Note: This article is part of ETF Trends Strategist Channel.

By Dr. Vito Sciaraffia

Diversification correctly has been deemed “the only free lunch in investing.” However, the typical U.S. investor has failed to make a full meal of it. In this piece, we examine how international portfolios can benefit by fuller and more thoughtful diversification.

An initial step for proper diversification is achieving exposure to as wide a breadth of the markets readily and efficiently available for a given type of asset class. For example, two-fifths of the market capitalization of global equity markets is in countries outside of the United States. Hence, U.S. investors’ portfolios can benefit from the expanded set of fundamental exposures—developmental, macroeconomic, demographic and political characteristics, among many others—those international markets represent.

However, we believe that even more benefit can be found by diversifying within those passive international equity exposures, an approach we refer to as enhanced weighting. And good news for U.S. investors is the evolution of exchange traded funds, which has greatly expanded the available universe of country-specific equity markets. As a result, augmenting portfolio diversification through both expanded representation and enhance weighting of equity markets (i.e., countries) is much easier to achieve in modern portfolios than it was just a few years ago.

Rethinking representation and weighting

Nonetheless, achieving enhanced representation is only part of the solution. Generic passive capitalization-weighted regional allocations miss the mark when it comes to the second step in improving portfolio diversification. A key driver of that thinking is the fact that most passive indexes are market capitalization-weighted, with no “cap” on the percentage representation of individual country equity markets in the index. So, while investment strategies that seek to track that index might be great ways to diversify a purely domestic U.S. exposure, the index can be seen as allowing the undue influence of a few countries to overshadow the broader merits of the many.

The MSCI All Country World ex. USA (ACWX) Index, for example, is a commonly used benchmark by U.S. investors to measure the performance of international markets. According to MSCI, the index represents 22 developed market countries and 23 emerging market countries, and covers approximately 85% of the global equity opportunity set outside of the United States. At a glance, the index seems reasonably diversified, at least in terms of representation.

As shown in Figure 1, the top five country equity weights are close to 50%. The top ten countries represent nearly three-quarters of the index, leaving the remaining 35 competing for a mere quarter of the index weight. Unfortunately, that doesn’t quite sound like good diversification.

Room to Improve

Incremental diversification atop passive, capitalization-weighted exposures can provide additional risk-adjusted return over that static market-weight allocation. The goal is to develop appropriate methods that survive the test of time. International equity index exposures provide easy targets, as the most well-known are heavily exposed to a slim number of country equity markets.

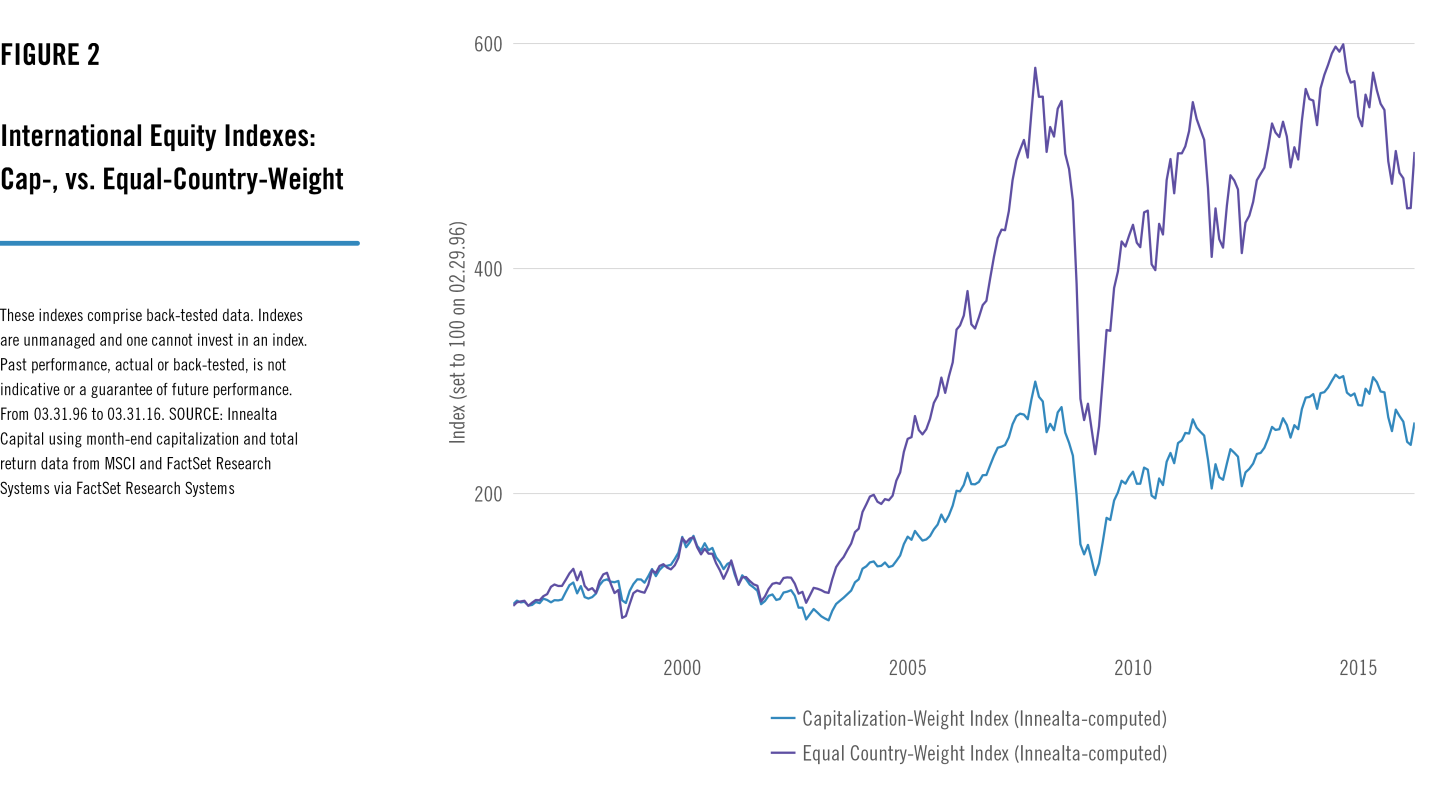

We developed an equal-country-weight version of the MSCI ACWX to demonstrate the potential benefit of improved diversification among allocations at the country-equity-market level in international markets. In Figure 2 we show the long-term returns of both the market-cap-weight and the equal-country-weight indexes. Obvious at the outset is the long-term outperformance of the more diversified (same representation/membership, but more diversified by weight/allocation) equal-country-weight index reconstruction, versus the capitalization-weighted version.

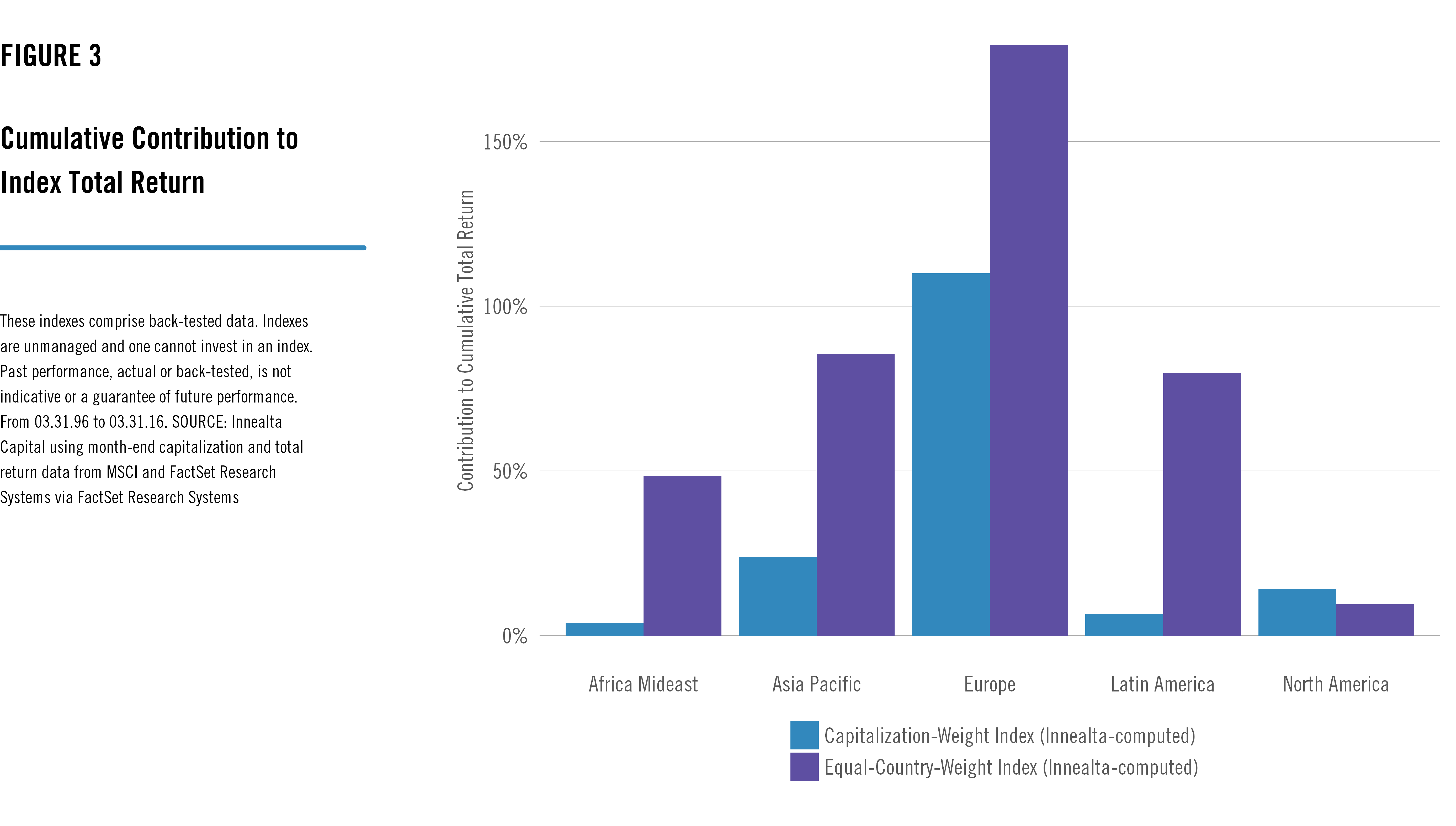

We also see in Figure 3, that the regional composition of long-term contribution to index total return shifts to those regions that held weaker weights in the cap-weighted index, but which saw on average higher total returns. That shift, in turn, pushes overall long-term total return higher for the equal-country-weighted index.

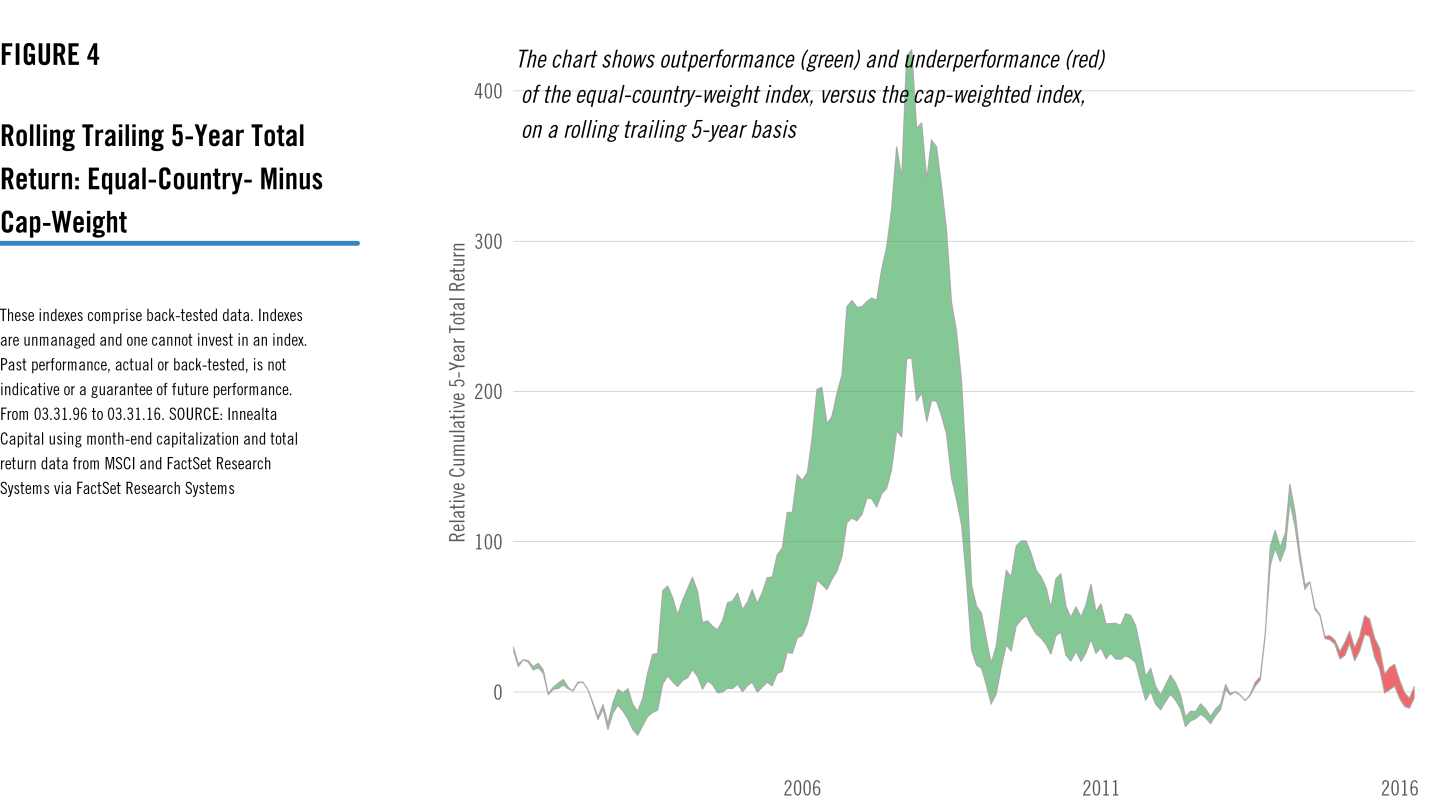

As shown in Figure 4, outperformance is not invariable, as there have been certain periods when the equal-country-weight index has underperformed the cap-weighted index.

Conclusion

We argue in this paper that portfolio diversification is beneficial for investors, and show that augmenting portfolio diversification through both expanded representation and enhance weighting of equity markets further increases the expected returns of model portfolios.

Dr. Vito Sciaraffia is the Co-Chief Investment Officer at Innealta Capital, a participant in the ETF Strategist Channel.

[related_stories]The information provided comes from independent sources believed reliable, but accuracy is not guaranteed and has not been independently verified. The security information, portfolio management and tactical decision process are opinions of Innealta Capital (Innealta), a division of AFAM Capital, Inc. and the performance results of such recommendations are subject to risks and uncertainties. Past performance is not a guarantee of future results, and diversification does not protect against loss in declining markets.

Using index market capitalization data provided by MSCI via FactSet Research Systems we created an equal-country-weight version of the MSCI All Country World ex. U.S. Gross USD Index. The MSCI All Country World Index (ACWI) has a longer history than the ACWX, so we first gathered the dates of membership for the various countries MSCI has included and excluded from the ACWI over the years. We then removed the United States from the group and recalculated index weights using month-end data for market capitalization, making some exceptions for certain total return series that were not available at the time of publication. In turn, we constructed a monthly time series of total returns for the cap-weighted international equity index, using the gross USD returns of the underlying country equity markets. We used the gross returns as, at the time of publication, they were the fullest set of data we could assemble. This approach results in a time series of total returns that broadly matches that of the ACWX.

To present one approach for remapping country market weights within the index, we next recalculated country-member weights so that they would be equal at each month end (which presumes a monthly rebalancing of the index). Therefore, at the end of 1996, each of the 44 member countries received a 2.27% weight in the equal weight index, while we assign a 2.22% weight to each of the 45 country equity markets presently represented in the index. We then constructed a monthly time series of total returns for the equal-country-weight index.

AFAM Capital, Inc. is an Investment Adviser, registered with the Securities & Exchange Commission and notice filed in the State of California and various other states. For more information, please visit afamcapital.com. Registration as an investment advisor does not imply any certain level of skill or training.