Why is this the case?

As mentioned earlier, XIV provides 1x short exposure to 1-month VIX futures, reset daily. Therefore, if 1-month[10] VIX futures rise by 100% or more, XIV will go to $0, losing 100% of its value[11].

It’s important to point out here that VIX futures exposure is not the same thing as exposure to the VIX index. Historically, 1-month VIX futures have a beta to the VIX index of approximately 0.5[12]. So, for XIV to lose all its value, we would need to see spot VIX increase by 200% or more[13].

Is this within the realm of possibility? Since XIV launched in 2010, the largest one-day loss (measured from the previous day’s close to the next day’s low) was 31.0%. This occurred on August 24, 2015 when VIX spiked 90.1% from 28.03 to 53.29. This VIX spike was the largest in the CBOE VIX dataset, which goes back to the early 1990s.

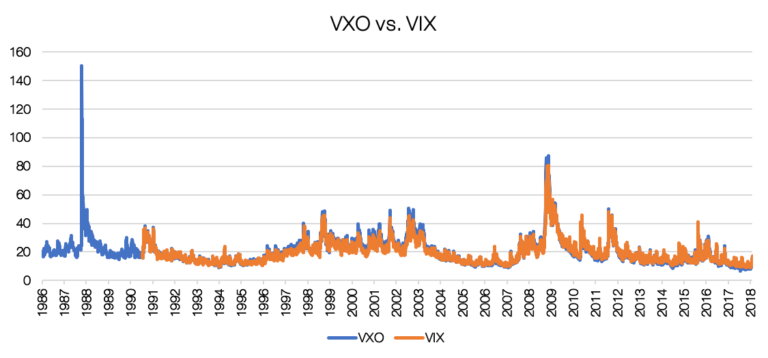

Fortunately, we can go back even further by looking at the VIX’s predecessor, the VXO index. VXO was launched in 1993 and has price history dating back to 1986.

There are two main differences between VIX and VXO:

- VIX is based on S&P 500 options and VXO is based on S&P 100 options.

- VIX uses a broader range of strike prices than VXO, which used only near-the-money strikes. In addition, VIX was designed so that it can be statically replicated as opposed to the VXO, which requires dynamic hedging to replicate.

Despite these differences, VIX and VXO track each other pretty closely.

Source: Bloomberg.

Black Monday immediately jumps out from the above chart. On Friday, October 16, 1987 VXO closed at 36.37. On Monday, October 19, 1987, the index spiked to an intraday high of 152.48, an increase of 319%. A similar spike in VIX would almost certainly cause XIV to lose all of its value.

This gets to why XIV has a “long-term expected value of zero.” The longer you hold it, the more likely you are to experience a 1987 event and lose all of your money. Hence, XIV is not a great option as a standalone, buy and hold investment.

The more relevant question for us though is: “Does this invalidate the Derivatives ETN 60/40 as a viable way to introduce leverage into your portfolio over the long-run?”

We think the answer is no for two main reasons.

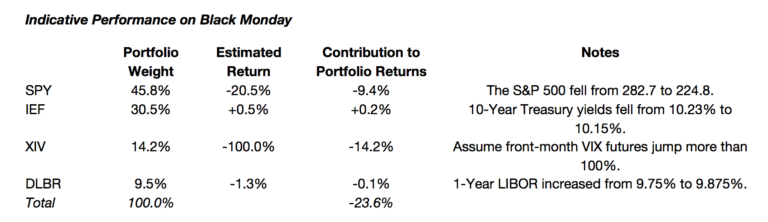

First, the proposed strategy does not use XIV as a standalone position, but rather as a part of a portfolio. The actual allocations for the hypothetical Derivatives 60/40 are 45.8% to SPY, 30.5% to IEF, 14.2% to XIV, and 9.5% to DLBR.

Source: Bloomberg. Calculations by Newfound Research. None of the ETFs were actually live on Black Monday (October 19, 1987). Returns were estimated using index returns and other index data. Past performance does not guarantee future results.

Based on the available data, the portfolio would have lost around 24% on Black Monday. While this is obviously painful, it’s not all that different than the projected 21% loss on the 1.7x levered SPY/IEF portfolio. A 1987-like event will always be extra painful for those using leverage, whether something like XIV is used or not.

Second, the proposed strategy rebalances on a monthly basis and so it doesn’t truly buy and hold XIV. Instead, any XIV gains are constantly harvested and reinvested in the other parts of the portfolio as monthly rebalances are executed. Similarly, when XIV underperforms the other positions in the portfolio, rebalances will trim other positions to invest in XIV.

But let’s say that we are really concerned about the impact of a 1987 type of outlier. What can we do? There are a few options (other than just foregoing short volatility as a means of achieving leveraged equity exposure altogether).

- We could replace XIV with a lower risk short volatility alternative.For example, we could short mid-term VIX futures instead of short-term VIX futures. ZIV (VelocityShares Daily Inverse Medium-Term ETN) is an ETN that offers exposure to the S&P 500 Mid-Term Futures Inverse Daily Index. This index takes short positions in fourth, fifth, sixth, and seventh month VIX futures contracts. The benefit from a risk perspective is that this index has a beta to the VIX of around -0.2 instead of the -0.5 for short-term VIX futures. As a result, we need to see a more extreme VIX move to be wiped out (~500% spike instead of a ~200% spike, assuming long-term betas hold).The main disadvantages of moving to mid-term futures are that (i) the risk-adjusted return of shorting mid-term futures has lagged that of shorting short-term futures and (ii) a larger allocation to the derivatives-based portfolio relative to the simple 60/40 SPY/IEF is needed to hit the volatility target. In fact, when we approximate a Black Monday stress test of the portfolio with ZIV replacing XIV, we actually end up with a larger loss (-28% vs -24%) – despite the fact the ZIV position does not get wiped out – because we have to hold more ZIV to get the same amount of leverage.Another replacement for XIV would be a strategy that pairs short positions in short-term VIX futures with some type of long volatility hedge. An example would be the VelocityShares VIX Short Volatility Hedged ETN (ticker: XIVH), which tracks the S&P 500 VIX Futures Short Volatility Hedged Index. This index pairs a 90% short position in VIX futures with a 10% 2x long position in VIX futures, rebalanced quarterly on a rolling basis. The offsetting positions may be confusing, but the idea is actually interesting. We discussed it in Hedge Hunting: Wrangling the VIX[14].At the 10% 2x long/90% 1x short base weights and still keeping our -0.5 beta estimate to VIX, we would need to see a 285% VIX spike to get wiped out instead of the 200% spike necessary with pure XIV. In practice, the weighting is rarely 10% 2x long and 90% 2x short since the rebalancing is not daily. In fact, we found that the long volatility weighting was less than 2.5% about 7.5% of the time going back to 2005. If we were unlucky enough to have a black swan hit at a time where we were this underweight the long volatility position, a ~215% VIX move would wipe us out.We still have the same side effect, albeit to a lesser degree, that we had with ZIV in that by using a lower volatility product, we require a larger allocation to get the same amount of leverage.

- We could utilize an active strategy to trade XIV. For example, approaches using momentum, the slope of the VIX futures curve, and comparisons between implied and realized volatility all show promise. Using some combination of these approaches may indirectly reduce the impact of a large volatility spike by reducing the probability that we have a full position in XIV. Yet, events like 1987 that largely come out of nowhere are almost certainly not going to be predicted any type of active trading approach via skill.

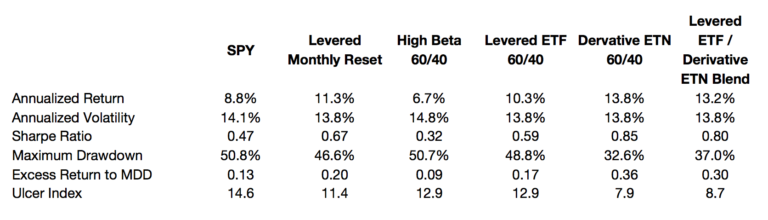

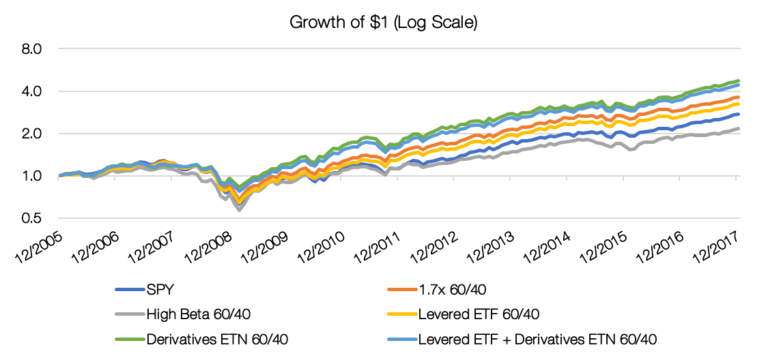

- We could combine the Derivatives ETN 60/40 with the Levered ETF 60/40 to reduce the size of the XIV position. We present the results of this combination below. The XIV position is reduced from 14.2% to 11.0% and the simulated 1987 return improves from -24% to -23%.

Source: CSI, Bloomberg. Calculations by Newfound Research. Data covers the period from December 2005 to December 2017. Index returns are hypothetical. Fees for underlying exposures are netted out, but no other fees (advisor fees, trading costs, etc.) are accounted for. Returns include the reinvestment of dividends. Past performance does not guarantee future results.

Source: CSI, Bloomberg. Calculations by Newfound Research. Data covers the period from December 2005 to December 2017. Index returns are hypothetical. Fees for underlying exposures are netted out, but no other fees (advisor fees, trading costs, etc.) are accounted for. Returns include the reinvestment of dividends. Past performance does not guarantee future results.

Conclusion

Leverage is a tool. When used prudently, it can help investors potentially achieve much more risk-efficient returns. When used without care, it can lead to complete ruin.

For many investors who do not have access to traditional means of leverage, they can mimic the effect using levered ETFs and derivative ETNs (or they can do so inefficiently with high beta ETFs).

Over the period from 2005 to 2017, levered ETFs showed comparable performance to a traditionally levered 60/40 portfolio while derivative ETNs exhibited strong outperformance.

Looking back even further in history, a 1987-like event will always be extra painful for those using leverage, regardless of the method use to achieve it. However, combining the levered ETF and derivative ETN approaches may improve the outcomes in these trying market environments.

By employing leverage in creative ways, we are not destroying the risks associated with using traditional forms of leverage; we are merely transforming them. Each method comes with its own set of risks, but these options provide investors with practical ways to convert high risk-adjusted returns into higher absolute returns without using margin directly.

[1] https://blog.thinknewfound.com/2017/12/portable-beta-making-returns-youre-already-getting/

[2] https://blog.thinknewfound.com/2018/01/levered-etfs-long-run/

[3] For the quarterly and annual reset versions, we stagger the resets over monthly increments to reduce timing luck.

[4] We actually use the S&P 500 High Beta Index with a 25bps annual fee applied as a proxy for the ETF as the ETF did not launch until 2011.

[5] The replicated daily returns consist of three components. The first component is simply twice the daily return of the reference index (the S&P 500 in the case SSO and the Bloomberg Barclays 7-10 Year Treasury Index in the case of UST (note: UST’s reference index is actually the ICE U.S. Treasury 7-10 Year Bond Index, but the two indices are very similar, and we were able to pull a longer history of the Bloomberg Barclays index). The second component is the financing cost for borrowing. We assumed annualized financing costs equal to the 3-month Treasury bill rate plus a spread. The spread was selected such that the total return of our replication index matched the total return of the actual ETF (SSO or UST) for their shared history. The third component is fees: 90bps for SSO and 95bps for UST.

[6] XIV is represented by the S&P 500 VIX Short-Term Futures Inverse Daily Index with fees (135bps) netted out.

[7] The first contract rolls off two days prior to expiry, so for a brief period of time the ninth listed quarterly contract is also included in the index.

[8] This is an imperfect analysis as actual returns will not just be influenced by interest rate levels, but also the shape of the Eurodollar futures curve.

[9] http://app.velocitysharesetns.com/files/prospectus/CS_VIX_VelocityShares_ETN_Amended_Final_Pricing_Supplement_AR48_long_form_2.PDF

[10] Exposure is actually to a rolling short position in the front two VIX future contracts.

[11] In fact, the ETN issuer has the right to accelerate the maturity of the ETNs in the event that XIV falls by 80% or more in a single day.

[12] This is a gross oversimplification of relative behavior between spot VIX and VIX futures.

[13] Again, this is a gross oversimplification. It is certainly possible that a spot VIX move smaller than 200% could lead to a VIX futures increase of more than 100%.

[14] https://blog.thinknewfound.com/2015/08/hedge-hunting-wrangling-vix/