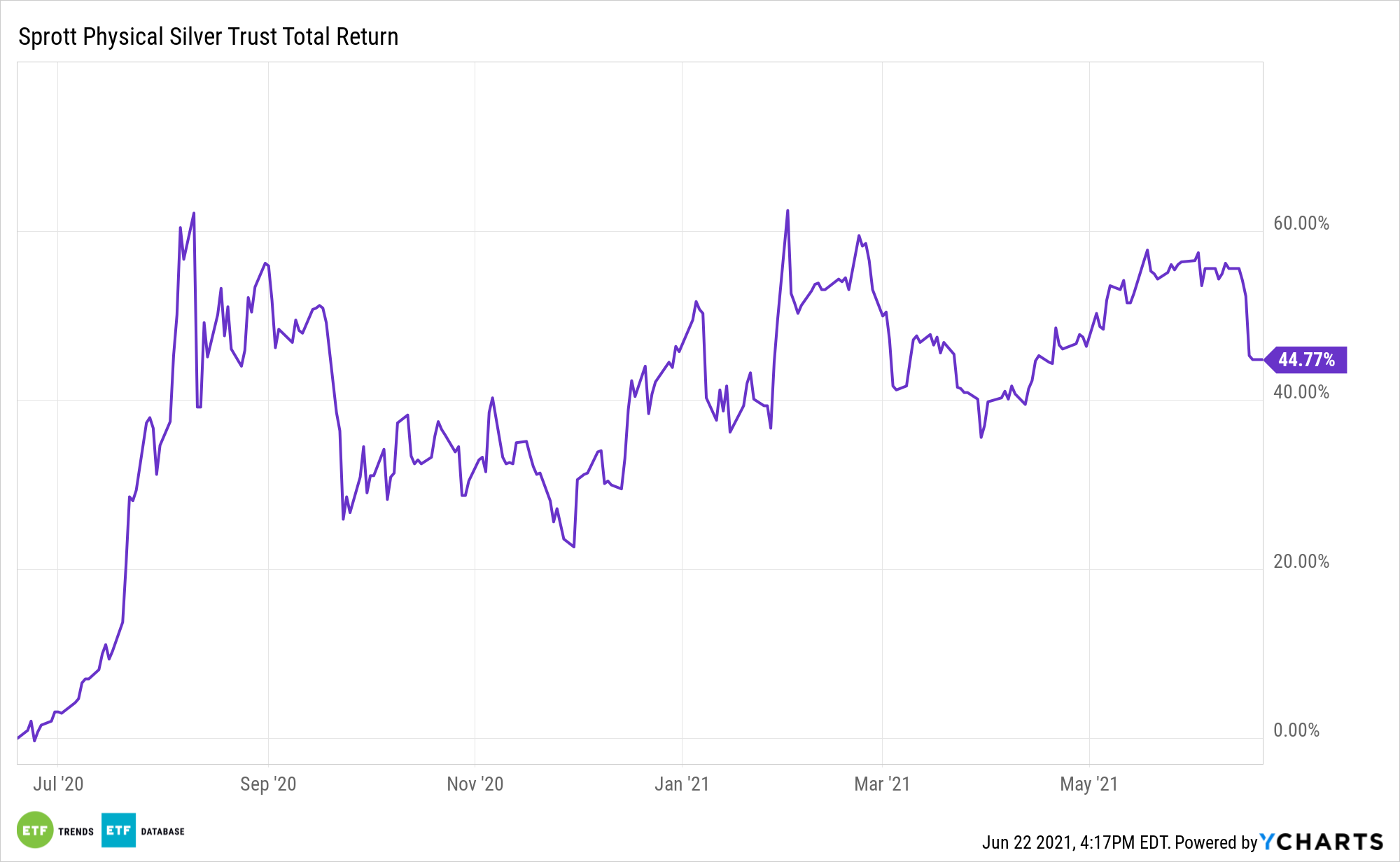

Good performance has been good to the Sprott Physical Silver Trust (PSLV).

Between May 2020 and May 2021, PSLV has returned 53%. Over the same time period, the fund gained over $2.7 billion in assets under management—a 199% surge, the fastest growth rate as compared to other U.S. based silver-focused ETFs.

Why Has Silver Outperformed? It’s Supply & Demand

While precious metals are well-positioned to thrive in the current environment, given inflation fears, silver is uniquely positioned to surge in the era of climate change.

Silver is a key metal in the green revolution. It is a primary component in a number of climate-friendly technologies, such as solar panels and hybrid cars, and has a number of surprising uses.

Because of the importance environmental technologies will have in the coming years, silver is expected to see rising demand, even as supply remains constrained. Overall production of silver was down in 2020, due to the COVID-19 pandemic.

In the upcoming years, an additional 100 million ounces of silver are estimated to be necessary to meet this new demand. “I don’t see a lot of 10 million-ounce mines coming online in the next 5-10 years,” said Sprott Senior Portfolio Manager Marina Smirnova in an episode of Sprott Talk Radio, adding she thinks that “a real shortage” of supply is likely over the next few years.

Her colleague Paul Wong said in a recent report that “fundamental supply and demand are overwhelmingly bullish [for silver]as investment and industrial demand, especially in clean technology, far outstrip supply for the foreseeable future.”

The Silver Institute expects silver prices to soar 30% in 2021, and finally break past the resistance point of $28/oz. Some even see the precious metal hitting $40 by the end of the year.

About PSLV

PSLV is a closed-end trust that holds unencumbered, fully-allocated London Good Delivery bars of silver bullion, stored in the custody of the Royal Canadian Mint.

Shareholders also have the ability to redeem their shares for physical bullion anywhere in the world (subject to certain minimum conditions). Such redemptions do not dilute the trust’s exposure for remaining shareholders.

PSLV’s expense ratio is 0.62%.

For more news, information, and strategy, visit the Gold & Silver Investing Channel.