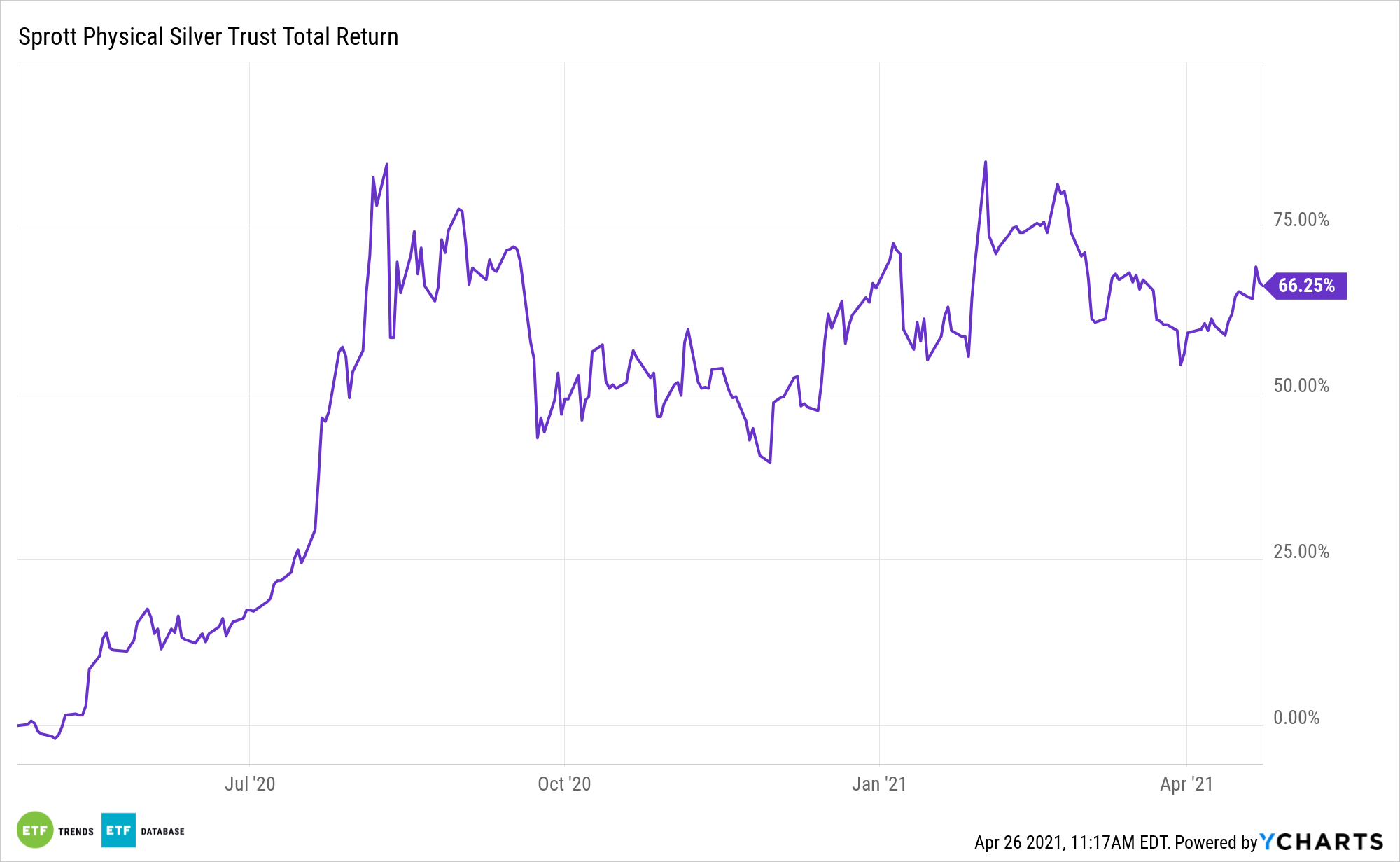

Like gold, silver’s value skyrocketed in 2020 due to the COVID-19 pandemic, driven higher by falling interest rates and a shrinking global economy. But expectations have changed in 2021, said Sprott Asset Management senior portfolio manager Maria Smirnova in a recent interview.

On the latest episode of Sprott Gold Talk Radio, host Ed Coyne interviewed Smirnova to discuss silver and its prospects.

Enthusiasm for gold and silver has dampened in 2021, as the dollar has strengthened, economic optimism has improved, and interest rates have begun to rise, said Smirnova. But she added that “we do see this as transitory.”

As Smirnova pointed out, the recent $1.9 trillion stimulus package is still coursing through the economy.

“Silver is benefiting from the economic recovery,” she added, adding that 60% of silver’s usage has historically been in industrial applications.

For centuries, silver has had value in everyday life, but it has found new applications in the accelerating clean energy economy. For example, solar photovoltaic panels require silver in their construction, and as solar buildout continues, their demand for silver will continue to grow. Hybrid and electric vehicles also use silver—more than internal combustion cars—and the charging stations needed to keep these cars on the road require additional silver as well. Even 5G-enabled cell towers need silver.

“We’ve counted 100 million incremental ounces we’ll need every year for the next ten years,” said Smirnova.

See also: The Case for Silver Investing and Sprott’s ‘PSLV’

Silver’s Evolving Supply

Yet silver miners face significant headwinds. Smirnova points out that 80% of silver is mined and the rest comes from scrap—and that percentage has dropped recently. That’s because scrap is price sensitive: when the silver price drops, fewer people recycle it, which means more metal needs to be mined to make up the supply gap.

Given that an estimated 100 million ounces of silver will be needed to be mined to fit upcoming demands over the next few years – roughly 10% of the current silver market – shortages are highly likely. Additionally, few mines focus exclusively on silver. It is often mined in tandem with other metals (such as gold, copper, lead, and zinc), further increasing the likelihood of global shortages over the next five years.

“I don’t see a lot of 10 million-ounce mines coming online in the next 5-10 years,” she said, adding she thought thinks that “a real shortage” of supply is likely over the next few years.

“In the silver market,” Smirnova explains, “we produce about a billion ounces a year, but we produce about 150 million ounces of gold a year. If you look at that ratio, it is about 6.7 to 1, but [gold’s price] trades 65-68 to 1 versus silver right now. Silver, in my mind is still much more undervalued than gold is.”

To take advantage of silver’s intriguing market position, investors can use coins, which tend to have a premium to spot prices. They can also turn to assets like the physically backed Sprott Physical Silver Trust (PSLV).

“I’m a long-term believer in silver,” concluded Smirnova.

For more information, please visit the Gold & Silver Investing Channel.