For example, while both the U.S. stock market and broad emerging markets are trading at a premium to their historical valuations, stock prices in both the euro zone and in Japan are trading at a discount to their historical averages (exhibit 9). We think that the improving economic activity mentioned above, combined with additional monetary stimulus and attractive valuations, make European and Japanese equities attractive.

FIXED INCOME

We think the Fed will tighten monetary policy by both raising interest rates more quickly and more persistently than the market expects, and by passively letting its balance sheet shrink. As global growth and inflation pick up, the natural level of interest rates increases as well. As long as the Fed simply follows the natural rate higher, the economy can continue to grow.

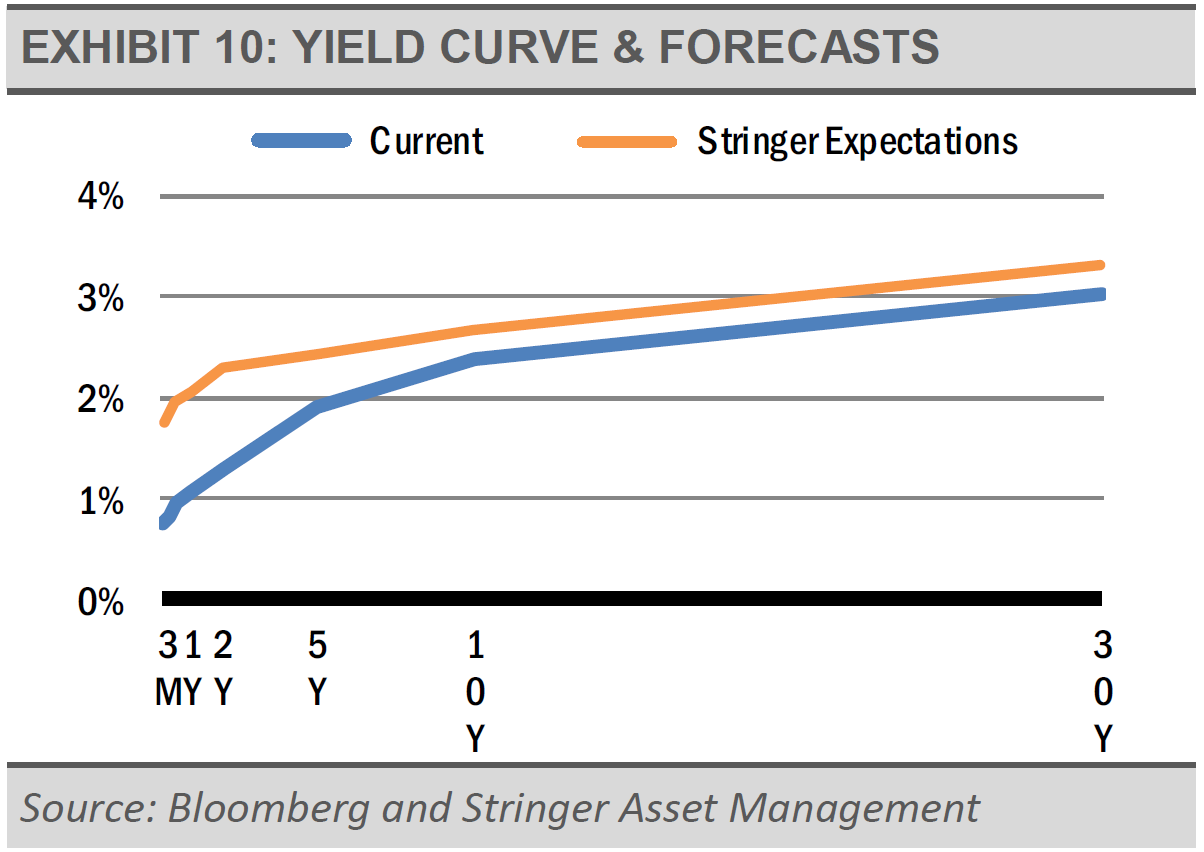

We think that short-term interest rates will move significantly higher from here, along with Fed policy, while long-term interest rates should be range bound at a rate a bit higher than the current level. As the Fed lets its balance sheet shrink, we expect some areas of the fixed income market, such as mortgage-backed securities, to underperform the broad fixed income market as that space adjusts to the new reality. We are finding more attractive investment opportunities elsewhere in fixed income.

We think that long-term interest rates, such as the 10-year Treasury yield, are likely to be range-bound below 3%, which is significantly lower than the long-term average.

Though global economic growth is solid, we do not expect economic growth and inflation to be strong enough to push long-term interest rates significantly higher. Furthermore, strong global demand from institutional investors for high-quality sovereign debt will likely provide a ceiling for long-term interest rates.

If the economy maintains its current positive trajectory, we think the Fed will raise interest rates three more times this year and the 10-year Treasury will move closer to 3%. In that scenario, the yield curve, as represented by the difference between the 10-year Treasury and the 2-year Treasury, will flatten, but not enough to risk choking off the creation of credit and causing a recession.

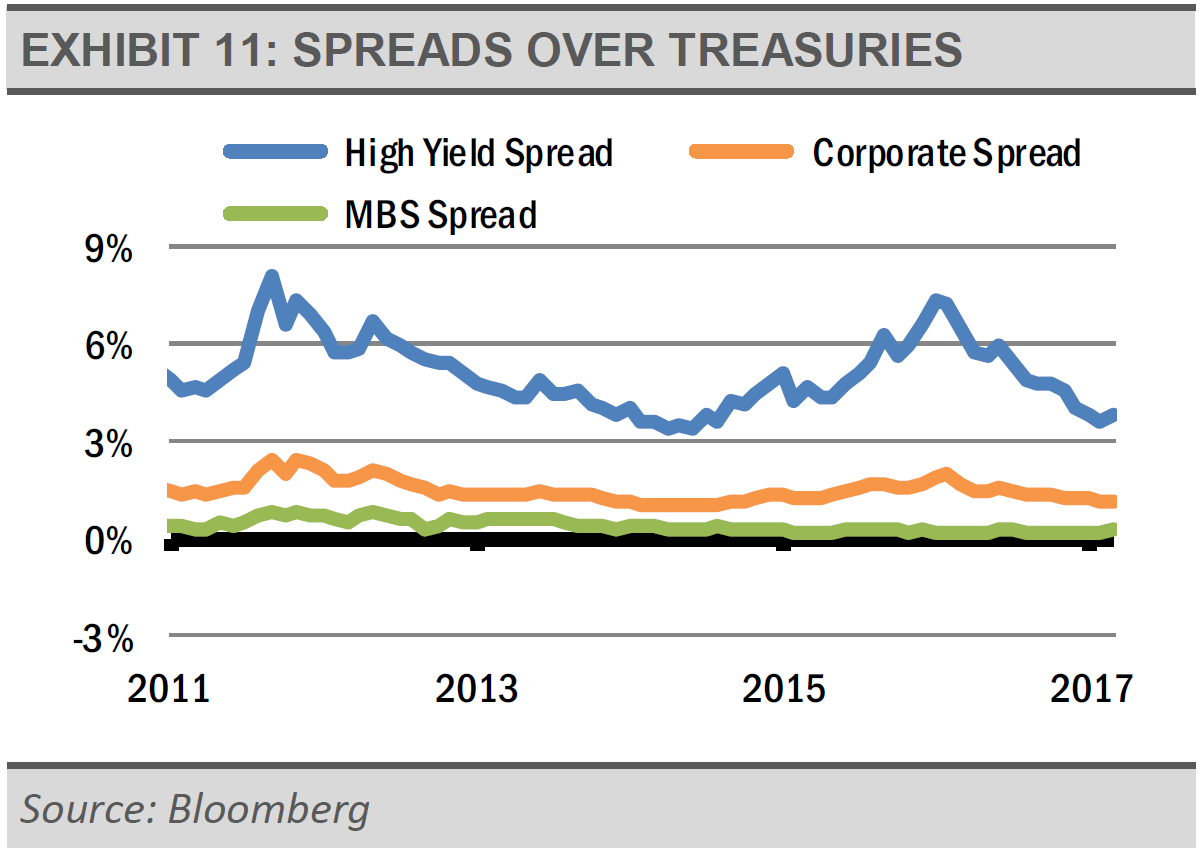

Similar to our expectations that certain areas of the equity markets that have rallied strongly will begin to lag, areas of the bond market that exhibit more credit risk may also struggle. As exhibit 11 illustrates, the premium, or spread, that investors earn for owning both investment grade and below investment grade bonds has declined, which reduces the attractiveness of these bond sectors.

In fact, we see increased uncertainty as the Fed considers letting its balance sheet shrink. Though we question how far the Fed can and will go in reducing the size of its balance sheet as increased global demand for the U.S. dollar may require a large endpoint, any significant balance sheet decrease can disrupt the fixed income markets.

Even a temporary disruption as the markets adjust to the new reality can have significant impacts given how tight spreads have become.

We think that corporate bonds and especially mortgagebacked securities (MBS) are the most vulnerable. During Quantitative Easing, the Fed started purchasing MBS to the extent that the Fed now owns more than 30% of the market. The Fed backing out of the MBS market will likely have adverse effects on the space. Thus, we have reduced exposure to corporate bonds and mortgage-backed securities in recent weeks.

We think that better opportunities exist in some fixed income sectors, such as taxable and high yield municipal bonds, as well as some investment grade credit sectors, including asset-backed securities. At this time, senior loans is the one high yield sector which may be attractive to us.

ALTERNATIVE INVESTMENTS

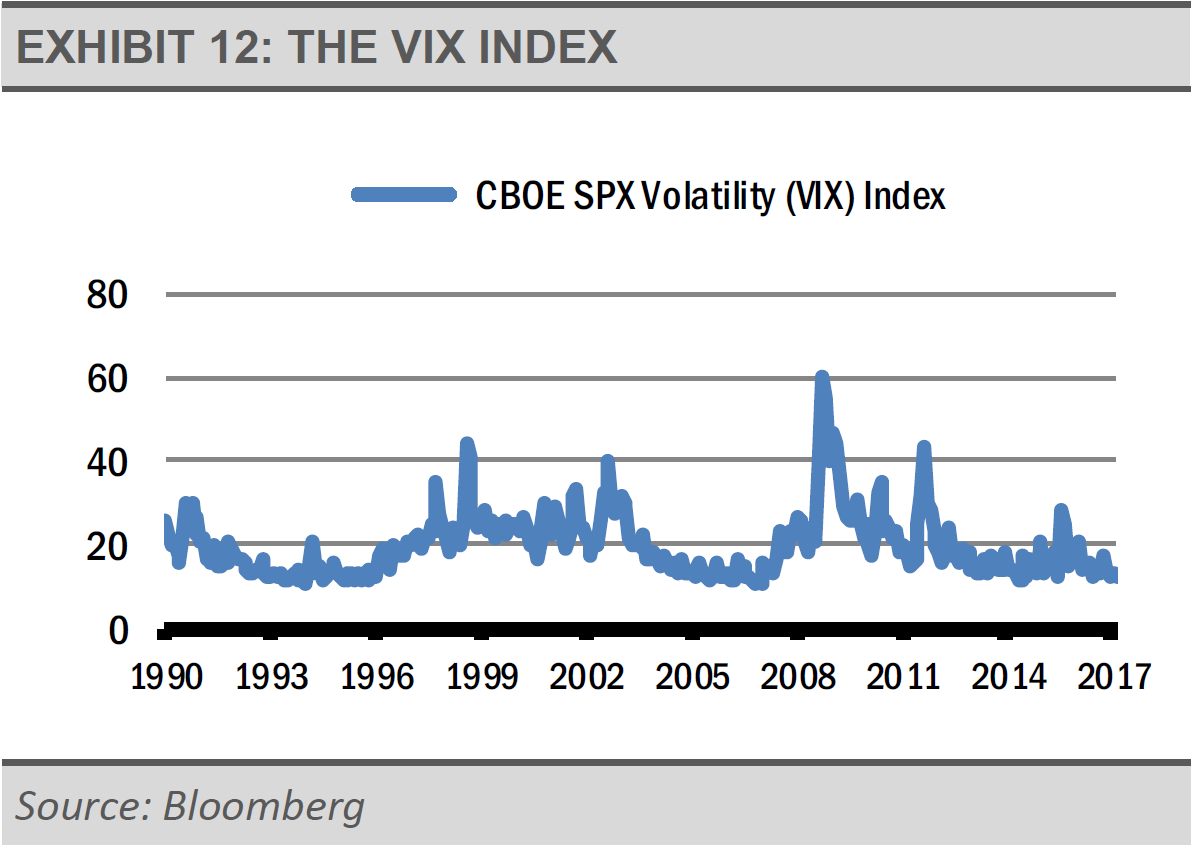

We expect volatility to increase as the Fed tightens monetary policy and the markets realize that other areas of policy change, such as regulatory and tax reform, may come more slowly than some would hope. As a result, we have made adjustments in our alternative allocations that should help dampen overall portfolio risk, while potentially generating return from increased market volatility.

Exhibit 12 on the following page shows the level of the VIX Index, a proxy for equity market volatility, since 1990. Periods of low volatility have been followed by periods of higher volatility, and the level of the VIX has been near historic lows of late. We expect a move to higher volatility in the future, though higher volatility does not necessarily mean a significant market decline.

We recently added two different options writing strategies that we think stand to profit from a higher volatility regime.

These ETFs generate returns by selling put options or call options on the S&P 500 Index. As volatility increases, so does the potential options premium generated from these sales. Both ETFs reinvest the premiums they receive to potentially increase the funds’ net asset value (NAV) over time.

In addition to those purchases, we added to our existing positions in convertible bonds. Convertible bonds offer an attractive yield, as well as potential for capital appreciation.

Still, overtime they have exhibited only about 70% of the volatility of the broad equity market.

Through our other non-traditional investments, we are finding a host of return enhancing and risk management opportunities further afield. From broadly diversified ETFs that blend allocations to REITs, MLPs, dividend-paying equities, and corporate bonds, to more focused, outside of the mainstream holdings, such as high yield municipal bond ETFs, ETFs focused on preferred stocks, and high quality floating rate fixed income ETFs, these allocations to non-traditional investments should serve to generate an attractive return while reducing overall portfolio risk through low correlation and volatility reduction.

In summary, with an eye towards risk management, we are positioned to benefit from solid global economic growth, rising short-term interest rates, and a strengthening U.S. dollar. We expect volatility and market dips. So long as fundamentals remain solid, we see potential dips as buying opportunities.

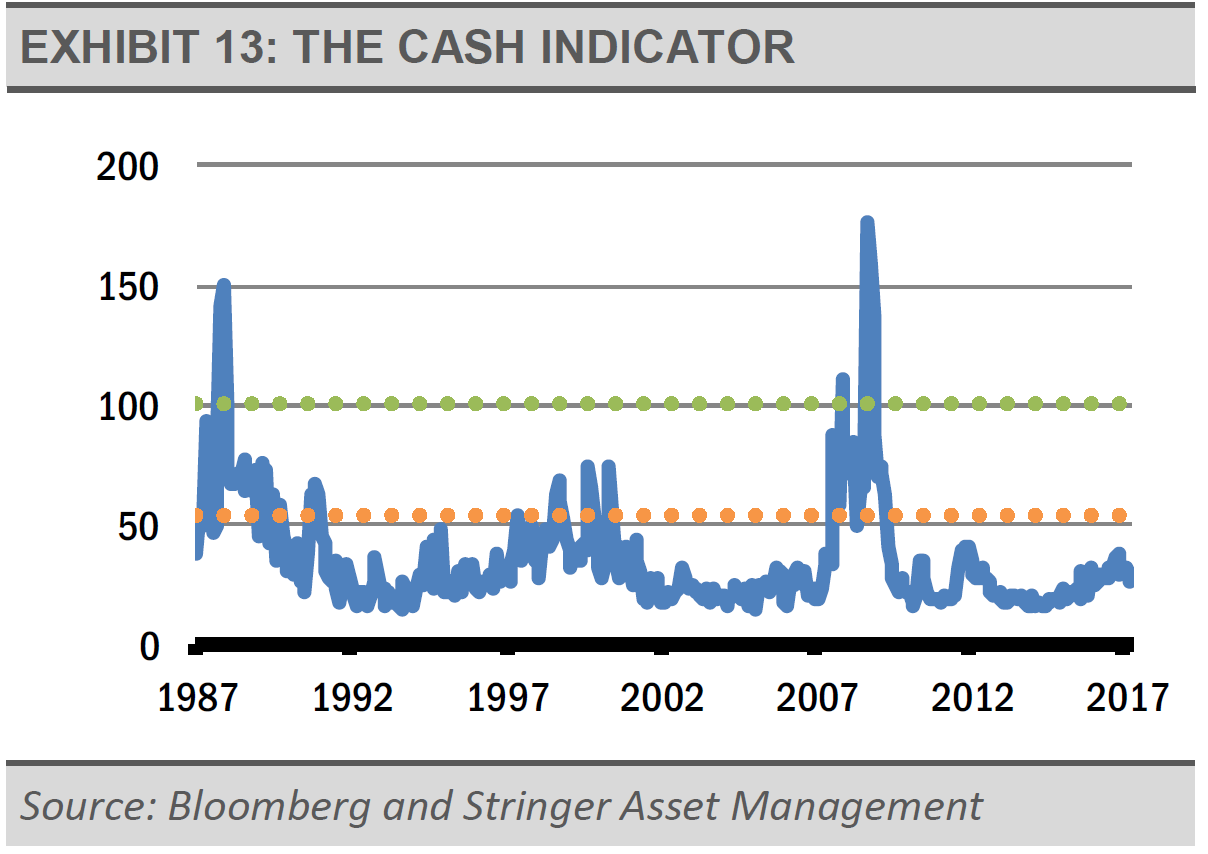

THE CASH INDICATOR

The Cash Indicator (CI) has declined to its lowest levels since last summer. At these subdued levels, the CI is another indication that a downward move in the equity markets is likely a buying opportunity to take advantage of, rather than a cause for panic.

This article was written by Gary Stringer, CIO, Kim Escue, Senior Portfolio Manager, and Chad Keller, COO and CCO at Stringer Asset Management, a participant in the ETF Strategist Channel.

DISCLOSURES

Any forecasts, figures, opinions or investment techniques and strategies explained are Stringer Asset Management, LLC’s as of the date of publication. They are considered to be accurate at the time of writing, but no warranty of accuracy is given and no liability in respect to error or omission is accepted. They are subject to change without reference or notification. The views contained herein are not be taken as an advice or a recommendation to buy or sell any investment and the material should not be relied upon as containing sufficient information to support an investment decision. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Past performance and yield may not be a reliable guide to future performance. Current performance may be higher or lower than the performance quoted.

The securities identified and described may not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in the securities identified was or will be profitable. Data is provided by various sources and prepared by Stringer Asset Management, LLC and has not been verified or audited by an independent accountant.