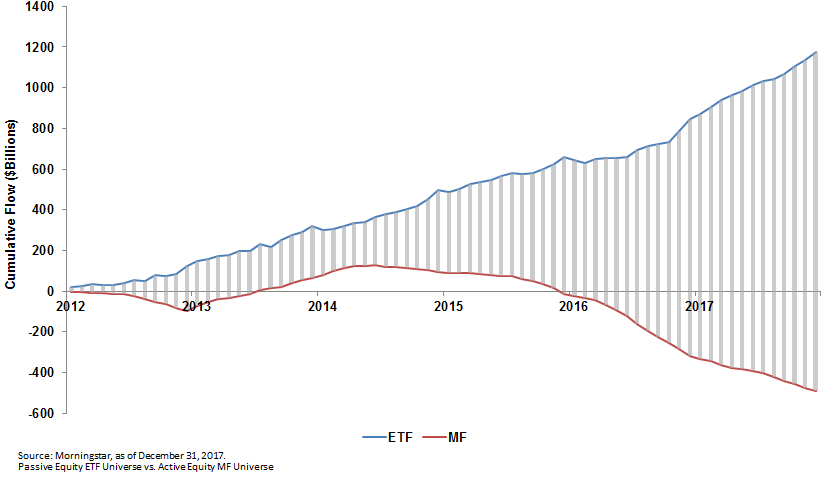

“Index equity ETFs have continued to have positive flows year after year, while active mutual funds have struggled with almost $500 billion in outflows over the last five years,” Noel Archard, Global Head of SPDR Product for State Street Global Advisors, said.

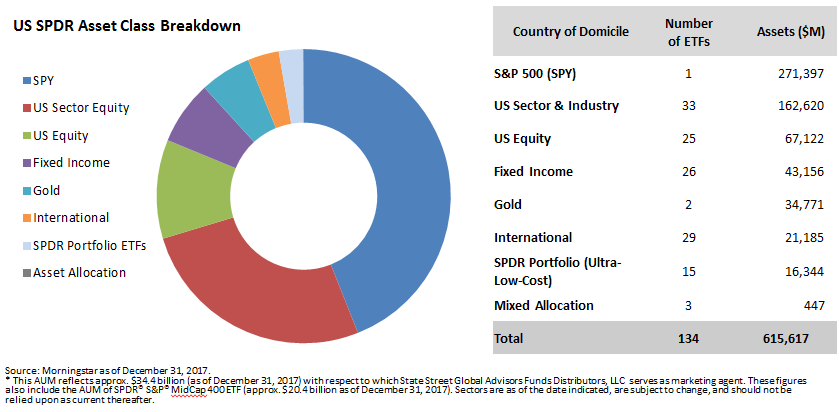

ETF investors have also focused on low-cost, index-based products as many grown disappointed with the underperformance and high cost of active mutual fund strategies. In 2017, low-cost core ETFs gathered 57% of ETF flows. These low-cost core ETFs also come with an average expense ratio of 0.09%, compared to the broader ETF industry’s 0.51% annual expense. While there are over 2,100 ETFs in the U.S., low-cost core ETFs make up just 5% of the universe and hold 37% of total assets.

Institutional investors have also increased their exposure to ETFs, citing benefits such as ease of use, high liquidity and market access, among others. Looking ahead, institutional ETF investors are expected to continue to raise their allocations toward ETFs in the years ahead.

As investors consider ETFs as part of a diversified portfolio, Archard argued that ETFs can fit both core or strategic positions and trading vehicles for tactical portfolios. ETFs can be used as strategic asset allocations to achieve diversified, long-term, buy-and-hold asset allocation while providing lowers fees and greater tax efficiency. Additionally, as tactical allocations, ETFs can help investors overweight specific asset classes, provide precise exposures and help with risk management and hedging.

Furthermore, ETFs allow investors take part in traditionally difficult-to-access market segments, such as commodities like gold, natural resources, currencies and emerging market countries, among others.

Financial advisor who are interested in learning more about the ETF industry can watch the webcast here on demand.