Fidelity Investments Inc. purchased a 7.4% stake in massive Bitcoin mining company Marathon Digital Holdings (MARA) at the end of July. Fidelity spent $20 million on the purchase.

The shares are to be spread across four index-based funds, the Fidelity Extended Market Index Fund (FSMAX), the Fidelity Nasdaq Composite Index Fund (FNCDX), the Fidelity Total Market Index Fund (FSKAX), and the Fidelity Series Total Market Index Fund (FCFMX).

The four funds have a combined market capitalization of $170 billion.

Large financial institutions and asset managers have become increasingly interested in MARA.

Fidelity joins large financial institutions, Blackrock, Susquehanna, and the Vanguard Group in holding a significant stake in MARA.

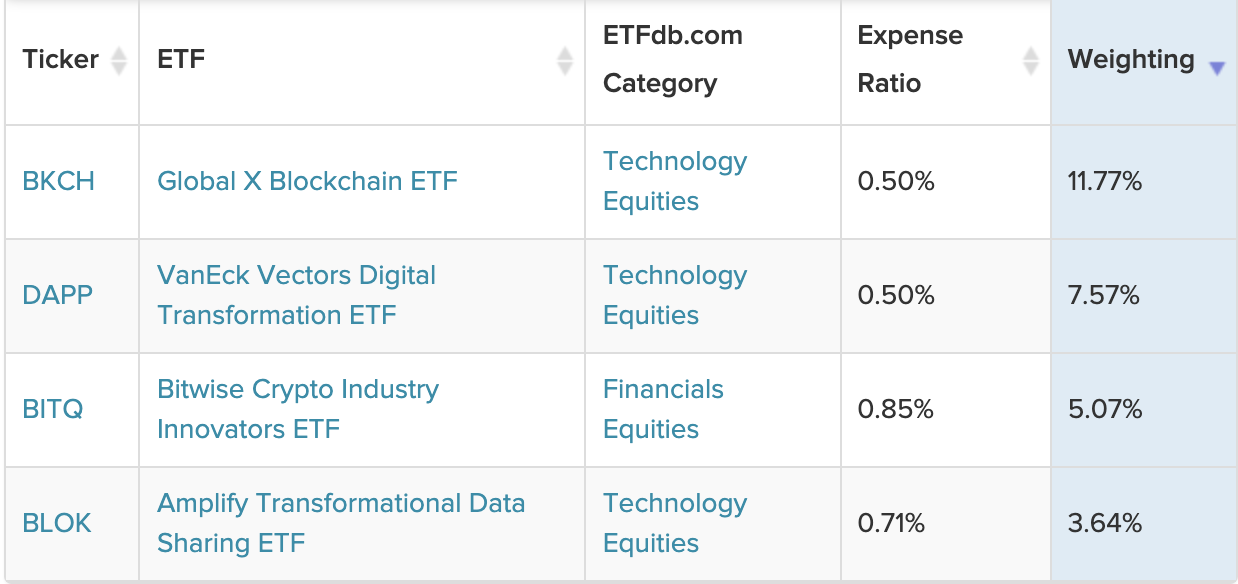

Additionally, MARA can be found in the portfolios of 45 ETFs, according to ETFDB.com.

Four ETFs, the Global X Blockchain ETF (BKCH), the Vaneck Vectors Digital Transformation ETF (DAPP), the Bitwise Crypto Industry Innovators ETF (BITQ), and the Amplify Transformational Data Sharing ETF (BLOK) all hold MARA in their top 15 holdings.

See also: Want Crypto Exposure without the Currency? These ETFs Own Crypto Miners

Source: ETFDB.com. Data as of August 8, 2021.

Marathon increased its Bitcoin production by 66% in July, Marathon CEO Fred Thiel told Yahoo! Finance. Marathon miners produced 442.2 BTC in July.

This increase is because of the massive drop in the global hash rate this July, most likely due to the number of Chinese Bitcoin miners forced to go offline.

The increase in production is likely not permanent as Chinese miners relocate to more crypto-friendly countries, increasing the global hash rate.

Marathon currently has 19,000 miners and has purchased an additional 100,000 that will be deployed throughout the coming year.

For more news, information, and strategy, visit the Crypto Channel.