![]()

FRAK seeks to replicate the price and yield performance of the MVIS® Global Unconventional Oil & Gas Index (MVFRAKTR) index that tracks the overall performance of companies involved in the exploration, development, extraction, and/or production of unconventional oil and natural gas. Its year-to-date returns have been 7.73 percent and the past year, it has gained 17.83 percent in total return.

5. Oppenheimer S&P 500 Revenue ETF (NYSEArca: RWL)

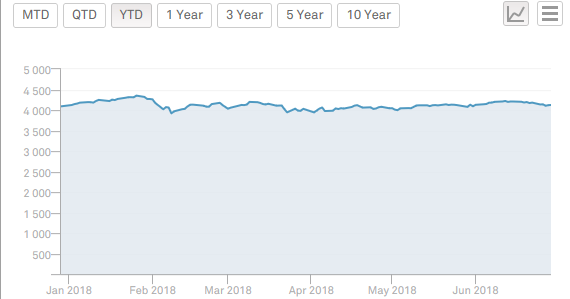

RWL tracks the S&P 500 Revenue-Weighted Index, which has been relatively flat in terms of its year-to-date performance. Nonetheless, value investors who rely heavily on fundamentals are predicting a strong second half of 2018 in terms of earnings, particularly for S&P 500 companies that will benefit from a corporate tax cut.

“The corporate tax cut is a windfall for companies and for the economy,” said notable value investor David Katz, the chief investment officer at Matrix Asset Advisors. RWL has 80% of its net assets in large capitalization companies within the S&P 500 according to the revenue earned by the companies. If the second half of 2018 shows strong revenue growth, this ETF could be in play. Thus far, it is down 0.91 percent, but boasts a return of 11.87 percent the past year and 8.58 percent the past three years.

“The corporate tax cut is a windfall for companies and for the economy,” said notable value investor David Katz, the chief investment officer at Matrix Asset Advisors. RWL has 80% of its net assets in large capitalization companies within the S&P 500 according to the revenue earned by the companies. If the second half of 2018 shows strong revenue growth, this ETF could be in play. Thus far, it is down 0.91 percent, but boasts a return of 11.87 percent the past year and 8.58 percent the past three years.

SEC Slackening ETF Rules

The playing field in the ETF space will get wider in the second half of 2018 as the SEC is looking to ease up on its rules for low-risk ETFS, making the regulatory barrier easier to cross and for more market opportunities to open up. The rule, 6c-11, would “exempt exchange-traded funds (‘ETFs’) from certain provisions of [the Investment Company Act of 1940]and our rules” and “permit certain ETFs to begin operating without the expense and delay of obtaining an exemptive order from the Commission.”

Related: SEC Looks to Ease Rules Approving Low-Risk ETFs

Rule 6c-11 should pave the way for more ETFs to enter the marketplace, providing a financial landscape that will be rife with innovation in investment solutions for the second half of 2018 and beyond.

““Given the strength and continuous growth of the ETF industry, today’s decision is a positive regulatory development,” said Luke Oliver, Head of ETF Capital Markets. “We echo Chairman Clayton’s words on the importance of a regulatory framework to embrace innovation in the financial markets.”

For more equity-related news, click here.