Investors looking to adjust their allocations may want to add Treasury Inflation-Protected Securities, or TIPS, to their fixed income portfolio. At least since the CPI notched a 9% year-over-year increase in the summer of 2022, inflation has been back on investors’ minds. And a possible recession in 2024 may not cause many to think interest rates are going down to near-0% again – or to forget the Bloomberg US Aggregate’s 13% loss last year.

In fact, last year was such a bad one for bonds that the inflation-adjusted return of the Agg was nearly -21%.

There are other reasons to think higher inflation is in the offing. For example, there is evidence that labor is getting stronger. Also, reshoring or “friend-shoring” away from China or the lowest-cost producers is occurring in an effort to build more secure supply chains. Higher labor costs could raise the prices of goods and services. But a more equal distribution of profits could mean greater demand. After all, according to some arguments, the middle and working classes spend more of their pay increases than the wealthy do.

The dramatic rise in interest rates that has accompanied inflation has made such an impression on investors that BlackRock foresees a long-term macroeconomic regime shift in its 2024 outlook toward higher rates and inflation regardless if a recession occurs next year. The firm reports that its “largest strategic overweight is. . . .to inflation-linked bonds.” That’s because, over the longer term, central banks “can’t respond to faltering growth like before.”

Happily for investors, U.S. Treasury inflation-protected bonds (TIPS) haven’t looked as attractive as they do now in years. And that means they may deserve a place in many portfolios.

Another piece of good news: there is a plethora of ETF options available to help investors get exposure.

TIPS Explained

Before making the investment case, it’s worth reviewing how TIPS, first issued by the U.S. Government in 1997, function.

Economist Jim Bianco gave a concise description of how TIPS work recently on the Meb Faber Show podcast, saying in addition to some yield “they also give you the inflation rate [in the form of accretion].”

That means the bonds’ face values go up as inflation rises. In other words, explains Bianco, “if you bought $100 worth of bonds, and inflation was at 4%, in a year you’ll have $104 worth of bonds [owing to the inflation rate getting expressed through the bond as accretion], and you’ll also still have the yield [the bonds were paying when you purchased them].”

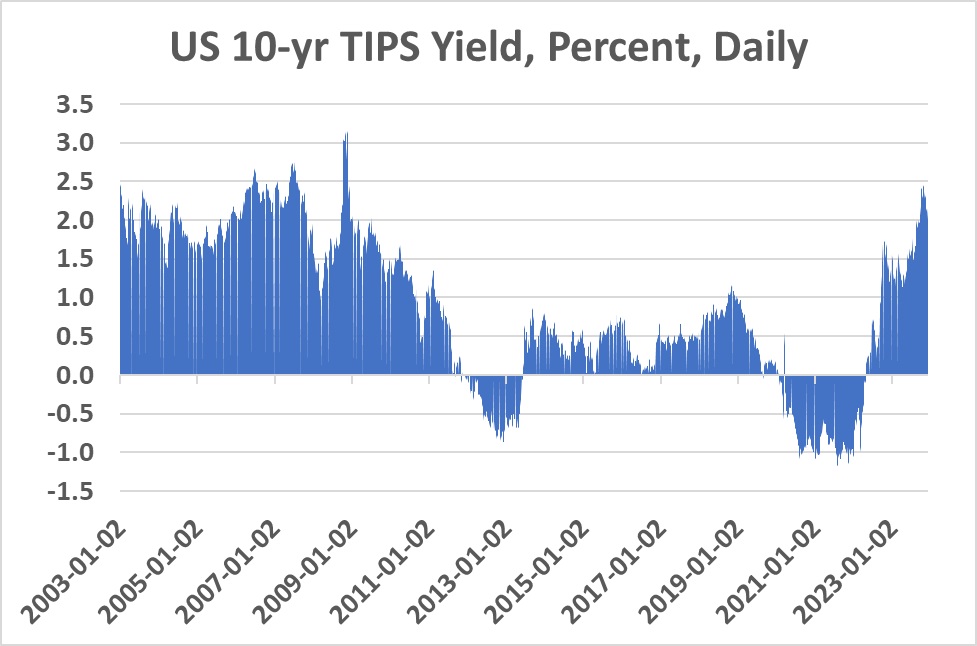

Also, while the tracking of CPI remains constant, that initial yield TIPS are offering has changed dramatically over the past two years. Up until the spring of 2022, TIPS were carrying a negative initial yield combined with the built-in inflation protection. And that initial yield was lower than -1% at its worst during the year before. But things have changed so much that investors now can capture a roughly 2% yield. That’s in addition to the inflation protection on a 10-year TIPS bond.

Source: St. Louis Fed

Market observers have noticed. Advisor and author, Bill Bernstein, has touted TIPS in recent interviews, while Morningstar’s John Rekenthaler also wrote an October article saying TIPS, with their increased yields, merit ‘serious consideration.’

As Rekenthaler puts it, in comparing a TIPS bond to its plain nominal counterpart, “A conventional 10-year Treasury that pays 5% will be a good investment if inflation averages an annualized 3% over the next decade but a poor choice if inflation is twice that rate. In contrast, fat TIPS yields persist. They pay and pay and pay. . . TIPS supply what other investments lack: payments that are fully inflation-adjusted.”

TIPS could get cheaper and yield more than they do now. However, by Rekenthaler’s calculations, investors can build a 30-year TIPS ladder that would let them spend well over 4% on top of inflation in retirement. At that point, the capital would be exhausted. But if an investor had enough money, another part of their portfolio could be stashed away in stocks.

ETFs to Consider

Investors who want to use funds instead of individual bonds to build such a ladder can use the iShares target maturity iBonds TIPS ETFs, though the last fund in the series matures in 2033. The iShares series includes a fund that matures in each year from 2024 until then. They all come with an expense ratio of seven basis points.

The target maturity funds are attractive options. That’s because they provide investors with a known day when their investment is redeemed.

An alternative to the TIPS ETF ladder is simply building a diversified portfolio of TIPS ETFs that includes short-term, intermediate-term, and long-term funds. The big difference in this case is that those funds never actually mature. They also don’t necessarily hold their components to maturity.

A portfolio of this kind could include the Vanguard Short-Term Inflation-Protected Securities ETF (VTIP) for short-term exposure, with the SPDR Portfolio TIPS ETF (SPIP) and the PIMCO 15+ Yr US TIPS ETF (LTPZ) as the intermediate-term and long-term options. The three ETFs have expense ratios ranging from 0.04% for the Vanguard fund to 0.20% for the PIMCO fund.

The Vanguard fund has an average effective maturity of 2.5 years. Meanwhile, the SPDR and PIMCO funds have average maturities of 7.3 and 21.9 years, according to Morningstar.

Finally, it’s worth noting that TIPS and the funds that own them can trade in unexpected ways despite their inflation protection. Last year, for example, the PIMCO fund was down a breathtaking 31.68%. Further, over the past decade, its 12.69% standard deviation of returns has been more than two times the 4.6% of the Agg.

Over the past decade through November 2023, the LTPZ’s 1.88% annualized return has beaten the Agg’s 1.37% annualized return. That margin of victory might not seem like much. However, 2022 notwithstanding, the past decade has been a tame one for inflation.

For more news, information, and analysis, visit VettaFi | ETF Trends.