The frenzied investor demand for minimum volatility products continues to increase certain defensive sector valuations and has created opportunities in other S&P 500 sectors, which now appear undervalued on a relative basis.

Flows in low-volatility, factor based products have been concentrated in the S&P 500 Consumer Staples sector while other defensive sectors, such as Healthcare and Utilities, have seen net outflows.

Based on several valuation techniques, the Consumer Staples sector appears overvalued and unattractive on both a relative and standalone basis.

The Financials and Healthcare sectors look attractive and warrant additional attention from investors focusing on opportunities in U.S. equity sectors.

Demand for low volatility stocks has concentrated investor flows within the S&P 500 Consumer Staples sector and consequently has stretched its valuation. We compared Morningstar data for particular sectors to the increase in shares outstanding of the iShares minimum volatility ETF, which we view as a proxy for minimum volatility strategy demand.

The data, displayed in Figure 1, shows an increase in correlation between the Consumer Staples sector flows and the demand for minimum volatility strategies which started in the beginning of 2016. Based on that same data, the phenomenon shows no signs of slowing.

Investors may be chasing returns due to recent past performance; however, they may also be ignoring the underlying fundamentals and are likely due for some future disappointment.

VALUATION

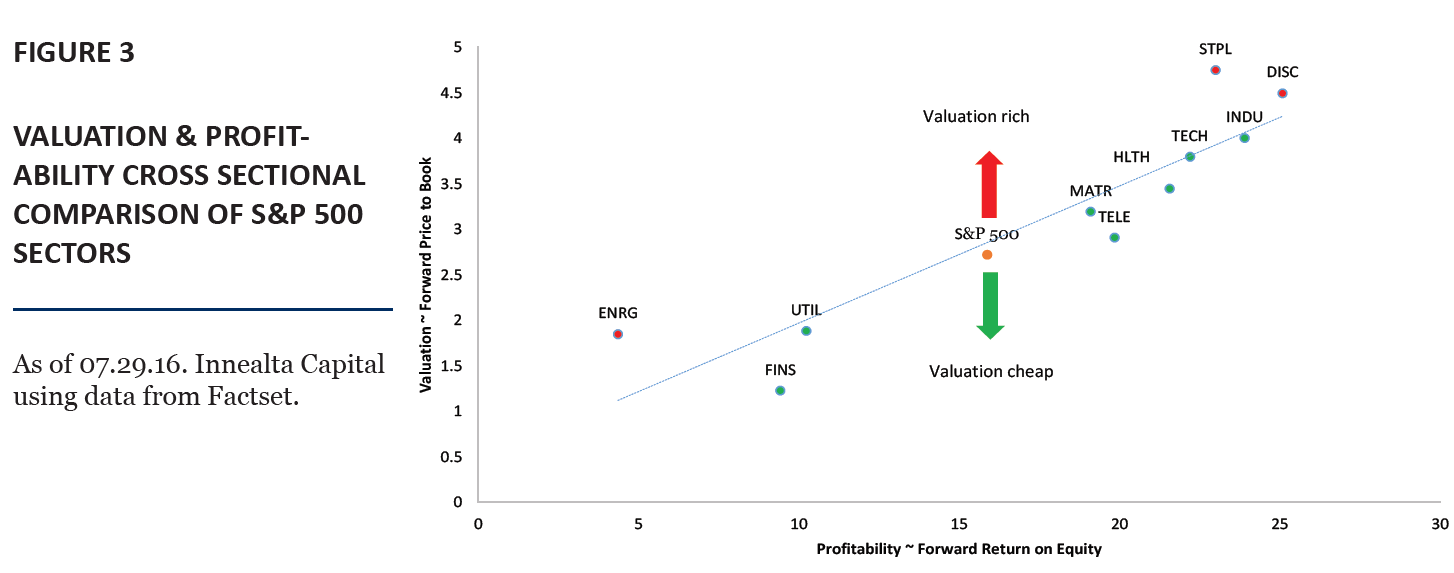

Based on multiple valuation metrics, such as price-to-book and profitability ratios, and combining cross-sectional and time-series techniques, we find the Consumer Staples sector overvalued and unattractive as a standalone holding.

The art, not the science, of valuation techniques requires using multiple lenses to view the attractiveness of any investment. At 4.74, the twelve month forward price-to-book ratio of the Consumer Staples sector is the highest across all ten S&P 500 sectors and is in the 96th percentile over past ten years. Comparing the Consumer Staples sector’s profitability metrics versus valuation metrics, the sector screens rich by approximately 19%.

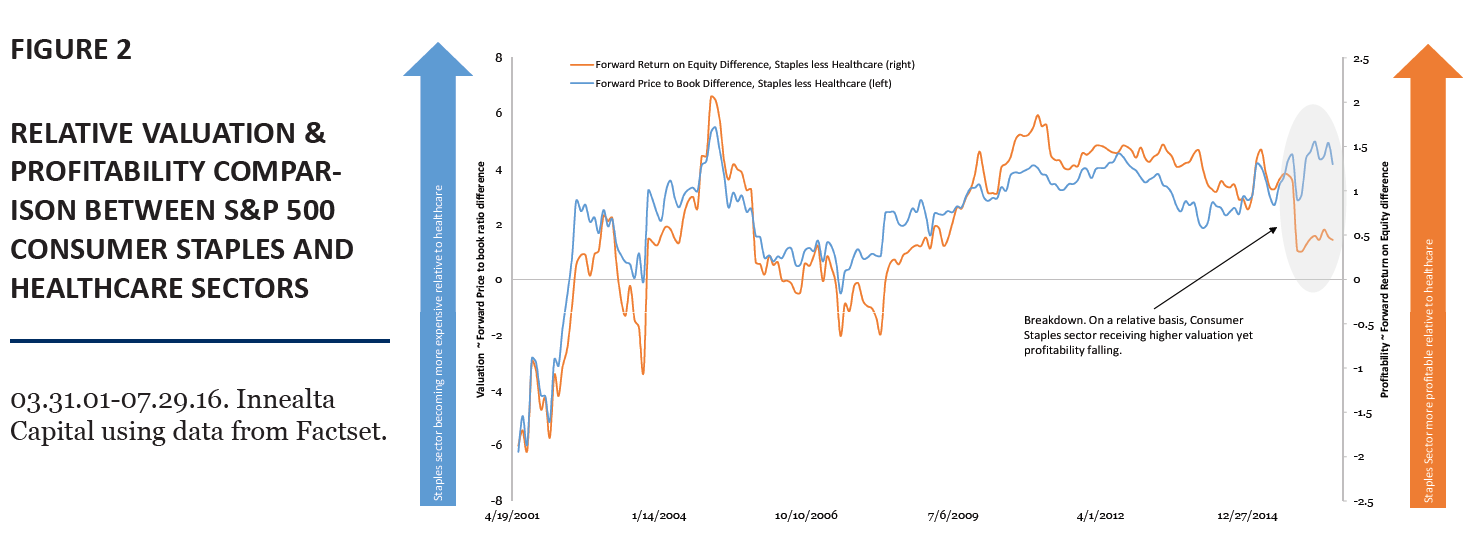

Analyzing the relative valuation and relative profitability between the Consumer Staples sector and another defensive sector, Healthcare, the Consumer Staples sector screens rich by 12%.

SEE MORE: Rising Interest Rates – A Review of Domestic vs. International Equity Performance

Figure 2 shows the relationship between the relative price-to-book ratio and the relative return on equity. As the relative valuation of the Consumer Staples sector has increased the relative return on equity has actually decreased.

In our opinion, this divergence creates an opportunity to either view the Consumer Staples sector as 12% rich, the Healthcare sector as 12% cheap, or some combination of the two.

OPPORTUNITIES

The Financials sector is another area that has the potential to add value on a relative basis. At 1.22, the twelve month forward price-to-book ratio of the Financials sectors is the lowest across all ten S&P 500 sectors and is in the 55th percentile over the past ten years. A cross sectional snapshot of all ten S&P 500 sectors using valuation and profitability metrics, shown in Figure 3, portrays the Financials sector as cheap.

SEE MORE: Volatility Spikes: A Test of Mental Fortitude

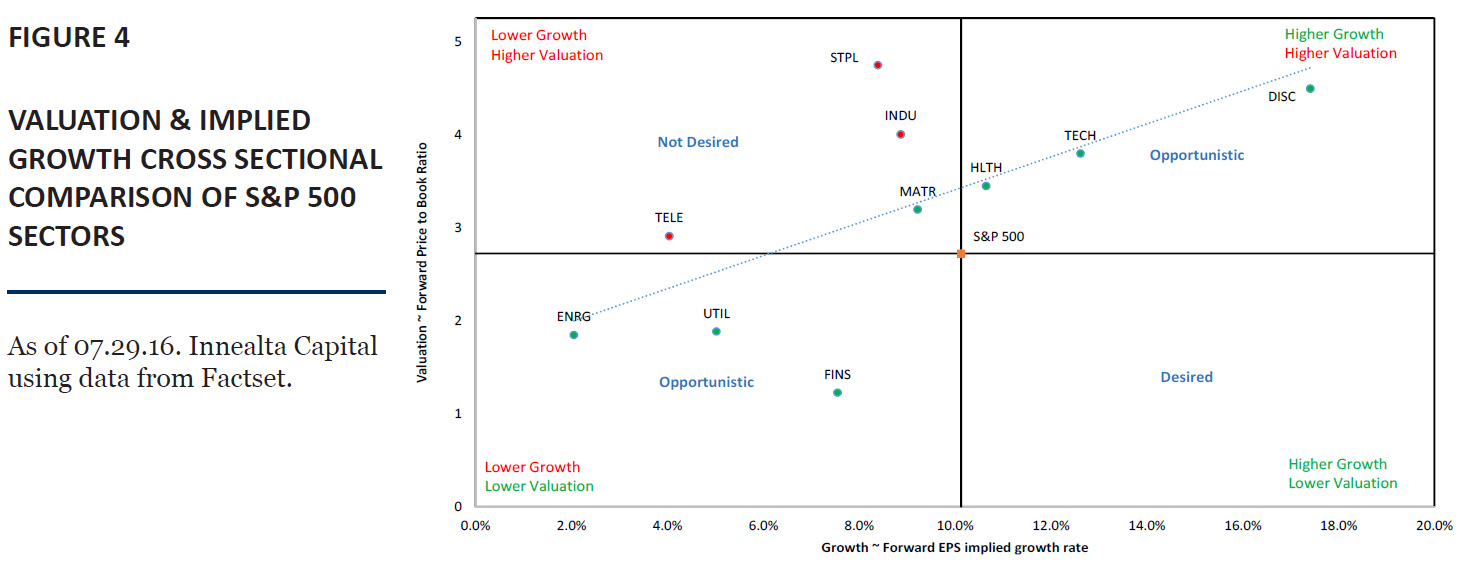

Comparing the implied EPS growth against price-to-book valuations, shown in Figure 4, the Financials sector offers slightly less implied growth than the S&P 500 but at a much cheaper valuation. Innealta Capital’s Sector Rotation strategy currently reflects the opinions that the Consumer Staples sector appears overvalued while the Healthcare and Financials sectors appear undervalued.

CONCLUSION

Divergences in sector fundamentals can create investment opportunities. Within defensive sectors, various combinations of cross-sectional and time series analyses using absolute and relative value data supports the notion that the Consumer Staples sector is overvalued and unattractive while the Healthcare sector is undervalued and attractive. Additionally, the same techniques support the notion that the Financials sector is undervalued and attractive.