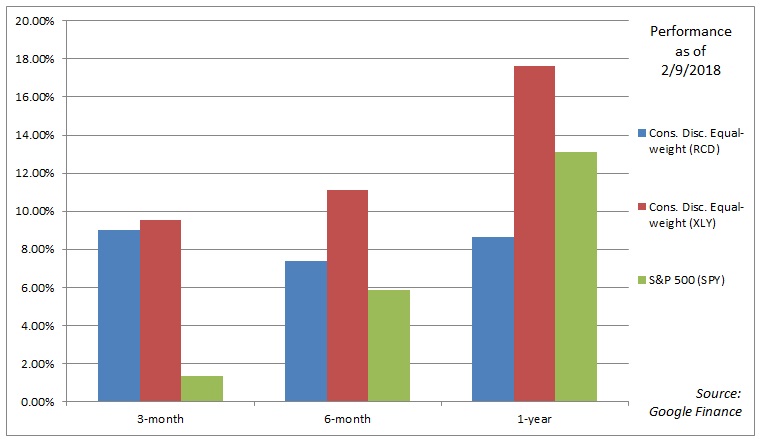

What is more, these robust numbers have been reflected in the performance of the stock prices of consumer discretionary companies. Again, while many will be tempted to explain away the overall performance of the sector by claiming a distortion from Amazon’s performance, the reality is that an equal-weighted consumer discretionary portfolio (as measured by Guggenheim’s ETF, symbol RCD), has performed very well over the last 12-, 6-, and 3-month periods.

While the equal-weighted portfolio has trailed both the market and the Amazon-centric XLY over the last twelve- and six-month periods, it has come close to matching XLY over the last three months, while both RCD and XLY have trounced the broader S&P 500 over the period. This seems somewhat significant, given consumer discretionary’s market-leading status, and that this most recent period, of course, includes the bout of volatility that has everyone spooked:

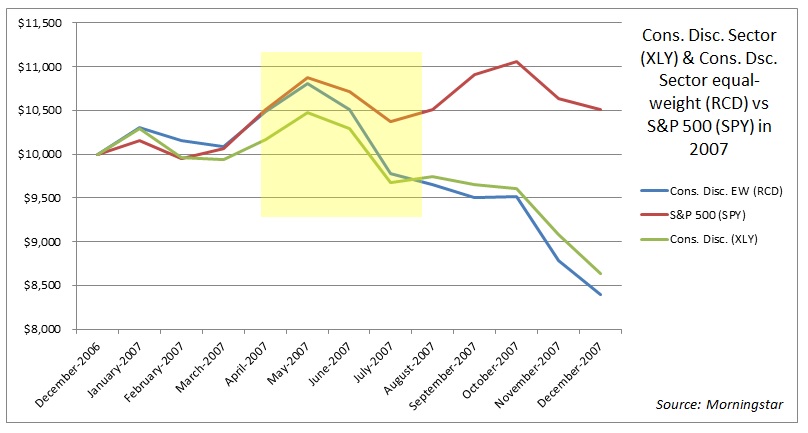

This performance stands in marked contrast to 2007, the year the last recession began, when RCD and XLY rose with the market before ultimately breaking down well before the market peaked in October of that year:![]()

Of course, the market may remain volatile for an extended period, and the economy may slow at some point soon. However, given the strong performance thus far in the consumer discretionary space (among other things), the odds seem to be against a recession any time soon, and thus a bit more life for the bull market.

The following post was republished with permission from Fortune Financial Advisor.