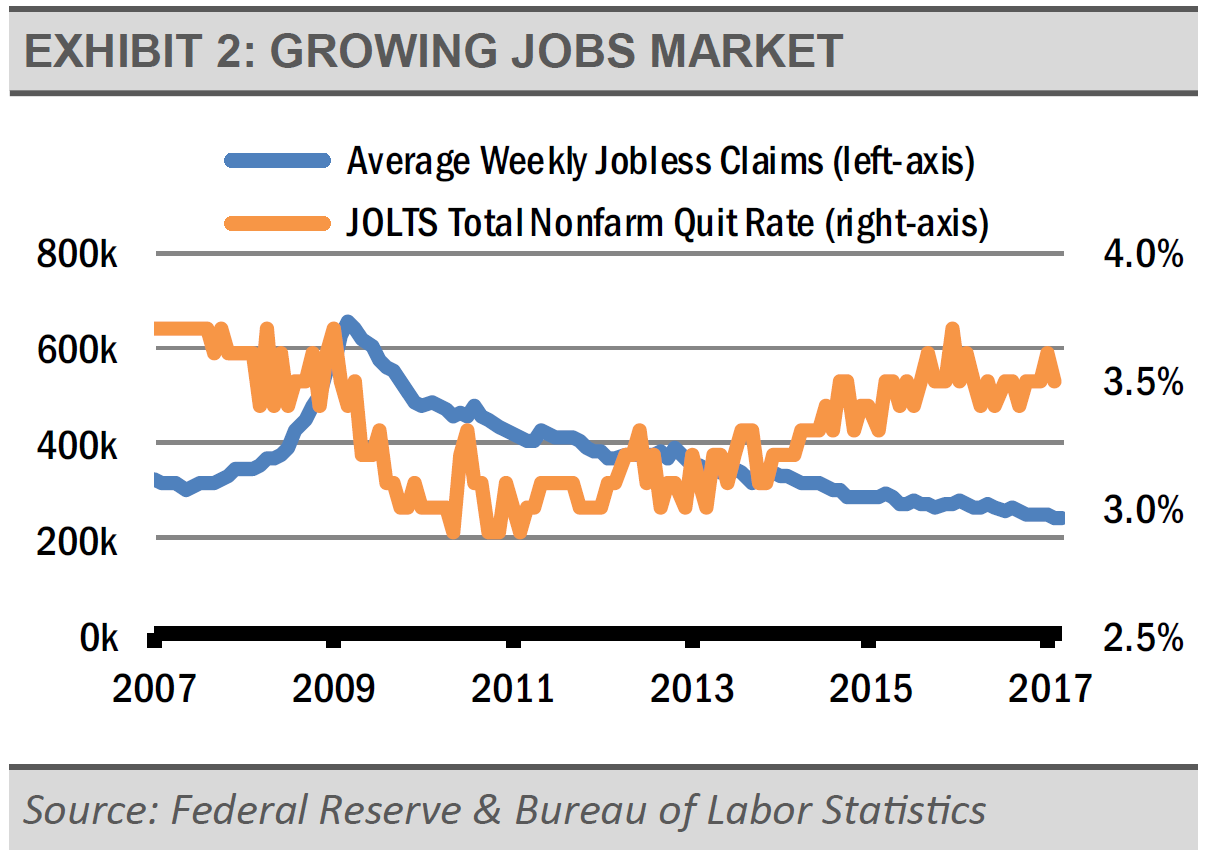

We also prefer to look at other indicators of labor market strength, such as weekly jobless claims and the pace of voluntary departures, known as the quit rate. When corporate views turn pessimistic, layoffs, as represented by weekly jobless claims, increase. Conversely, claims decrease when companies turn more optimistic. Similarly, when workers are more pessimistic, they tend to not quit their jobs, but the quit rate picks up as workers become more confident in their ability to find new and better jobs.

As exhibit 2 shows, the data seems to confirm our confidence in a strong jobs market with layoffs declining since 2009 and quits increasing since 2013.

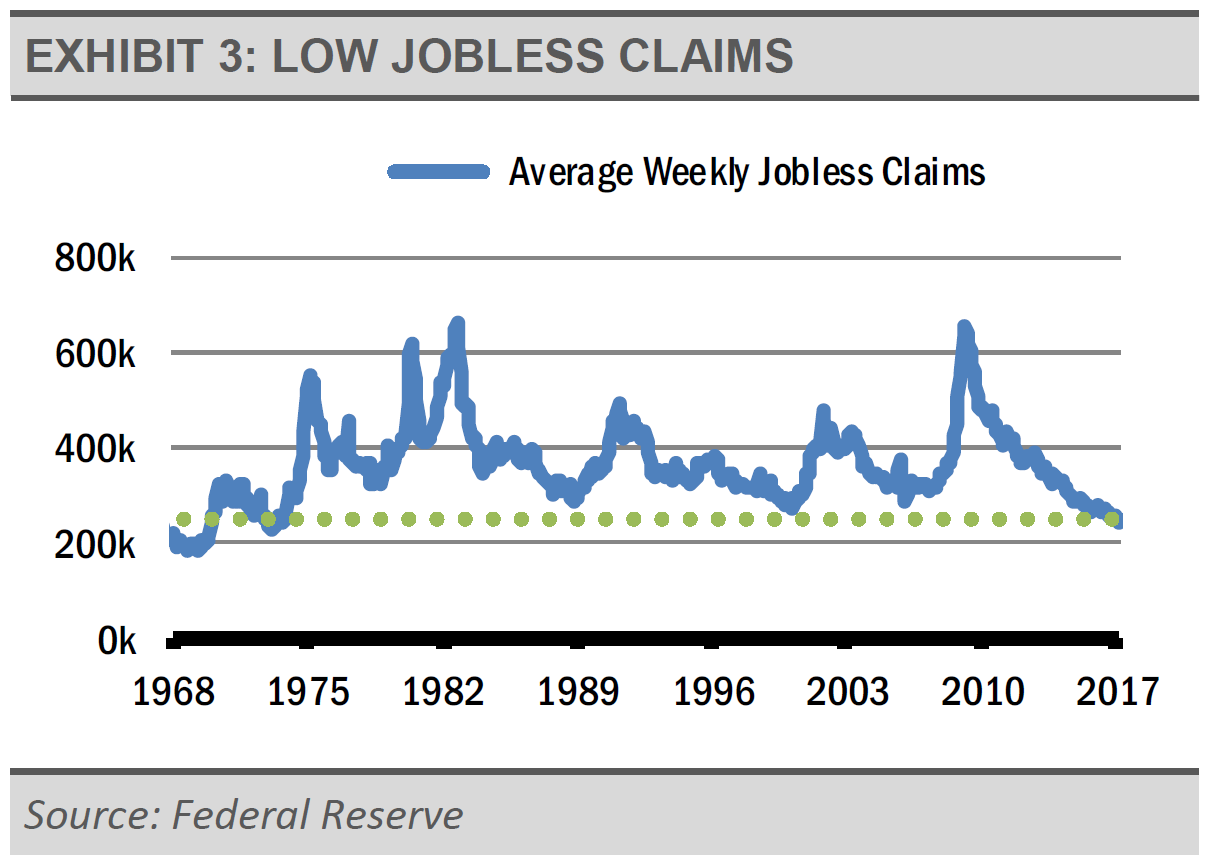

Not only are weekly jobless claims down year over year, they are down to levels not seen since 1973 (exhibit 3).

To put that into perspective, the 1973 labor force was approximately 90 million people. Today, the U.S. labor force is roughly 160 million strong. The size of the current labor force is nearly double what it was 44 years ago, but layoffs are at the same low level. We think this situation reflects strength in the U.S. economy, which should lead to more jobs creation in the future. Therefore, we expect consumer spending to be exceptionally strong going forward as the economy adds more jobs and more income, which is already at an all-time high.

Alongside improvements in the labor market, we are seeing improvements in business optimism and investment.

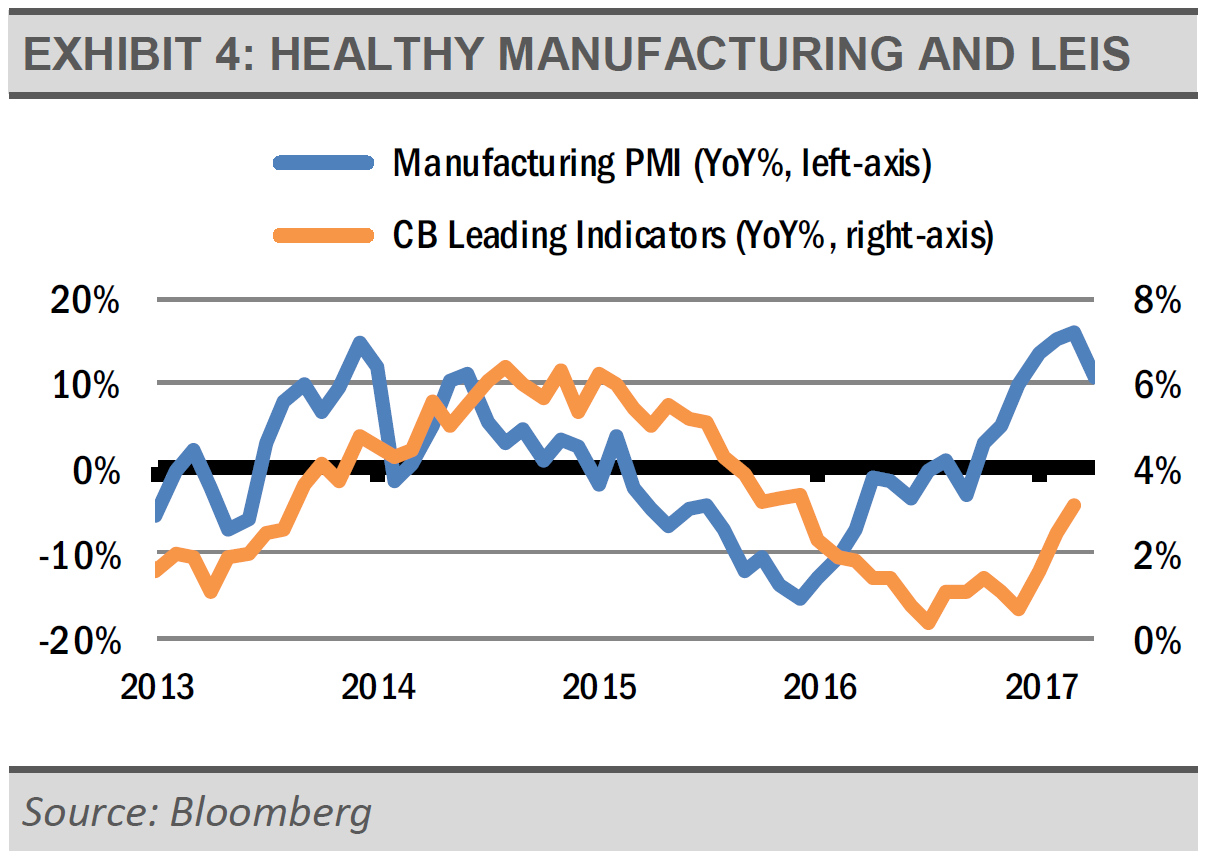

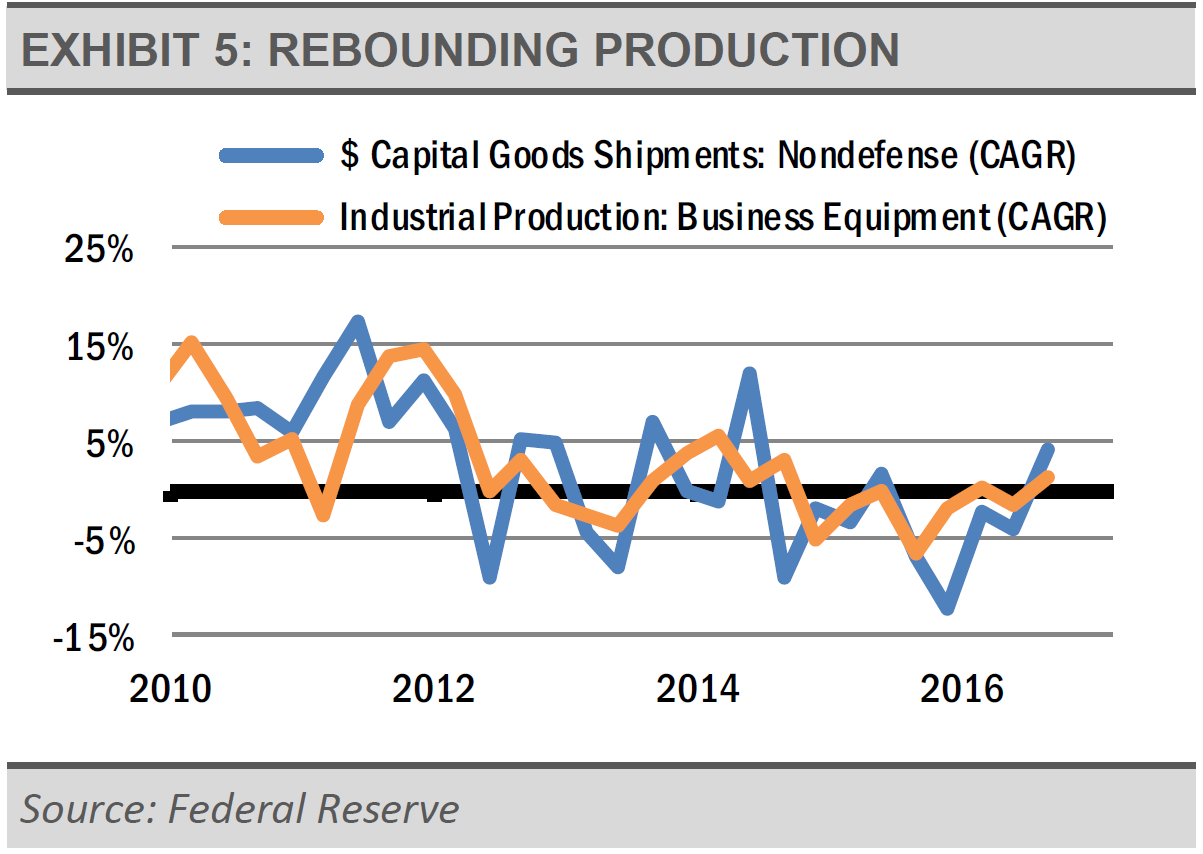

As exhibit 4 shows, the ISM Manufacturing Purchasing Managers Index growth rate has softened but continues to impress. Additionally, the Conference Board’s U.S. Leading Index of Ten Economic Indicators continues to make positive gains as well. We are seeing this optimism translate to investment as shipments and production of business equipment are on the rise as exhibit 5 suggests.

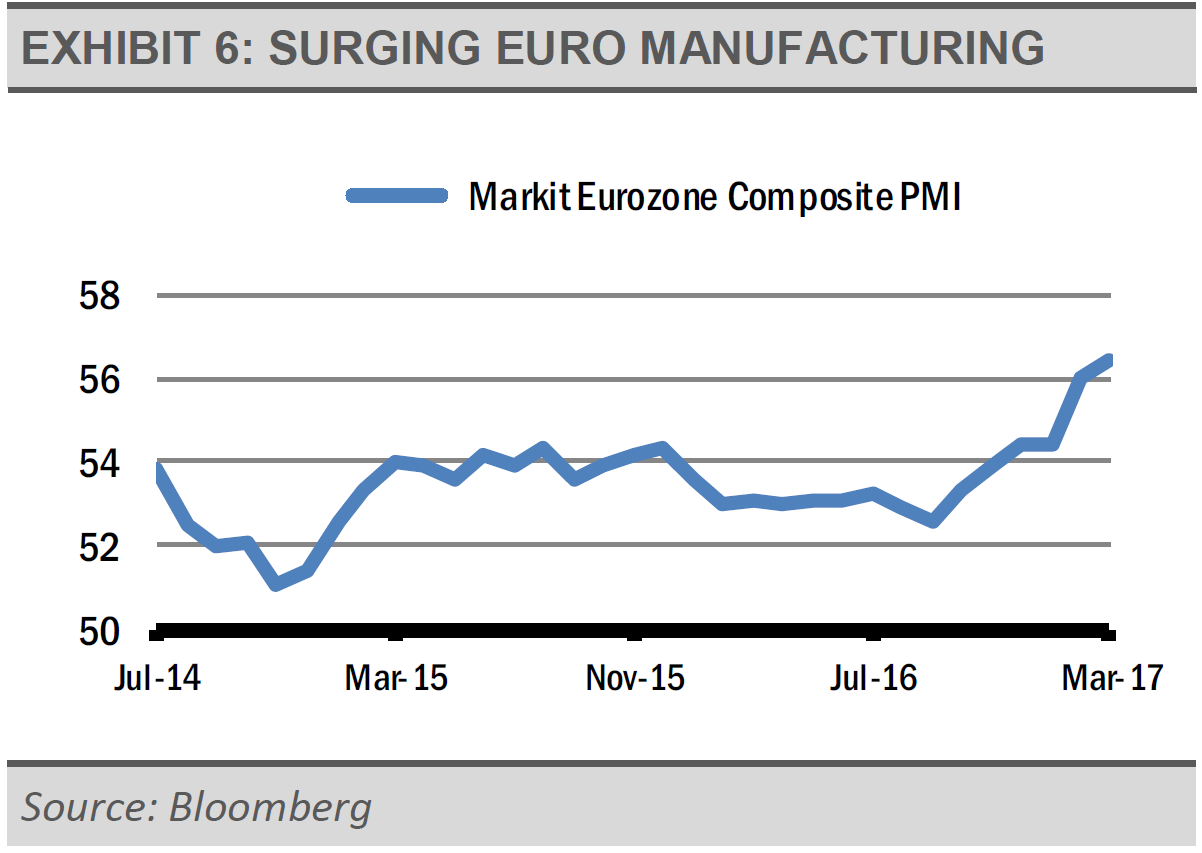

Importantly, this strength is not just in the U.S., euro zone business activity has surged to its highest level in years, per the latest IHS Markit survey (exhibit 6). Euro zone job creation is at levels not seen in nearly a decade, while new orders and business optimism are moving higher, which bodes well for economic activity.

INVESTMENT IMPLICATIONS: EQUITY

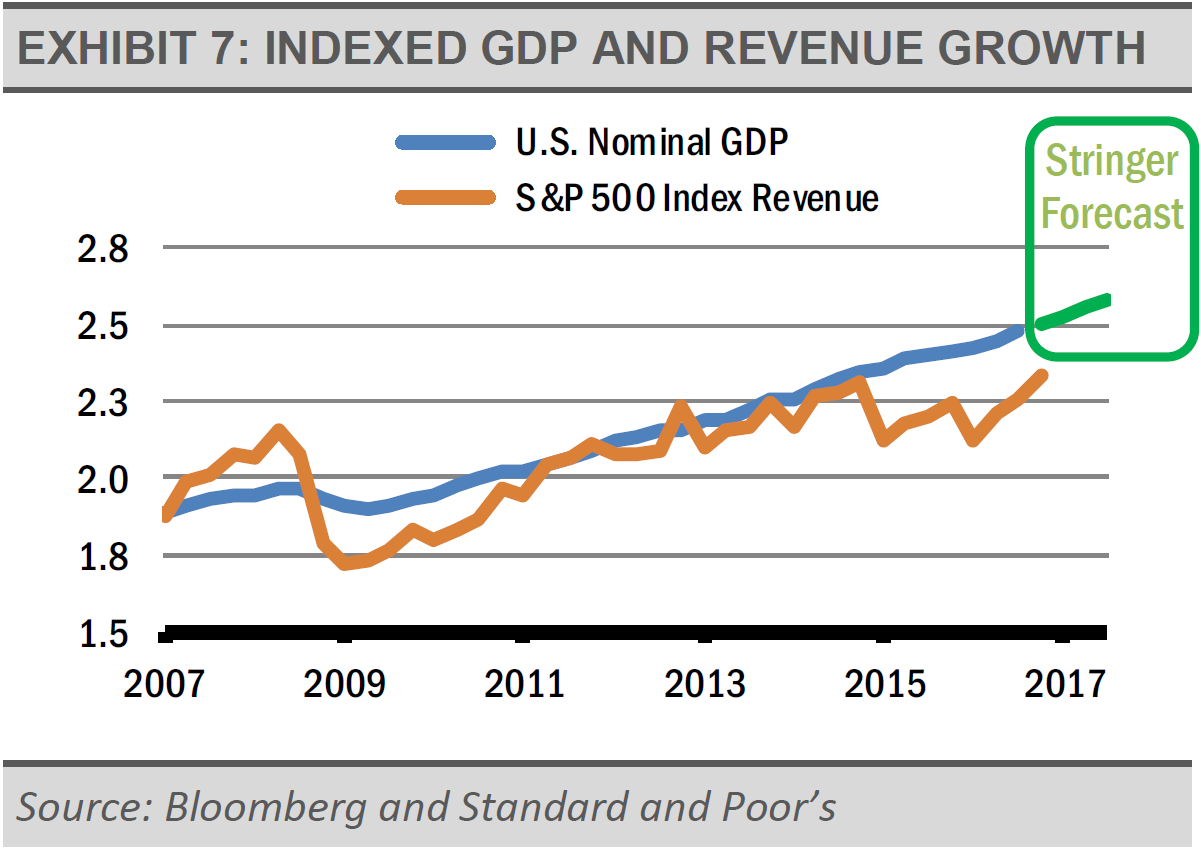

We are finding pockets of opportunity domestically, though we think that the broad U.S. equity market is fairly valued. Equity valuations in Europe and Japan look more interesting, though emerging markets appear to be unattractive from a risk/reward standpoint to us. Given the positive economic signals we are tracking, we think that the U.S. economy will continue to grow at a steady pace. We think that increasing U.S. nominal GDP will support increased corporate revenues (exhibit 7), which can propel earnings higher. Note that we expected all of this to occur even without the new Presidential administration’s push for regulatory and corporate tax reform. Additional tailwinds from these reforms can propel earnings even higher.

In particular, we find attractive valuations and potential earnings growth in the information technology, consumer discretionary, and health care sectors, while we are generally underweight consumer staples, energy, industrials, and materials.

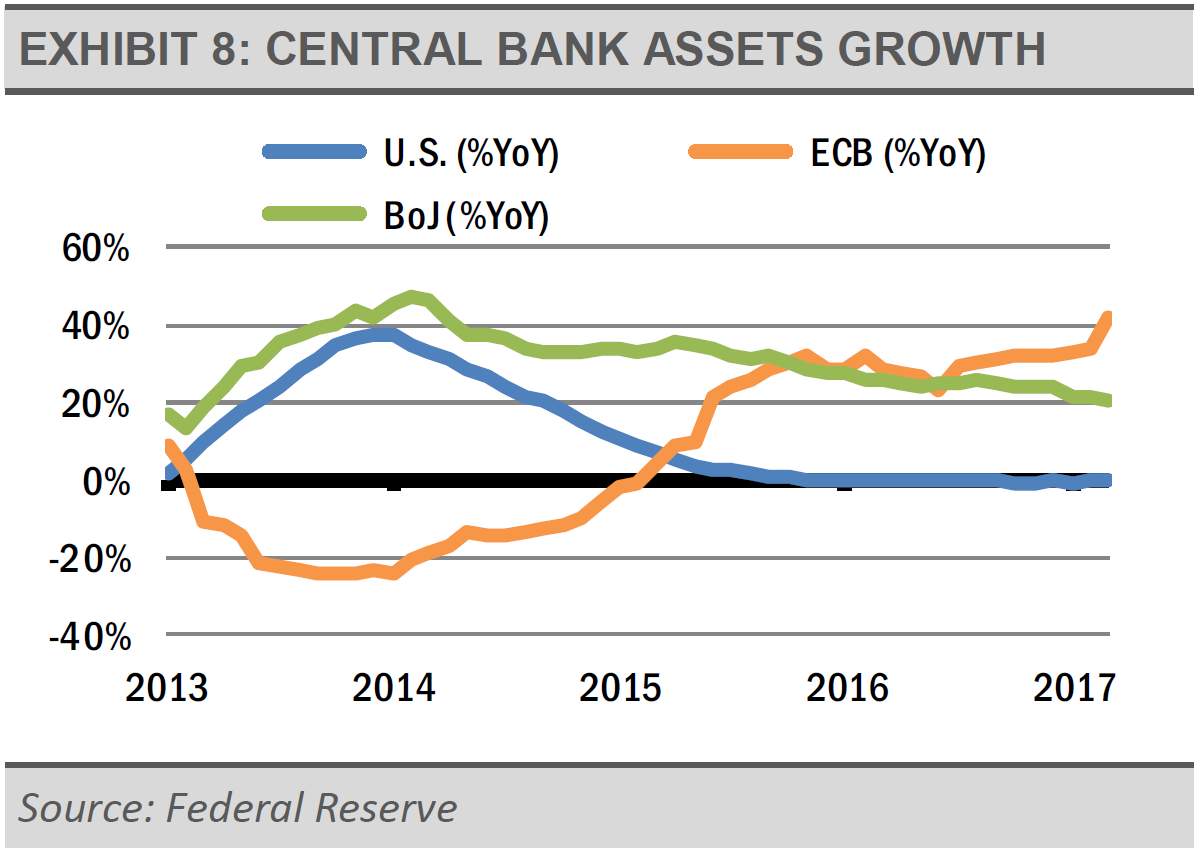

Furthermore, while the Fed has begun to tighten monetary policy in the U.S., the European Central Bank (ECB) and the Bank of Japan (BoJ) continue to inject large amounts of monetary stimulus into their economies. Year-over year, the ECB has increased the size of it balance sheet by 40%, while the BoJ has increased by 20% and the Fed balance sheet has been flat (exhibit 8).

This injection of stimulus should help support economic growth and unlock what we believe to be attractive relative valuations.