We think that in today’s global economy, where money flows freely across international borders, the natural level of interest rates is also influenced by global economic conditions, such as global economic growth, inflation, employment trends, and credit spreads.

For example, if the German Bund, which is of a similar credit quality to the U.S. Treasury Bond, yields 1%, the Treasury Bond of a similar maturity will yield a similar rate, accounting for other costs, such as currency exchanges. If the Treasury moves sufficiently higher relative to the Bund, global investors will sell Bunds and buy Treasuries, causing the Bund’s rate to increase and the Treasury yield to decline.

Since long-term interest rates in other countries, such as Germany, affect long-term interest rates in the U.S., the Fed must pay attention to global markets outside of the U.S. when setting interest rate policies that are appropriate for the times: tightening when inflationary pressure is building and loosening when trying to spur growth.

Long-term interest rates are low globally, reflecting a sluggish economic growth environment and little inflationary pressure. These low long-term yields give the Fed little room to raise interest rates in our opinion.

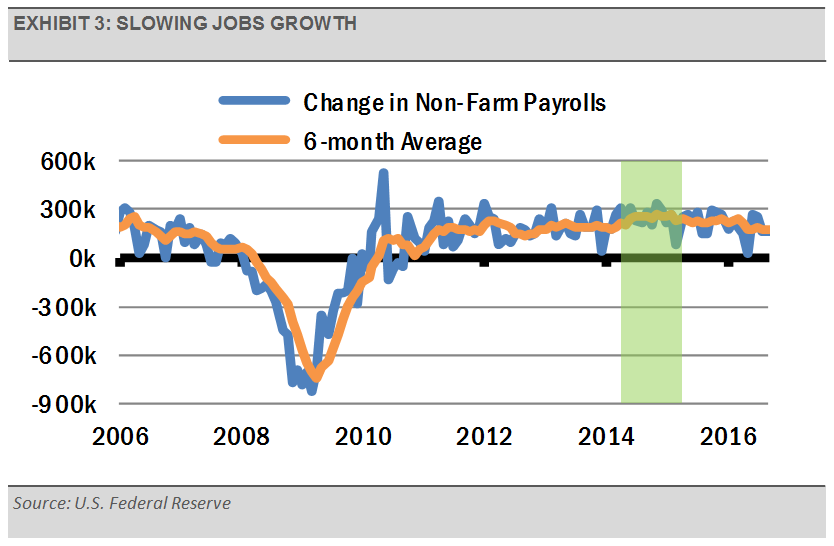

The September U.S. monthly employment report, released on October 7th, missed expectations as jobs creation cooled significantly from prior months. To reduce the month to month volatility in the jobs reports, we prefer to look at the rolling 6-month average. We think trends in the rolling average numbers are more important than the individual monthly reports.

The rolling 6-month average has settled at a rate significantly lower than in late 2014 and early 2015. Though the average current rate of jobs creation is near the low-end of the recovery range, these are not bad results. We think these numbers are reflective of an economy that continues to grow slowly and generate well-paying jobs.

Still, the declining rate of jobs creation is one of several risk factors that we are watching, and it suggests that the Fed should move cautiously going forward.

We think that if the Fed can be disciplined and wait for improving signs of jobs growth and increasing signs of inflation, the economy can continue to grow. As the economy grows, sales revenue should increase, along with corporate earnings. These trends can lead to positive financial market performance, which is our base scenario.

DISCLOSURES

Any forecasts, figures, opinions or investment techniques and strategies explained are Stringer Asset Management LLC’s as of the date of publication. They are considered to be accurate at the time of writing, but no warranty of accuracy is given and no liability in respect to error or omission is accepted. They are subject to change without reference or notification. The views contained herein are not be taken as an advice or a recommendation to buy or sell any investment and the material should not be relied upon as containing sufficient information to support an investment decision. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Past performance and yield may not be a reliable guide to future performance. Current performance may be higher or lower than the performance quoted.

The S&P 500 Index is an unmanaged index of 500 stocks used to measure large-cap U.S. stock market performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. Returns are based on price only and do not include dividends or other sources of income. Past performance is not a guarantee of future results.

The securities identified and described may not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in the securities identified was or will be profitable. Data is provided by various sources and prepared by Stringer Asset Management LLC and has not been verified or audited by an independent accountant.