By Todd Rosenbluth, Head of ETF & Mutual Fund Research, CFRA

Key Takeaways

- U.S. e-commerce sales swelled 37% in the third quarter of 2020 relative to a year earlier but remained just 14% of overall sales, creating significant room for growth.

- While attention has long been focused on Black Friday and Cyber Monday as key shopping days, CFRA expects online spending to be strong throughout the fourth quarter, as many consumers have shifted habits while being at home due to the pandemic.

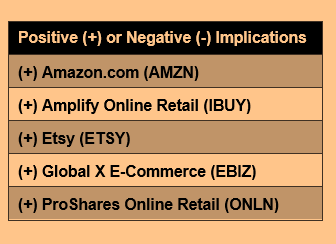

- With a range of potential global retailer winners, it is essential to understand the differences between popular industry ETFs such as Amplify Online Retail ETF (IBUY) and ProShares Online Retail (ONLN).

Heading into the traditional holiday shopping season, online retail is well-positioned for continued growth. According to the Census Bureau of the Department of Commerce, during the third quarter of 2020, e-commerce sales grew 37% year-over-year and represented 14.3% of U.S retail sales, up sharply from 11.2% a year earlier. Apparel and accessories experienced 34% growth, while food and beverage shopping online more than doubled. Such sharp growth is understandable, given that third-quarter 2020 sales for e-commerce industry heavyweight Amazon.com (AMZN) grew revenues 37%, while more targeted U.S. online retailers Etsy (ETSY) and Chewy (CHWY) tallied 128% and 47% recent growth, as consumer sought for masks and pet care, respectively. Outside the U.S., quarterly revenue at Alibaba (BABA) swelled 30%.

Growth is expected to accelerate during the last three months of 2020, but not driven by Cyber Monday. CFRA Equity Analyst Camilla Yanushevsky forecasts the e-commerce channel will account for 16% of fourth-quarter sales. According to a survey conducted by the National Retail Federation between October 1-9, a majority (60%) of consumers say they planned to make holiday purchases online this year, compared to 56% in 2019. Almost all (91%) digital shoppers plan to take advantage of free shipping, while 44% expect to use Buy-Online-Pickup-In-Store (BOPIS) and 16% same-day delivery.

Yanushevsky believes Covid-19 has prompted traditional holiday shopping days such as Black Friday and Cyber Monday to lose their bearing. Amazon’s Prime Day, held this year on October 13, likely marked the start of the holiday shopping season as the 36-hour event likened to Amazon’s version of a Black Friday sale (usually held mid-July) was delayed due to the pandemic. The National Retail Federation surveyed 54 retailers concerning their approach toward the 2020 holiday shopping season. Nearly two-thirds of respondents said they were ready in October for holiday inventory and sales. Similarly, management consulting firm Accenture found that 64% of consumers indicated that they are less likely to hop on the Black Friday shopping bandwagon than they would a few years ago. When asked about Cyber Monday, nearly 60% indicated that they are less inclined to participate. These figures had increased from last year’s 55% and 47%, respectively. CFRA thinks that the prolonged pandemic that led to an extended shopping spree is partly blamed for the loss in interest for such one-day sales events.

According to RetailNext, which provides cameras, software, and analytics to U.S. stores, foot traffic to stores on Black Friday fell 48% this year. Yet, Adobe Analytics said Black Friday online sales rose 22%.

“One of the reasons that the pandemic-driven acceleration of e-commerce is likely to persist is that growth has come from not just well-penetrated, but the least penetrated categories as well,” explained Simeon Hyman, ProShares Global Investment Strategist. “Food and Beverage is a great example that has grown at a very fast rate over the past two quarters. Perhaps more consumers no longer feel it necessary to handpick their produce and browse physical grocery aisles? Importantly, technological advances are rapidly improving the ability of companies to profitability deliver an order consisting of many small-ticket items.”

Read more about Hyman’s views: https://www.proshares.com/resources/retail_disruption_charts.html?utm_source=CFRA&utm_medium=native&utm_campaign=retaildisruption&utm_content=ONLN&ps_type=FP

Online retail ETFs are not all the same. ProShares ONLN was our November Focus ETF of the month. The ETF recently held a 22% stake in AMZN and a 10% position in BABA, with more moderately sized 4.5% positions in ETSY and CHWY and even smaller weights dedicated to less established online retailers. Meanwhile, Amplify’s IBUY takes a more diversified approach with no recent position as large as 4.0% and AMZN, BABA, CHWY, and ETSY less than 3.0%. A third offering, Global X E-Commerce (EBIZ), recently had a 5% position in ETSY and 3%-4% stakes in AMZN and BABA. However, EBIZ also had more non-U.S. positions than its peers. In rating ETFs, CFRA combines holdings-level analysis with fund attributes, such as performance and costs.

CFRA thinks the global pandemic has accelerated the long-term shift to online retail, creating many potential winners. ETFs provide the benefits of diversification in a moderately priced, liquid structure, but investors need to look inside a fund to understand what they own.

Originally published by CFRA, 11/30/20

Contact CFRA

1 New York Plaza, 34th Floor

New York, NY 10004

USA

P: +1-800-220-0502

www.cfraresearch.com

All of the views expressed in this research report accurately reflect the research analyst’s personal views regarding any and all of the subject securities or issuers. No part of the analyst’s compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed in this research report. For more information and disclosures, please refer to CFRA’s Legal Notice at https://www.cfraresearch.com/legal/.

Copyright © 2020 CFRA. All rights reserved. All trademarks mentioned herein belong to their respective owners.