Household borrowing rises: Households have been deleveraging since early 2008. Although households probably still have too much debt, there has been a slowdown in the pace of deleveraging and consumption, and the economy could see a significant boost if households begin to borrow again.

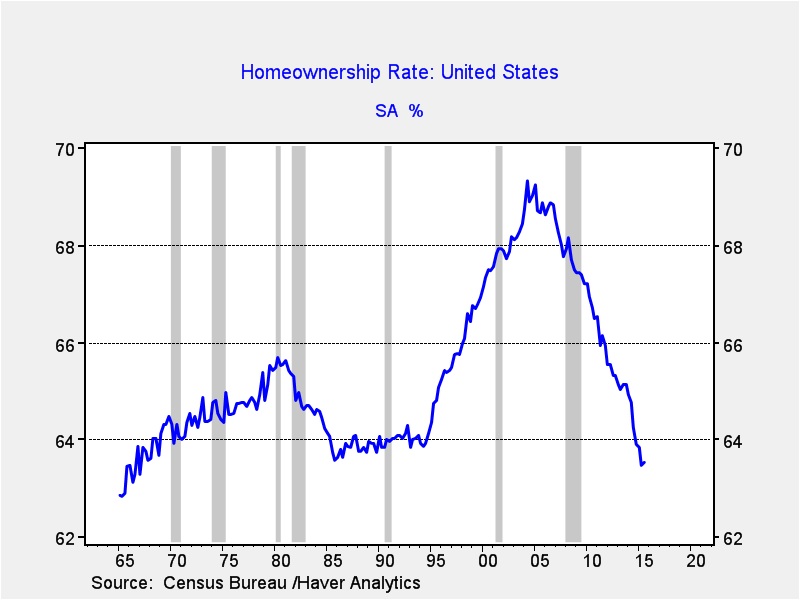

Housing: The housing bubble that developed from 1995 to 2005 has been reversed.

This chart shows homeownership rates among all households. Note that the current level is the lowest since the mid-1980s. Homeowners’ equity as a percentage of household real estate assets has recovered from the trough of 37.1% in Q1 2009 to 56.7% in Q3 2015. In general, a level of 60% would probably signal that the recovery from the bubble is complete and lead to increased real estate activity and more consumption.

Our base case is predicated on continued slow recovery in consumption. As we noted in the outlook report, labor markets remain sluggish, most likely due to widespread skill and location mismatches that have led to both low unemployment and labor participation. However, if we are too pessimistic in our outlook, it will probably be due to an underestimation of consumer strength. For this reason, we will continue to closely monitor the consumer in the coming months for signs of stronger than anticipated spending.

Bill O’Grady is an Executive Vice President and Chief Market Strategist and Kaisa Stucke is an Investment Strategist, both at Confluence Investment Management, a participant in the ETF Strategist Channel.