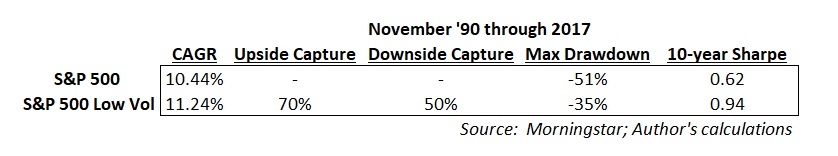

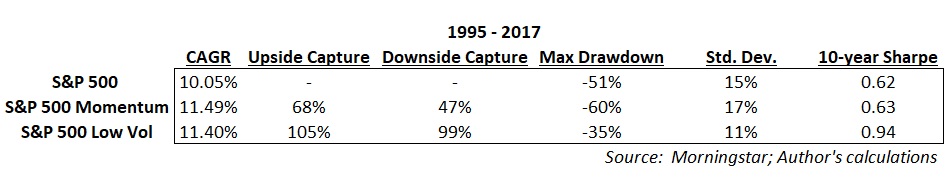

Importantly, since 1995, low-volatility has more or less performed in-line with last year’s best performer, momentum, with quite favorable risk-reward characteristics:

In light of these comparisons, investors would be wise to reconsider abandoning low-volatility strategies, especially now that the market is, by almost any measure, expensive, and volatility has been uncharacteristically benign for so long. Low-volatility investing should continue to be a good way to maintain exposure in an expensive market while being positioned advantageously for the inevitable correction.

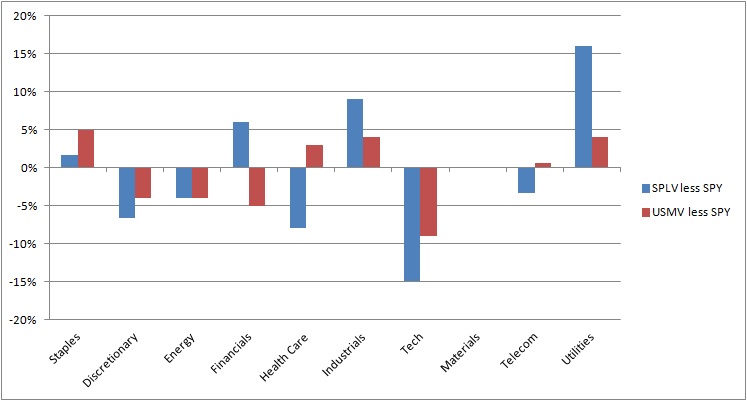

NOTE: For anyone interested in investing in low-volatility strategies, it is important to understand that there are vast differences between some of the more popular low-volatility indices and the ETFs that track them. For example, relative to the broader market, the MSCI low-volatility ETF (symbol USMV) deviates less from the S&P 500 sector composition (as measured by the SPDR ETF, SPY) than does the S&P 500 low-volatility ETF (symbol SPLV), as can be seen in the graphic below (data as of January 2018):

This article was republished with permission from Fortune Financial Advisors.