Elevated levels of production remain an issue for oil as well. OPEC has kept up production to pressure high-cost rivals, such as the developing U.S. shale oil producers. The International Energy Agency expects it will take several years before OPEC can effectively price out high-cost producers. Russia has also signaled it might trim output as much as some traders have hoped for.

ETF investors interested in gaining exposure to the improving energy sector have a number of broad plays to choose from. For example, the Energy Select Sector SPDR (NYSEArca: XLE), the largest equity-based energy ETF, is the best-performing member of the sector SPDR group this year.

SEE MORE: Energy Stocks, ETFs can Keep Surging

“Following the February lows, where crude hit $26 per barrel, the commodity has risen 96 percent—thanks in large part to OPEC’s willingness to cut production levels by nearly 700,000 barrels per day. On Sunday, Saudi Arabia stated the cartel was looking for new ways to cooperate with non-OPEC members to stabilize markets,” according to CNBC.

For more information on the oil market, visit our oil category.

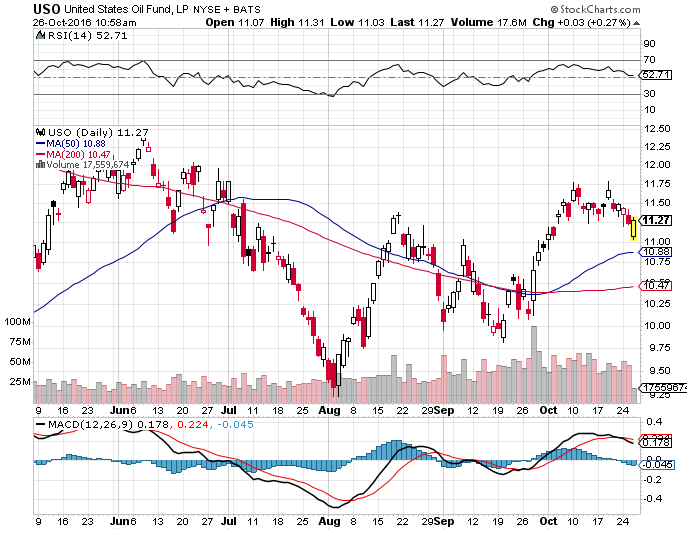

United States Oil Fund (NYSEArca: USO)