Note: This article appears on the ETFtrends.com Strategist Channel

By Innealta Capital

As global growth stubbornly refuses to reignite and as valuations across the capital markets remain lofty when placed in historical context, investors likely are to increasingly seek yield and income to bolster near-term total return. Global yields have been falling for years and should not be viewed as generous. Magnanimously accommodative central bank policies have resulted in developed-world bond yields at or near historic lows.

The Japanese 10-year has gone negative, and the German 10-year is even flirting with zero, as we show in Figure 1. So, if not among developed sovereign yields, where can income be found? We find three pockets presently most interesting: domestic investment-grade and high-yield debt, emerging market high yield and certain global dividend-generous equity markets.

Obvious Yield

A common investing belief is that incremental credit/solvency risk should demand incremental “spread” in terms of additional yield over more secure investments. Investment-grade securities generally offer a spread over Treasuries and high-yield bonds generally offer incremental spread over investment-grade and Treasury securities to compensate for additional solvency risk. With the European Central Bank backstopping Eurozone sovereign debt, however, yields among the southern periphery undercut even U.S. Treasuries (see Spain’s 10-Year in Figure 1), highlighting the yield-search conundrum. Even so, more rational pricing of risk can be seen in U.S. fixed income, where relatively better fundamental characteristics and more attractive yields garner our attention.

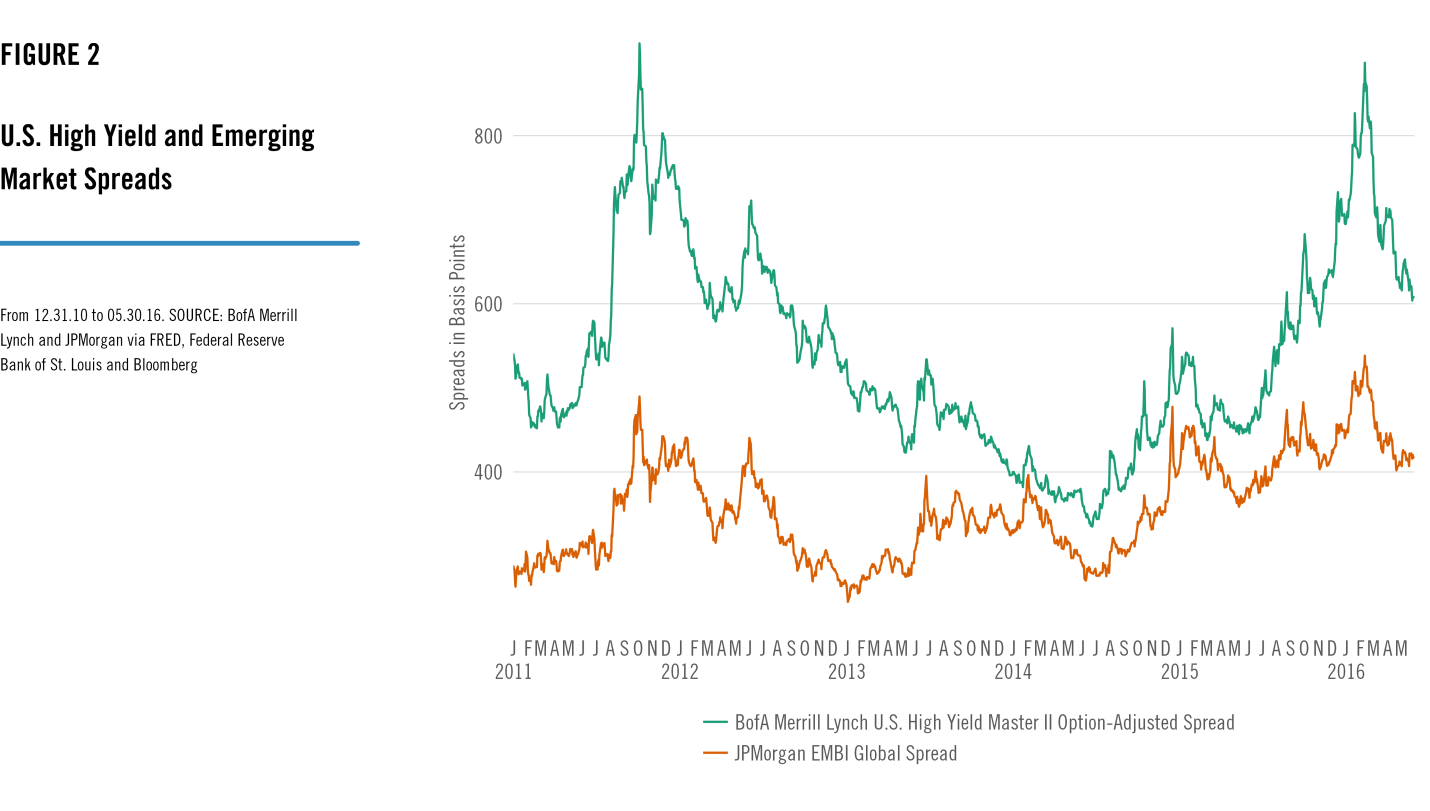

Also interesting are emerging market high-yield securities, exposure to which we maintain in the Global All Asset and Country Rotation Portfolios. With a yield to maturity presently in excess of 8 percent and an effective duration of 3.75 years, this exposure in 2015 experienced the strongest total return and provided the leading contribution to total return in the standalone Fixed Income Portfolio. And, relatively strong gains have continued in 2016.

Related: International Portfolios: How Thoughtful Diversification Can Reap Benefits

After a significant rally since the beginning of the year, spreads remain near the middle of the range observed since the financial crisis abated. And with a forecast of rising rates, that the additional yield can be found without greatly increasing duration risk is a bonus. While the deleterious effects of the gap-out in spreads over the second half of 2015 are still fresh in our minds, we continue to find the return/risk tradeoff warranted in this environment.

Not-So-Obvious Yield

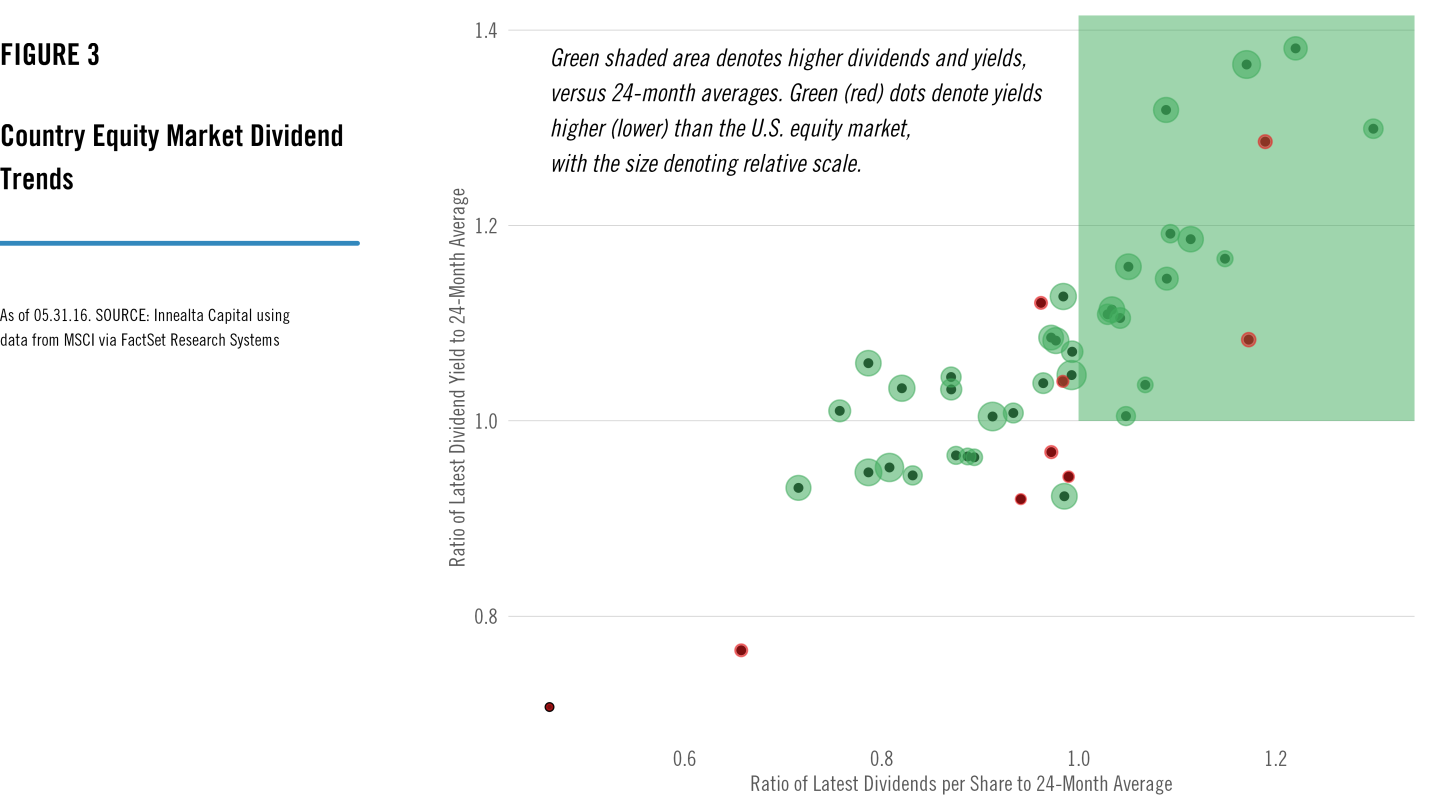

Not to be overlooked, global equity markets offer another yield opportunity. As part of our daily quantitative review, we examine the dynamics of a range of fundamental series for each equity market. As an addition to that process, we evaluated medium-term changes in dividends per share and dividend yields to sort out those country markets that saw flat or negative price shifts produce rising yields atop rising dividend payouts.

Related: Rising Rates – A Review of Domestic vs. International Equity Performance

Detailed in Figure 3, dividend yields among most country equity market markets we follow are greater than that for the U.S. And more than a third of those markets have seen increased dividend payouts on a per-share basis, versus the average of the past two years, along with an increase in overall yield. Investment decisions do not turn on this metric alone, of course. Nonetheless, in a world starved of yield, we find it an additional indicator of relative attractiveness to further support our investment decisions.

Demands for Adaptability

Innealta ETF-based strategies approach this challenging environment with a unique perspective that engenders both opportunism and adaptability. As the broader capital market backdrop remains challenging—with policy, fundamental and behavioral characteristics particularly exceptional in the historical context—we look forward to further demonstrating the benefit tactical flexibility can provide in the support of long-term total return.

This article was written by the team at Innealta Capital, a participant in the ETF Strategist Channel.

IMPORTANT INFORMATION

The information provided comes from independent sources believed reliable, but accuracy is not guaranteed and has not been independently verified. The security information, portfolio management and tactical decision process are opinions of Innealta Capital (Innealta), a division of AFAM Capital, Inc. and the performance results of such recommendations are subject to risks and uncertainties. For more information about AFAM Capital, Inc. please visit afamcapital.com. Past performance is not a guarantee of future results.