Editor’s Note: This article was republished with permission from Fortune Financial Advisors.

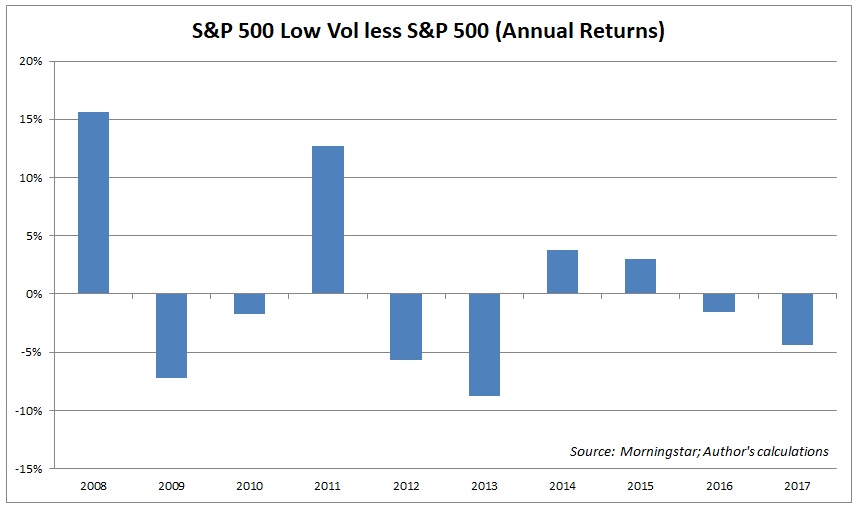

![]() 2017’s strong market resulted in the largest out performance for the S&P 500 index versus its low-volatility counterpart since 2013:

2017’s strong market resulted in the largest out performance for the S&P 500 index versus its low-volatility counterpart since 2013:

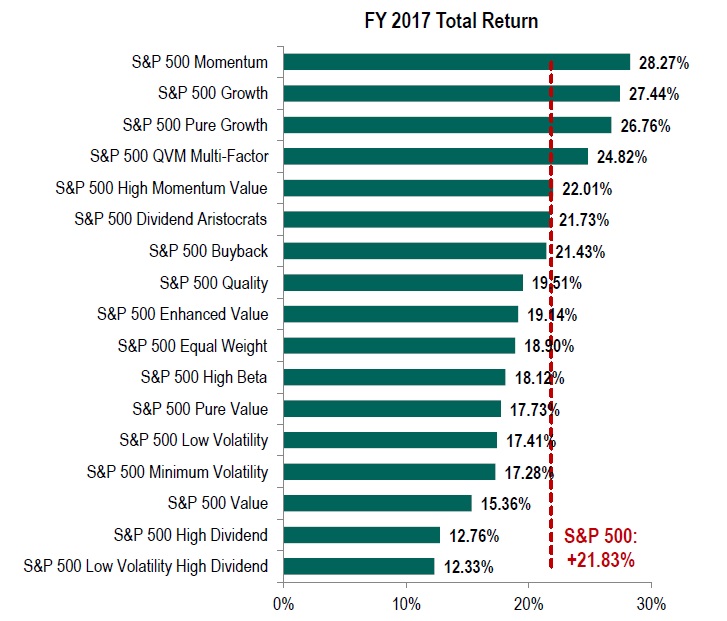

In fact, last year saw the S&P 500 low-volatility index fail to outperform all but a handful of the other factor benchmarks, trailing the growth and momentum indices by more than 10% each (via SPIndices):

Largely as a result of this relatively poor performance, assets have been bleeding from the popular ETFs that track the S&P 500 and MSCI low-volatility indices. With the market off to another strong start in 2018, it would not be surprising to see even more investors exiting low-volatility strategies.

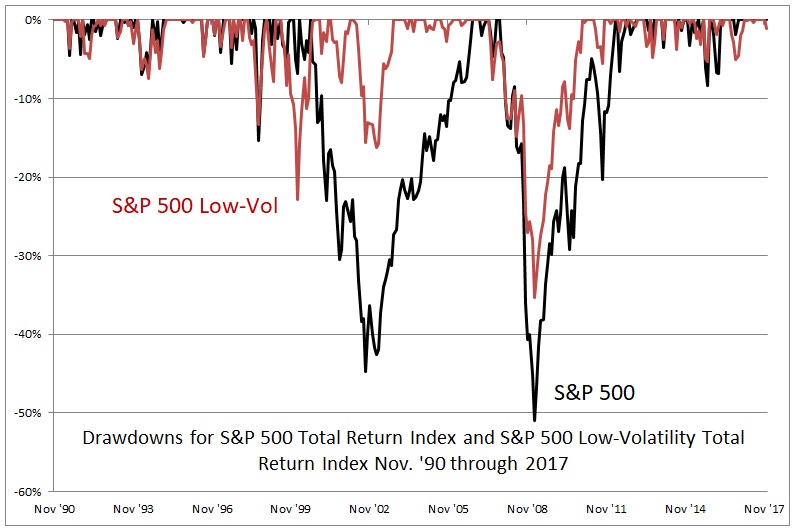

However, as a long-time proponent of low-volatility investing, I would not encourage you to follow suit. There are many advantages to low-volatility strategies such as the consistency of their returns, about which I wrote last summer. Additionally, low-volatility strategies have generally suffered shallower drawdowns with shorter durations than the broader market:

Furthermore, while investors may be inclined to think that risk necessarily equals more reward, the opposite is true in this case; since November of 1990 (the earliest point for common data), the S&P 500 Low-Volatility Index has outperformed the S&P 500 Index by 80 basis points annually, with 70% upside capture, but only 50% of the downside capture: