Today we are celebrating the 25th anniversary of the first exchange traded fund to hit U.S. markets. As we look back at how the S&P 500 ETF fundamentally changed the way many investors view the markets, we may also roughly outline what is in store for the next 25 years.

On the recent webcast, An Innovation that Sparked a Revolution, Jim Ross, Executive Vice President of State Street Global Advisors and Chairman of Global SPDR, helped paint the ETF landscape. After the launch of the first index-based ETF, SPDR S&P 500 ETF (NYSEArca: SPY), back in 1993, the ETF industry now offers a range of strategies that touch upon many different asset categories, such as international, fixed-income, commodities, alternatives and currencies, among others, to help investors gain exposure to many different markets that they would otherwise not consider.

Ross explained that the ETF idea came about after the October market crash of 1987, or also known as the Black Monday event. The Securities and Exchange Commission argued that this sudden crash could have been avoided if market makers turned to a single product, or something like an ETF, for trading baskets of stocks instead of individual stock securities. Consequently, market damage and volatility could have been significantly diminished.

Consequently, American Stock Exchange came up with the idea and partnered with State Street Global Advisors to launch SPY, which tracks the S&P 500, one of the most widely followed indices by institutional investors.

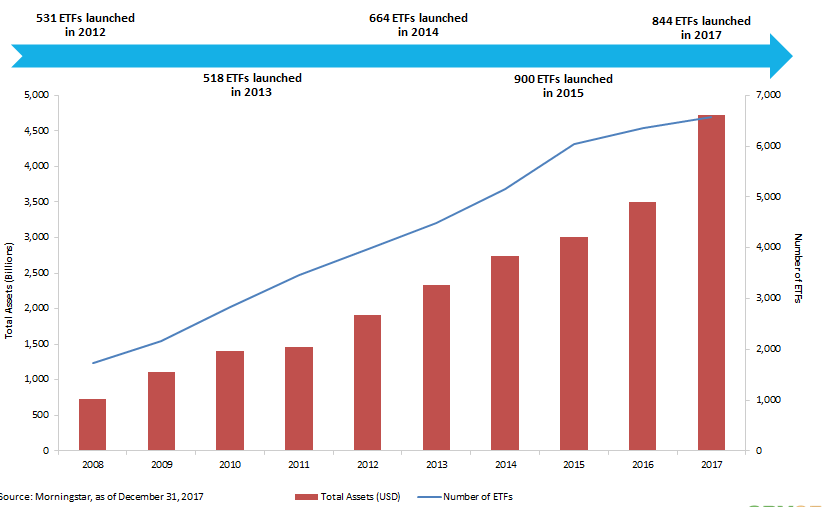

After 25 years, there are now over 5,000 ETFs that track specific industries, sectors, geographies, or cross-sections of each, with over $5 trillion invested worldwide. On a typical day, ETFs make up about 25% of equity trading volume.

![]()

ETFs are a type of pooled investment vehicle that issues and redeems individual shares only in large aggregations known as Creation Units. These ETF shares are then traded on securities exchanges like how stocks are bought and sold.

ETFs exhibit many differences to traditional open-end mutual funds, opening a whole new world of wealth management for investors and advisors. For instance, ETF shares are bought and sold in the secondary market or stock exchange, whereas mutual funds are bought and sold directly through a mutual fund company. ETFs are continuously priced during the day and prices fluctuate like stocks and have bid/offer spreads while mutual fund shares are priced once a day after market closing. ETFs can be traded through a broker and investors can use limits, stock-limit, short-sale orders and trade on margin. Additionally, ETFs exhibit greater transparency by disclosing of portfolio holdings on a daily basis, whereas mutual funds are only required to disclose holdings on a monthly or quarter basis.

Investors have also witnessed the benefits of utilizing ETFs and have been quick to switch assets into ETFs, often at the expense of mutual funds.