By MSCI

How an index approach can help investors align with the Paris Agreement

The worldwide push to arrest climate change is reshaping industries and putting pressure on investors to align their strategies with the 1.5-degree Celsius increase in global temperature targeted by the Paris Agreement.

Challenges to companies in carbon-intensive industries, the risks of extreme weather and, especially in Europe, the setting of standards for sustainable finance all are reshaping the relationship between risk and return and influencing efforts by investors to navigate the transition to a low-carbon future.

Indexes such as the MSCI Climate Paris Aligned Index suite offer a path to climate-strategy implementation. The indexes are designed to help investors seeking to address climate change holistically over time by minimizing their transition and physical risk, pursuing green opportunities and aligning their portfolios accordingly.

The indexes incorporate the recommendations of the Task Force on Climate-related Financial Disclosure, aim to substantially reduce their carbon footprint (including scope 3 and supply-chain emissions), elevate the weight of companies with substantiated reduction targets, and reduce their exposure to risk from extreme weather and other physical manifestations of a changing climate, based on MSCI’s Climate Value-at-Risk model (Climate VaR)

But what may be important is that the indexes also are designed to self-decarbonize; that is, they target a reduction of their carbon footprint by 10% annually. By design, the rate aims to exceed the minimum EU standard to align the indexes with the 1.5-degree Paris target. An analysis by MSCI ESG Research explains why.

Taking the temperature of the index

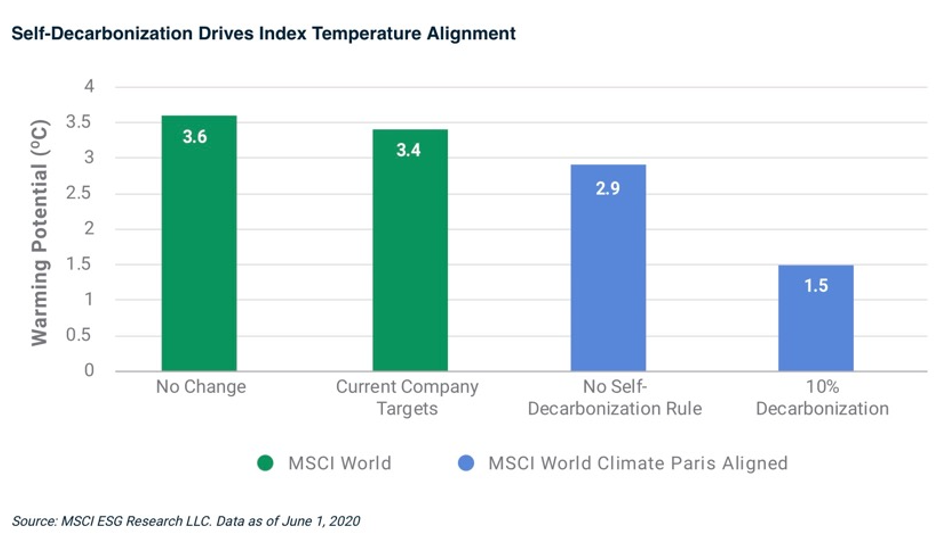

Based on the MSCI’s “warming potential” methodology, which computes the contribution of a company’s activities toward climate change, relatively few companies are currently aligned with the 1.5-degree scenario. That means the core exclusions and reweighting of the MSCI Climate Paris Aligned Index may be useful for investors to support their active ownership but are insufficient in themselves to limit the increase in temperature to 1.5°C.

Self-decarbonization made the difference. Without it, the MSCI Climate Paris Aligned Index had a temperature of 2.9 C, as shown in the chart below. By applying a 10% self-decarbonization rate through 2030, we saw a warming potential of 1.5 C for the index together with a positive Climate VaR.

To determine the rate of self-decarbonization, MSCI tested a range of company-level self-decarbonization rates between 5% and 15%, which is the range of global carbon emissions required annually to achieve net-zero between 2050 and 2100.

Setting the rate at 10% allowed the index to achieve the 1.5-degree target even if some companies fell short in their efforts. In that scenario, the index may naturally become more concentrated around companies that focus on renewable energy or clean technology.

As the analysis suggests, forward-looking measures of climate risk and return may help investors on the path to decarbonization. Whether used as a benchmark for allocating assets, a basis for financial products, a reference for assessing performance or a tool for engagement, MSCI’s Climate Paris Aligned Indexes can anchor a holistic approach to implementing climate strategy.

Read the analysis

Learn more about MSCI’s Climate Paris Aligned Indexes

Originally published by MSCI