These past few weeks we have come across very few trends—macroeconomic, capital market, geopolitical or otherwise—that warrant the sort of optimism for the New Year that would substantiate present valuations across a range of equity markets. Keeping our editorial light for the month, we selected a few top-of-mind views to support our continued cautious stance on domestic equity market exposures.

TOP AND BOTTOM LINES PRESSURED…

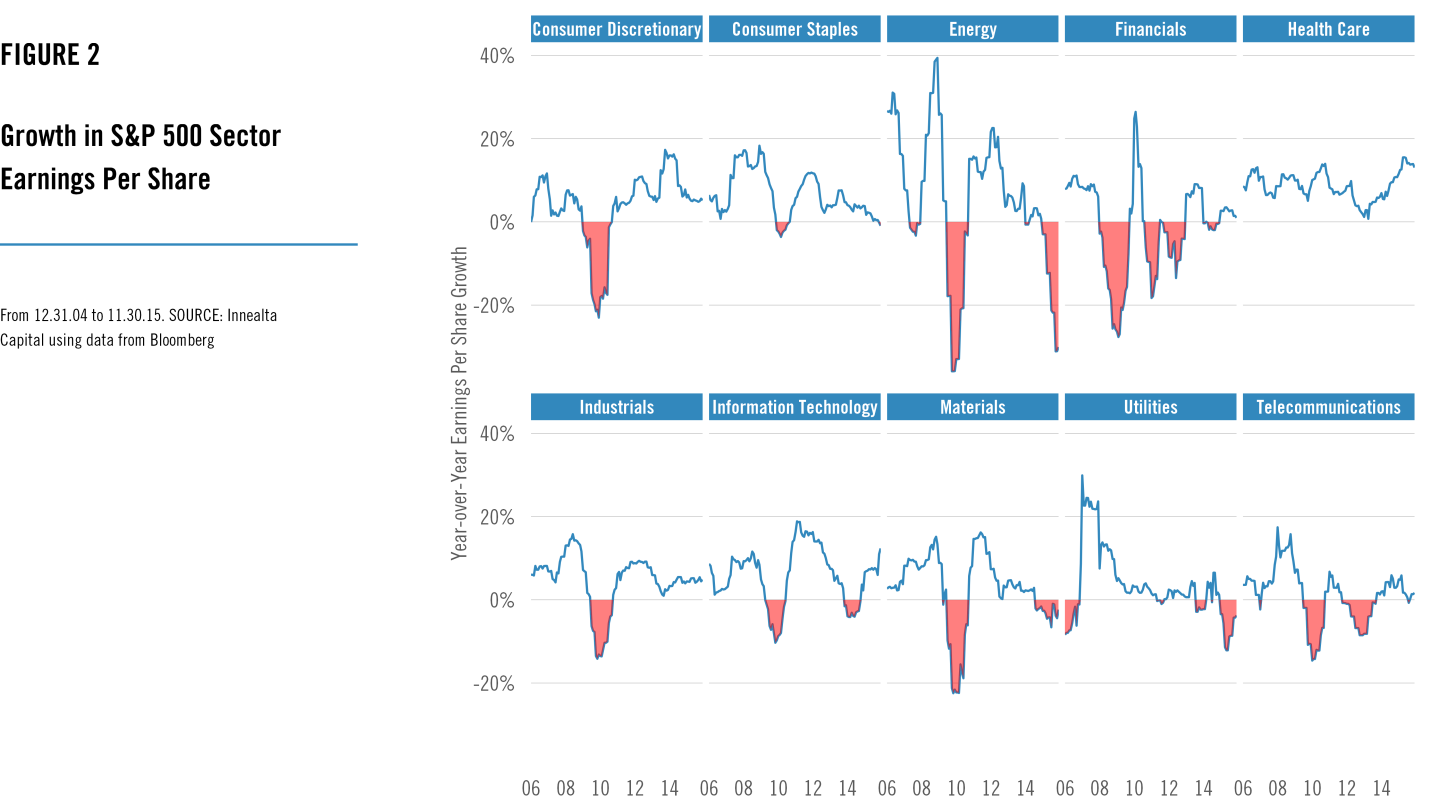

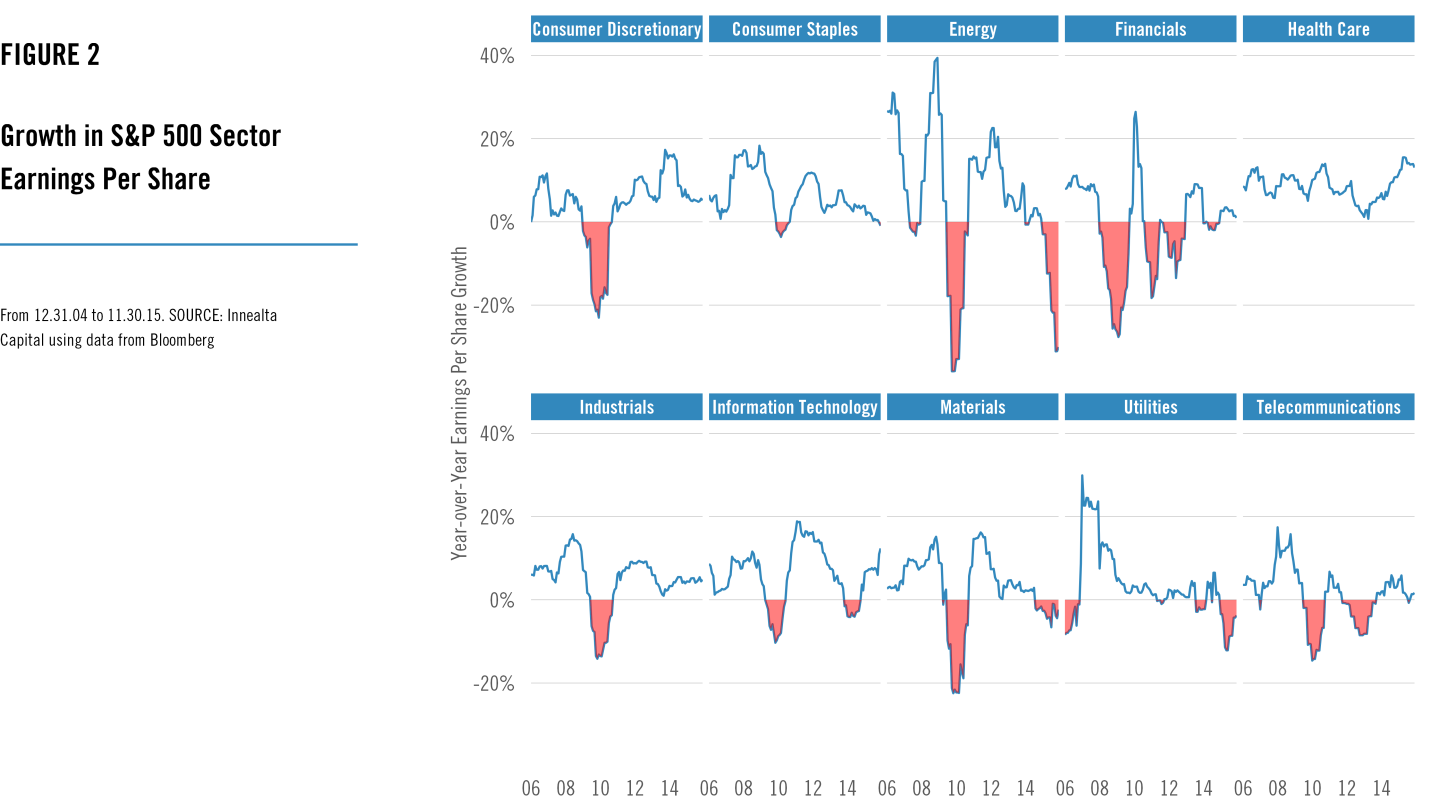

In Figure 1, we show that the trends in year-over-year declines in both revenue and earnings per share have not reversed since we last offered these data earlier in the year. The Energy sector, buffeted by plunges in petroleum and petroleum product prices, is not the only culprit. In Figure 2, we show year-on-year earnings growth across all ten sectors. With a few exceptions, earnings per share growth is slowing or is in outright decline.

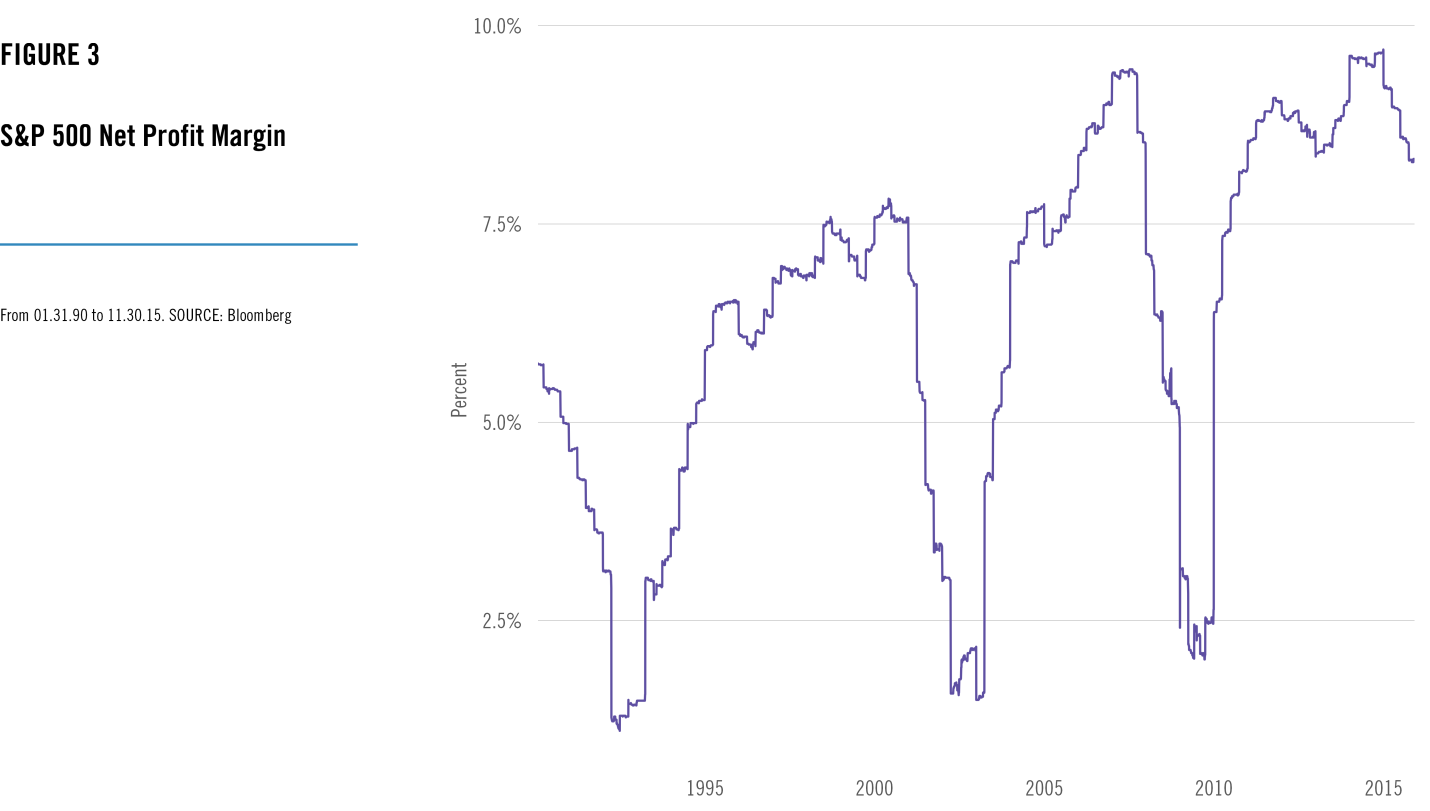

…AS MARGINS FADE…

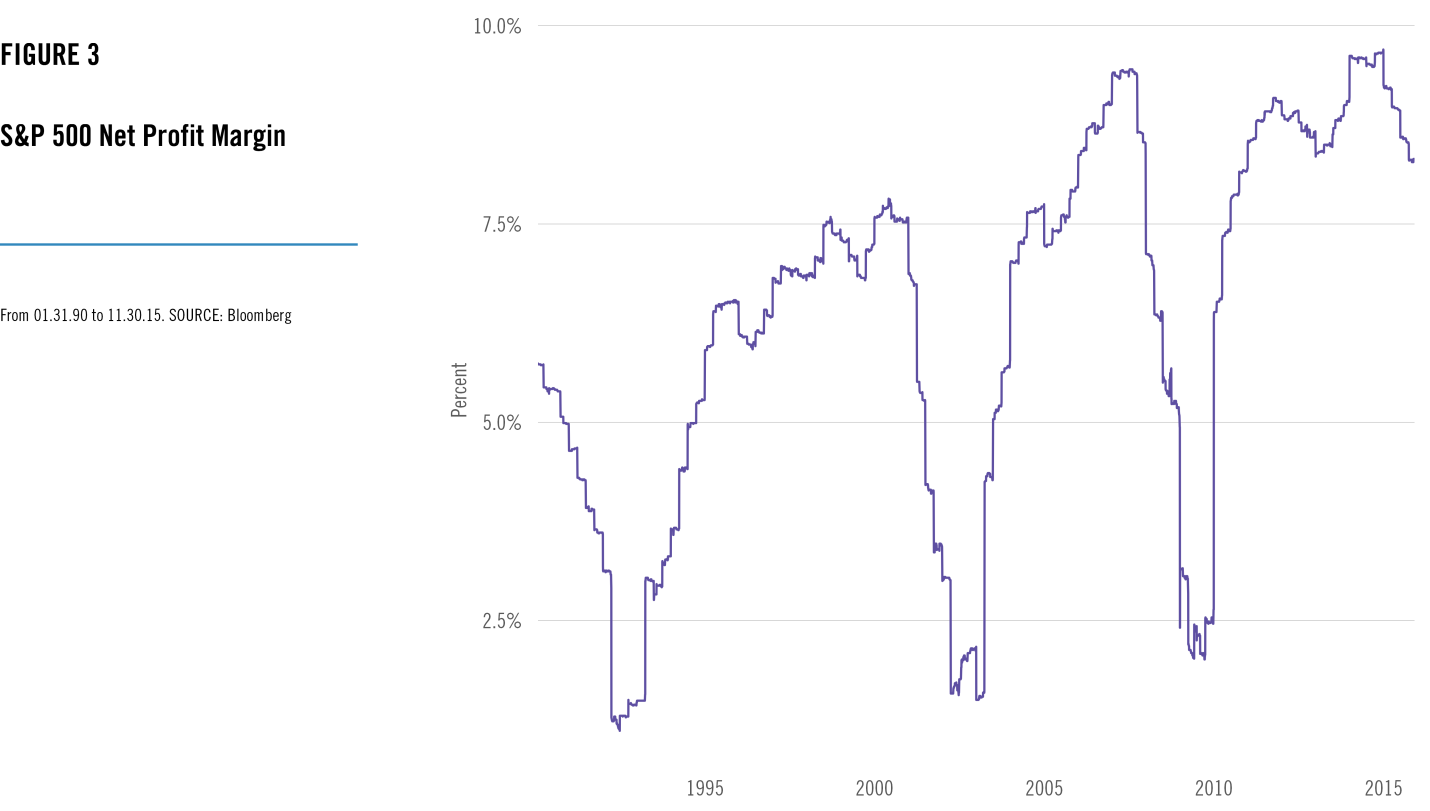

Indeed, profits are feeling the squeeze. Charted in Figure 3, this trend should not be so surprising, really, considering the long duration of weak to declining top-line growth. American managers seem to have run out of room to pare costs. As top-line growth slows, even turning negative, competition for incremental dollars intensifies. Profits suffer more. This down-cycle might turn, but we think it’d need resurgence in revenue growth to do so. Broader macroeconomic reviews limit optimism of any such turn in the medium term.

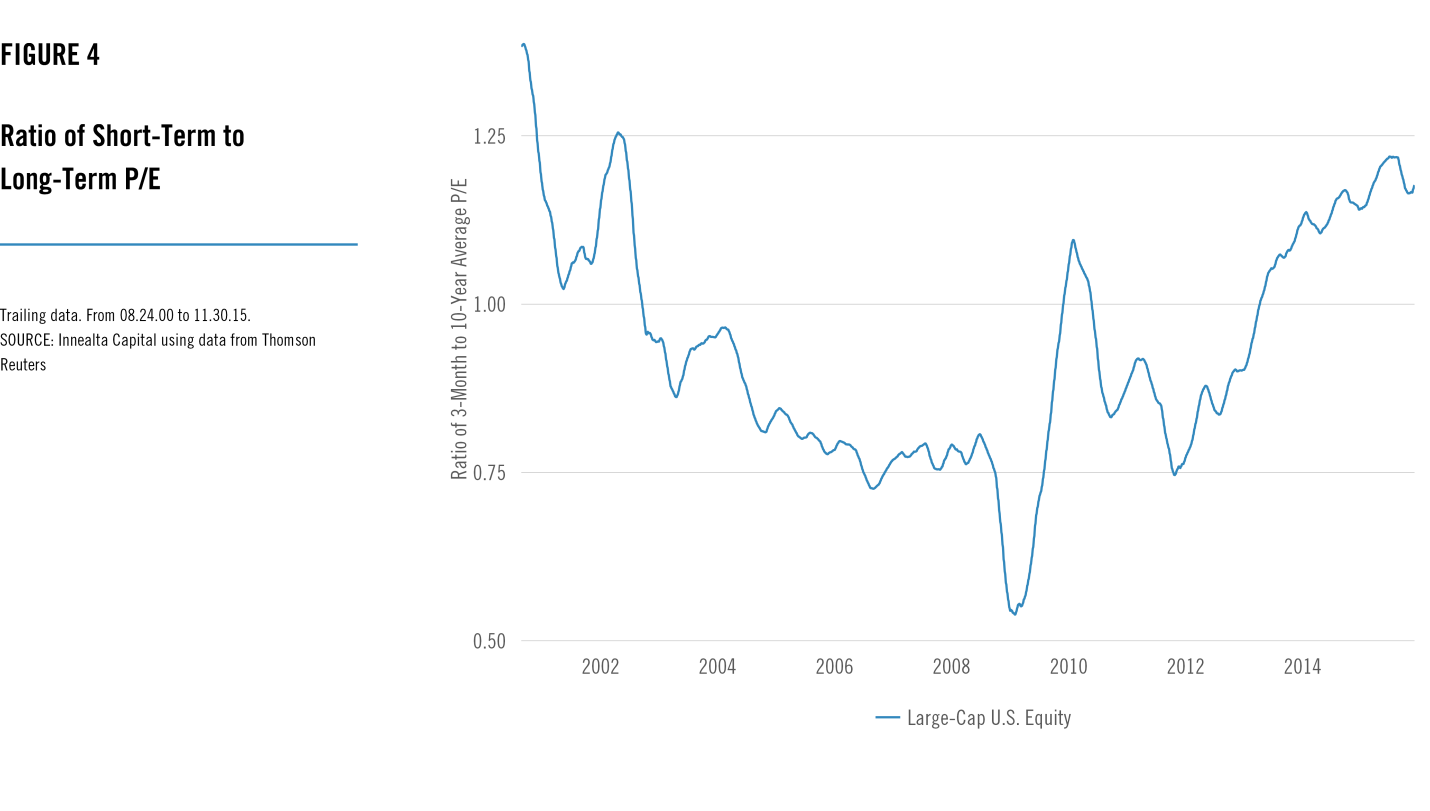

…BUT PRICES PERSEVERE

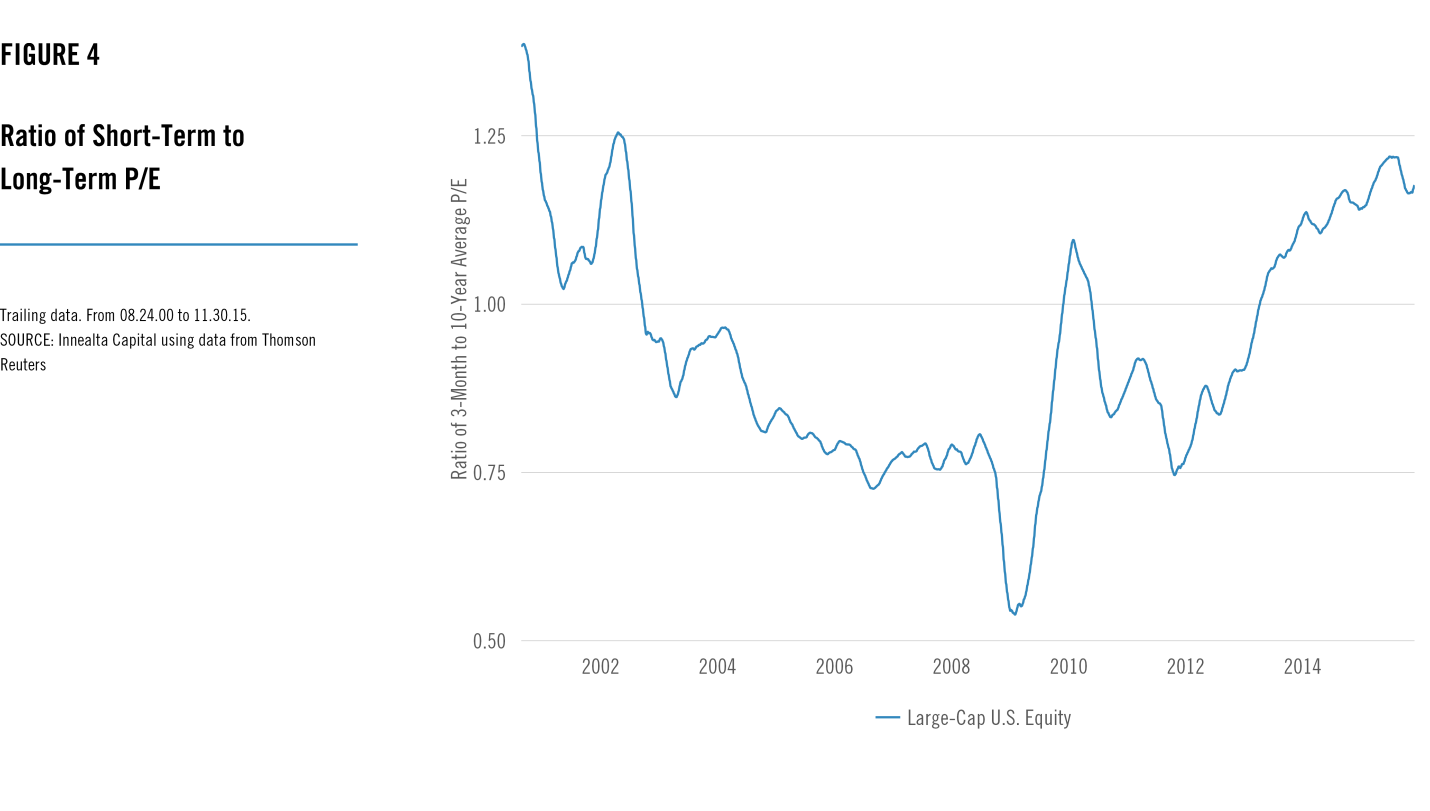

Nonetheless, even with the late summer correction, the S&P 500 has held up pretty well this year. That only can mean domestic large-cap equities are now even more expensive, decreasing the likelihood of further gains and increasing their inherent risk. Figure 4 reprises a chart we have shared in earlier commentaries that shows the near-term average price-to-earnings ratio for large-cap U.S. stocks relative to their long-term average. Elevated and still rising, the ratio can normalize only two ways: via a dramatic ramp in earnings, or as dramatic a decline in price. Leading macroeconomic indicators would suggest the path from here is heavily weighted to the latter.

COURSE CORRECTION

We remain firm in our belief that beta exposures should be chosen for a favorable risk-reward dynamic that strongly considers relative valuations, whether the tenure of those exposures are expected to be short- or long-term in nature. The equity market dynamic over the past few years seems to have spurned such a rational approach to investment management. Nevertheless, we continue to believe that our approach will be proved most reasonable in the fullness of time, despite the efforts of central banks around the world to convince investors otherwise.

Mark Mowery is a Senior Vice President and Portfolio Manager at Innealta Capital, a participant in the ETF Strategist Channel.

IMPORTANT INFORMATION

The information provided comes from independent sources believed reliable, but accuracy is not guaranteed and has not been independently verified. The security information, portfolio management and tactical decision process are opinions of Innealta Capital (Innealta), a division of AFAM Capital, Inc. and the performance results of such recommendations are subject to risks and uncertainties. For more information about AFAM Capital, Inc. please visit afamcapital.com. Past performance is not a guarantee of future results.

Any investment is subject to risk. Exchange traded funds (ETFs) are subject to risks similar to those of stocks, such as market risk, and investors that have their funds invested in accordance with the portfolios may experience losses. Additionally, fixed income (bond) ETFs are subject to interest rate risk which is the risk that debt securities in a portfolio will decline in value because of increases in market interest rates. The value of an investment and the return on invested capital will fluctuate over time and, when sold or redeemed, may be worth less than its original cost. This material is not intended as and should not be used to provide investment advice and is not an offer to sell a security or a solicitation or an offer, or a recommendation, to buy a security. Investors should consult with an investment advisor to determine the appropriate investment vehicle. Investment decisions should be made based on the investor’s specific financial needs and objectives, goals, time horizon and risk tolerance. All opinions and views constitute our judgments as of the date of writing and are subject to change at any time without notice.

Sector ETFs, such as Real Estate Investment Trusts (“REITs”) are subject to industry concentration risk, which is the chance that stocks comprising the sector ETF will decline due to adverse developments in the respective industry.

The use of leverage (borrowed capital) by an ETF increases the risk to the fund. The more a fund invests in leveraged instruments, the more the leverage will magnify gains or losses on those investments.

Country/Regional risk is the chance that world events such as political upheaval or natural disaster will adversely affect the value of securities issued by companies in foreign countries or regions. Country/Regional risk is especially high in emerging markets.

Emerging markets risk is that chance that stocks of companies located in emerging markets will be substantially more volatile, and substantially less liquid, than the stocks of companies located in more developed foreign markets.

Securities rated below investment grade, commonly referred to as “junk bonds,” may involve greater risks than securities in higher rating categories. Junk bonds are regarded as speculative in nature, involve greater risk of default by the issuing entity, and may be subject to greater market fluctuations than higher rated fixed income securities.

Diversification does not protect against loss in declining markets.

Registration of an investment adviser does not imply any certain level of skill or training.

AFAM Capital, Inc. is an Investment Adviser, registered with the Securities & Exchange Commission and notice filed in the State of California and various other states. For more information, please visit afamcapital.com. Registration as an investment advisor does not imply any certain level of skill or training. Innealta is an asset manager specializing in the active management of portfolios of ETFs.

Contact your financial advisor for additional information.