![]() Traditional beta index funds may expose investors to unintended risks by overweighting the largest or best performers in an ongoing rally.

Traditional beta index funds may expose investors to unintended risks by overweighting the largest or best performers in an ongoing rally.

However, with smart beta exchange traded fund strategies, investors can consider alternative ways to participate in the markets while reducing potential risks.

On the recent webcast (available on demand for CE Credit), Revenue Weighting—A Smarter Way to Own the Market, David Mazza, Head of Investment Strategy, Beta Solutions at OppenheimerFunds, argued that rising demand for smart beta has been driven by specific investor needs that traditional beta index funds do not provide. For instance, smart beta strategies aspire to beat benchmark indices, diminish portfolio risk through targeted exposures, maintain diversified portfolios through various market cycles and provide diverse ways to access the market in a cheap ETF wrapper.

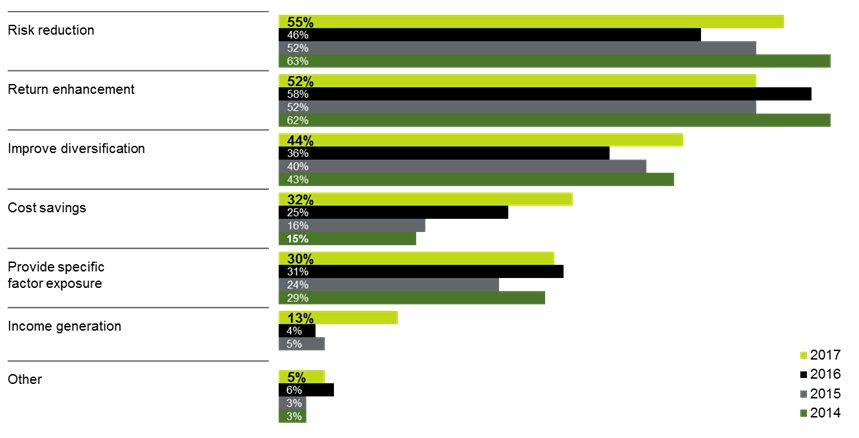

The things smart beta ETFs promise to achieve are also among the top attributes many are looking for in an investment. According to a recent FTSE Russell survey on asset owners, investors use smart beta largely for its risk reduction, return enhancement, improved diversification, cost savings and specific factor exposures.

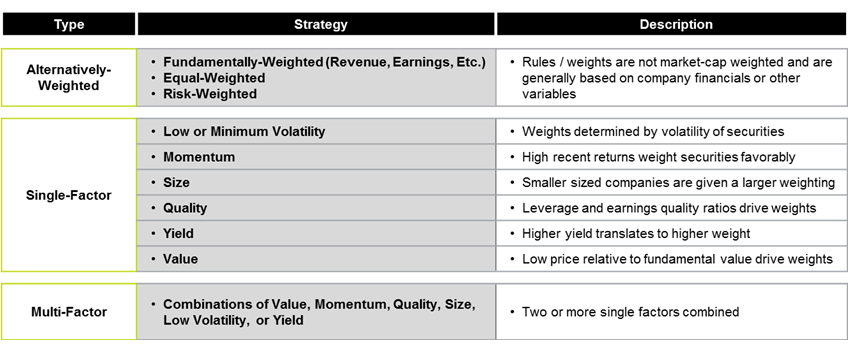

Given the growing universe of ETF options, investors are spoiled for choice as there are now a number of various smart beta strategies available from single factor offerings to multi-factor funds that combine various market proven factors.