A gold ETF is a type of commodity ETF that allows an individual to invest in gold through an exchange-traded fund (ETF). A gold ETF gives investors exposure to the precious metal as well as the benefits of an ETF wrapper.

Just like investing in physical gold, there are diversification advantages and other reasons to invest in the precious metal itself. However, through an ETF, an investor will gain other distinct advantages as opposed to just gold by itself.

Why Invest in Gold?

Investors will typically use gold as a safe haven asset, particularly when the value of the dollar declines. Furthermore, gold provides a hedge for inflation since its price typically rises in conjunction with consumer prices.

During the Great Depression of the 1930s, gold was also a hedge against deflation. While the price of assets were dropping during this time, the purchasing power of gold rose.

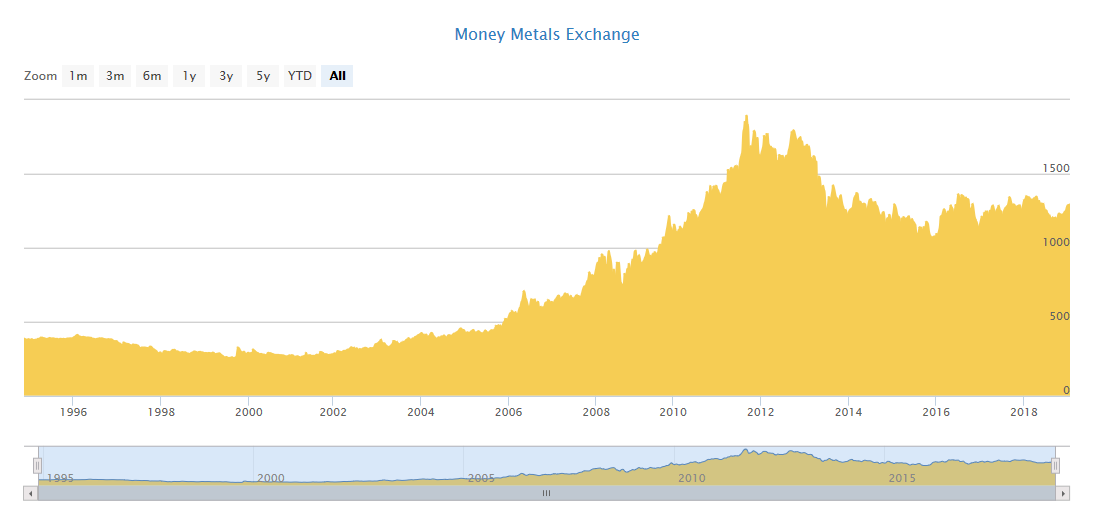

During the financial crisis in 2008, the price of gold increased sharply while faith in U.S. equities was languishing. In essence, gold has proven to withstand times of geopolitical and economic uncertainty.

Furthermore, the value of gold has risen steadily over the years.

Why Use Gold ETFs?

Precious metals like gold offer investors an alternative to divest their holdings. Like other commodities, gold will march to the beat of its own drum compared to the broader market.