(The following are my compiled notes for a recent presentation at ETF Trends. I’ve included the slides for reference in line, however you can also watch a replay here. Thanks!)

[[Note: I have talked to a lot of people in the past two weeks, through phones and Zooms and IBs and texts, and who knows what. I’m sorry if I discredited something or misrepresented some of your thinking here or adopted something of yours as my own. Please don’t sue me, my note taking is just not what it used to be.]]

Let’s start with a couple of quick asides: what we’re seeing in GME, and whatever else comes next, is most likely a blip. If you believe it’s a blip, here’s your narrative cheat sheet:

Right up front – I think this is the 98% outcome. We have a quick little bubble like we’ve seen before and we move on. But I think there’s a 2% outcome that which, while unlikely, is still instructive.

The Briefest of Recaps

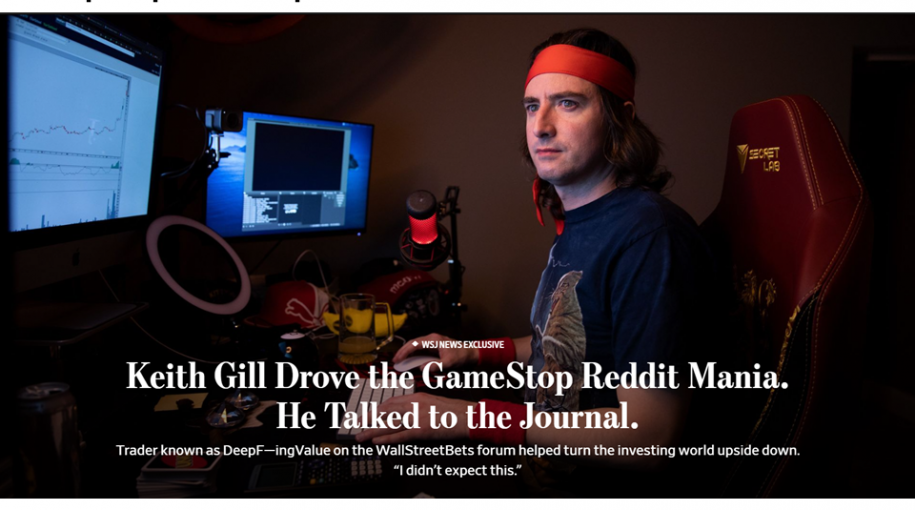

It’s been covered by everyone. Surprisingly well until it got to the end. The specifics aren’t as interesting as this guy named Keith Gill:

First, I gotta say, an incredible piece of journalism (especially photojournalism) here by the Journal. Gill was a genuinely smart, CFA-accredited value investor, and got really public about his pick of the moment on YouTube and on Reddit. He and a cadre of quite professional ‘amateurs’ educated an enormous legion of folks about short squeezes (GameStop was real short):

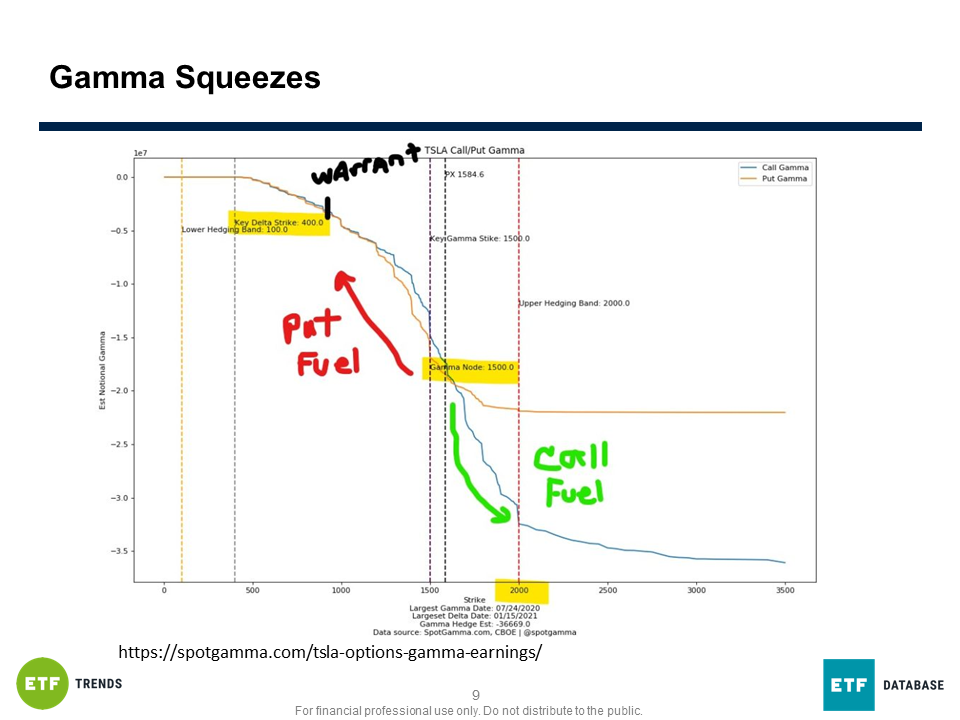

And more interestingly, about Gamma squeezes:

Which, in a nutshell, exploit the procyclical nature of how people who write call options have to hedge — that is, they initially have to hedge very little when things are well out of the money, until all of the sudden they turn into covered call writers. That idea of procyclicality is important, and we’ll come back to it.

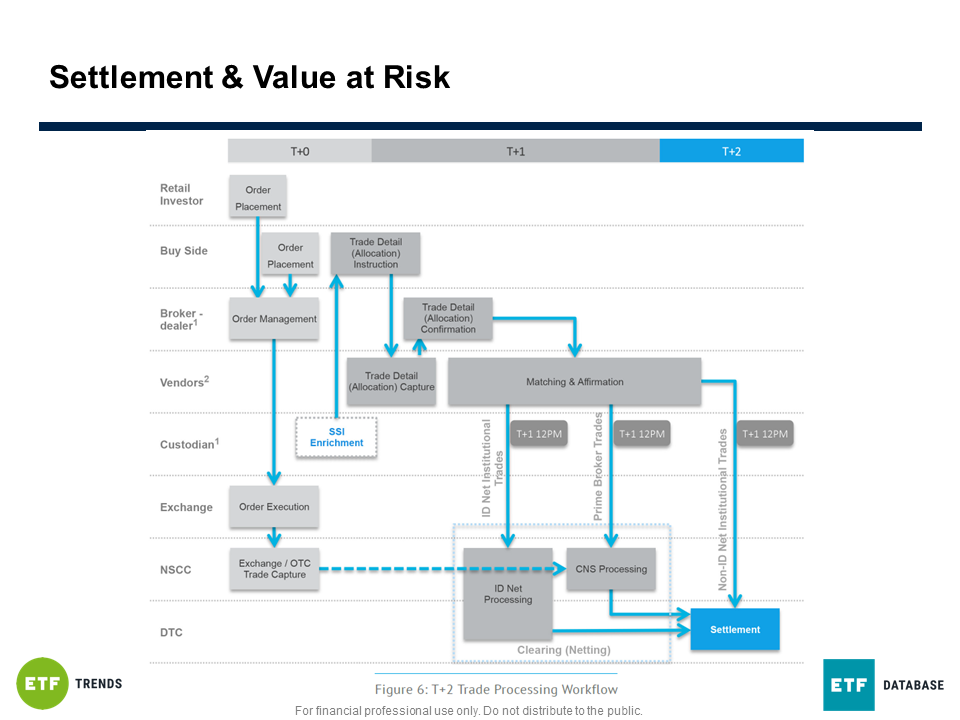

That’s Part A of the story. Part B is that these guys caused enough of a ruckus to cause some problems in this:

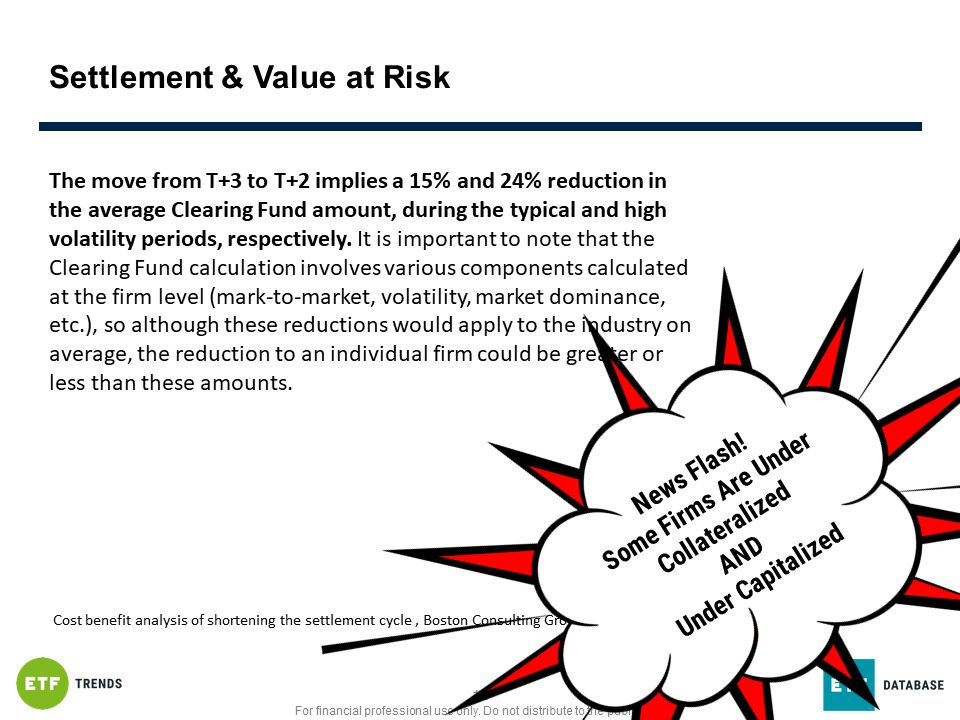

I will just drop this nugget from an old BCG study rather than get into the nitty-gritty. While Dodd Frank put in place fairly nuanced collateral requirements to make sure the DTC and NSCC could in fact backstop all the trading in the country, the move to T+2 actually scaled much of that capital back:

The end result is that some brokers had problems depositing enough cash in their accounts in the settlement plumbing because of how volatile they made the very thing they were deciding to own a lot of. But while it has been a rare treat to be someone who understands the most boring parts of investing for a few days, I don’t think any of this is all that new or unexpected, but more on that in a second.

To round out the recap, here’s the basic narrative of how this impacts things, and that’s risk realignment: short sellers stop being short sellers for fear of getting clocked. Long/Short hedge funds (and anyone else market neutral by design) have to ‘de-gross’ – a new word to me (probably made-up) that means covering your shorts AND selling your longs. In reality, many won’t want to let their longs go, so they go short beta (the market) and long their darlings. This puts, as Jim Bianco at Bianco Research says, the Masters of the Universe in trouble.

Okay, But WHY?

So, before I get into what I think’s happening, I want to acknowledge several things. First, things are moving stupidly fast, and by the time you read this it may all be over. I don’t much care, as I think the forces I describe below still matter. Second, this is 100% full of my own recency bias, egocentrism bias, and personal blind spots. Third, parts of this I know in my genetic makeup and parts of it are changing (and I’m learning) very fast, so I could just be flat out wrong on some of this. Other folks may have tested and disproved pieces of it, which I’m sure I’ve missed, and if this is all so obvious you think “Dave discovered water is wet” then, well, I’m just reading as fast as I can, and thinking hard, so who knows. And, of course, I’m 98% sure this all dissolves, possibly before you read this.

But I think asking ‘why’ is still important, even if this isn’t the next stock market revolution.

We’re seeing four key forces interact:

- Market procyclicality (the cousin to vol)

- Influence from crypto and new-capitalists

- The dominance of the Meme economy and curation algos

- A true societal crisis going on inside a generation

Market Procyclicality

The current market environment is both complex and relatively young. In 2007, Reg NMS made significant changes to how markets work, demanding that every venue connect through a Securities Information Processor, establishing a national best bid/offer and order protection rule, and dozens of other small changes. Many looked very pro-retail (after all, who doesn’t want a best price guarantee!), but as with any complex system, there have been unintended consequences, leading folks like me to talk about ‘speed vs. price’. I wrote a bit about this last week as well (sorry for the redundancy, things move fast).

This pushed a lot of longer term and larger capital into dark pools, changed the fundamentals of market incentives, and ultimately led (as predicted in 2010 by Daniel Buenza et al. at the London School of Economics) to a market where weak norms, rules, and uneven enforcement encourage risk taking, where a kind of toxic transparency uses transactions themselves as information signaling, and one where fragmentation means different parties evolve at different rates, leading to exploitable imbalances. They nailed it.

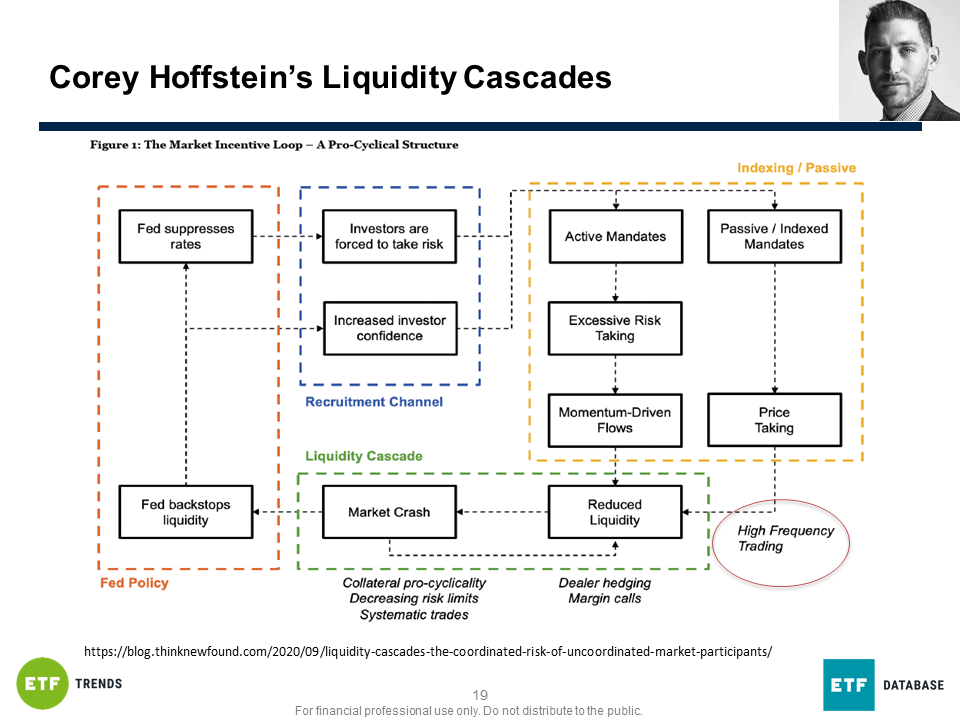

This set the stage for a number of procyclical market issues, from how liquidity is flowing from the Fed to how maker/taker markets and options hedging and index fund management all have their own tendencies to accelerate market movements. Many cancel each other out, but occasionally they align (as we’re seeing). Corey Hoffstein has the axe on this, and while dense, it’s essentially required reading these days.

This is a deep well, but I think Corey is right. The most recent example of these procyclical tendencies was in the rise of Tesla, which exploited several, from index inclusion to its own gamma and short squeeze. Tesla, in many ways, is the example of what the new, highly procyclical nature of markets means for capital formation.

(Side note: Tesla itself was procyclical from the beginning, a self-reinforcing internet-driven meme that was blossomed into being by true believers, who then hacked the capital markets to reward them for their belief. It’s amazing and kind of wonderful most of the time, but that’s not really even the point. The point is simply that markets are increasingly volatile and procyclical.)

Crypto/New-Capitalist Entrepreneurs

In case you weren’t paying attention, a lot of money has been won and lost in Crypto. Here’s a handy chart:

As a newbie to crypto, I didn’t viscerally participate in the carnage that was 2018. But to put it in context, $600 billion was made, and then lost, and then remade in a very short window of time. Now I’m not suggesting “every guy in GME is a crypto millionaire.” I’m saying there’s a high overlap, I suspect, between people who learned how money works primarily through crypto trading, and the current GME crowd. Some of them made real money, some of them learned really hard lessons.

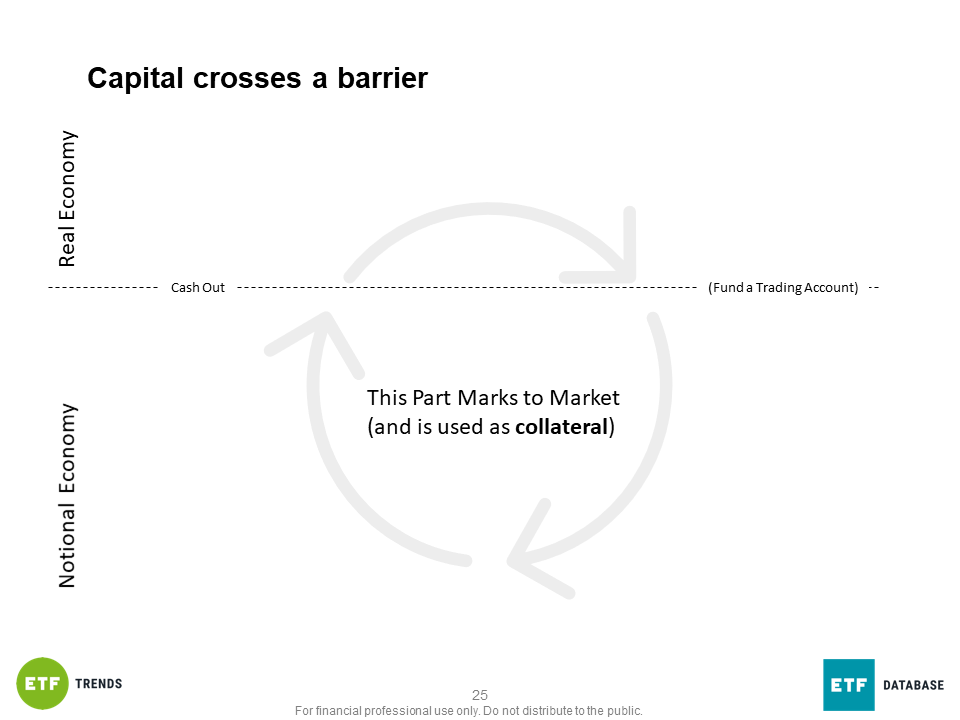

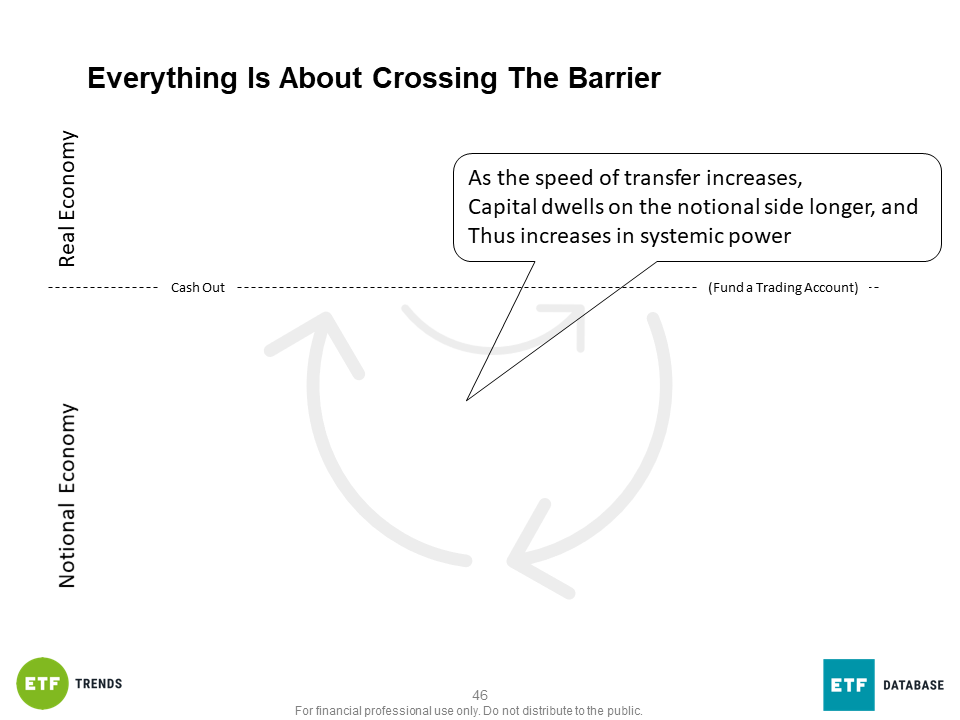

While I am a complete crypto moron, even a quick study sees the detritus of broken crypto traders. I mean the @REKT twitter account literally exists to document guys blown up on margin calls. But the other thing I believe they learned, subconsciously, is about real and notional economics. I think many very smart people have the idea that all economics is zero sum, but in reality, money moves from the real economy into the notional economy and back. The notional side has its own life. If Bob buys a stock for $100 and it goes to $300, Bob’s up $200. But he’s up $200 notional. He’s short $100 in the real economy and long $300 in the notional economy.

Every day, because we mark everyone’s notional capital to the market as a way of keeping score, billions and billions of dollars of capital are made and destroyed. Put another way, every unrealized gain is in a kind of Heisenberg state. It has enormous potential energy, but it needs to be released into the real economy in order to DO anything new. Now consider the roller coaster investors like Dave Portnoy or countless crypto-centric entrepreneurs have experienced in the market.

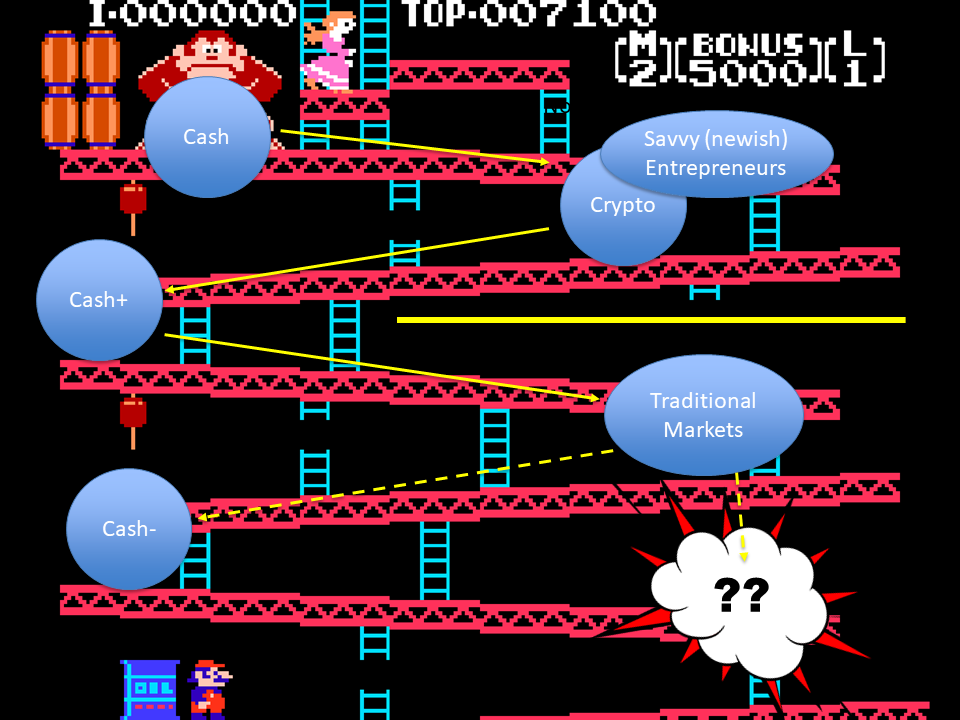

It has quite literally been a game for them, where they took money from the real economy, rolled it through either the crypto economy or the recent stock market, rolled some back into the real economy when Covid hit, and have now parked over in the notional economy in traditional markets, armed with a different approach to risk taking and an understanding of notional-value economics. And now we see whether that capital comes back depleted, or if something interesting happens.

For now, I’m suggesting we have a ‘bolus’ of capital trapped in GME stock, with some spillover into some sub-meme plays. It’s about $15 billion, and I believe it’s crypto-influenced.

The Meme-Attention Economy

The other thing that early crypto traders understood is that popularity is what matters, in crypto and pretty much everything else. Guys like David Portnoy and Elon Musk and even Keith Gill understand that the modern economy is actually about attention — keeping people on platform, whatever the platform is. And memes are the primary way of capturing and manipulating that attention. Yes, memes can be funny, but they’re mostly small packets of semantic density. The meme economy and social media have married.

The meme economy featured enormously in the last two political elections, to the point where I think nobody on any side is laughing any more. The meme economy has been part of finance for the past several years. You only need to read Jim O’Shaugnessy’s Twitter feed to see how well memes can slide right into our fancy B-school discussions, not as distractions, but as ways of communicating more information, faster.

Social media realized this a long time ago, but the absolute masters of this have been TikTok and Reddit. TikTok’s algo is predatory for those of us with attention issues. It’s a constant stream of 1-4 second interactions about things we sort of care about, designed to self-curate down to JUST WHAT YOU WILL STAY WATCHING. Reddit, for its part, has mastered the use of social capital (votes, gold, karma, intra-community rulesets, and tools) to achieve similar results: pushing you toward content you’ll stay engaged with. As I wrote last week, that has its own procyclicality, only now it’s about information.

And guys like Portnoy are masters of this. They get it.

(If you want a great jumping off point for a deeper dive on this particular active force at work, the Journal did a great link-dump style article that is both a great read and a great set of other things to read in the links. A few years ago the Outline did a great piece on shrinking meme dwell time. The Meme Economy is a real thing).

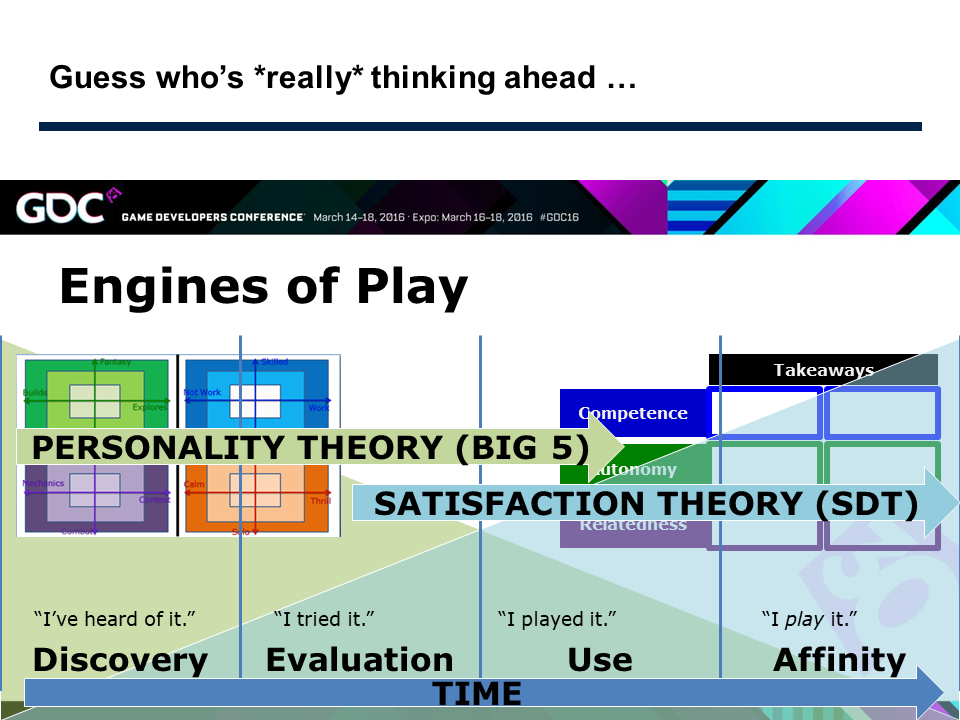

This kind of behavioral nudging and analysis isn’t just about TikTok and Facebook though. You wanna know who’s doing the very-most -interesting work on this kind of behavioral nudging and analysis? It ain’t Wall Street. It’s a video game designer named Jason VandenBerghe (don’t know him personally) who now works for a company called Level-Ex. He previously worked at Ubisoft hacking the human mind until he developed a unified field theorem of gamer purchase and play behaviors.

The work being done *outside* finance on modelling and monitoring human behavior so that we can influence decision making is just light years ahead of anything I’ve seen *inside* finance. On the one hand, yay? I’m glad Jason (who I don’t know) is now working on ‘games for good’ type projects, because when you go down this rabbit hole, you’ll see just how GOOD the game industry has gotten at this, and it’s a bit scary honestly. “Gamification” isn’t just a fun sounding word. It’s a whole way of approaching experience design. They’ve groked this in fullness.

And so has social media.

And so has a whole crew of folks with brokerage accounts. And the overlaps are enormous. My video gaming Twitch streamers are now all just learning the markets. They’re all in. And they understand the attention economy. They understand you have to play a new game right at launch, or the player base disappears.

Social Crisis & Heroes

I’m a big Scott Galloway fan (don’t know him personally). He’s a professor from NYU who does a great podcast called Pivot with Kara Swisher. He’s a real no BS guy, and spends pretty much all his time studying how culture and markets are interacting. He’s kind of an ‘it guy’ in the wonkosphere. He believes a very big driver of what’s happening comes down to what sounds a bit obvious, but also made a lot of people uncomfortable. His narrative goes something like this: we have a whole generation of young men who are trapped at home and bored. They’re also angry because they feel like they’ve been lied to about how the world is supposed to work. The markets have become their war, their thing to rally behind. But they’re going to realize they have no friends in the foxholes when the market fights back.

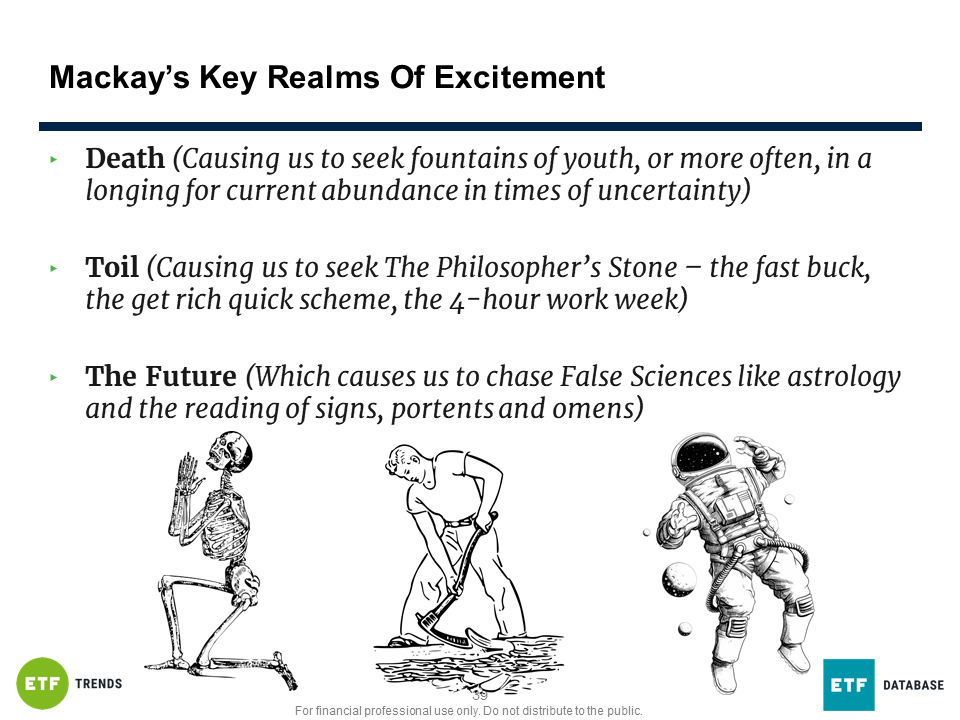

This actually blends in well with how Charles Mackay told us this would work back in 1841. He suggested you need to excite people in several dimensions to get a real madness rolling:

Fear of death causing risk taking behavior – yolo! Desire to make money from the ‘system’ instead of work? Sign me up. No, seriously, that one’s universal right? And is uncertainty about the future driving us toward irrationality? Absolutely.

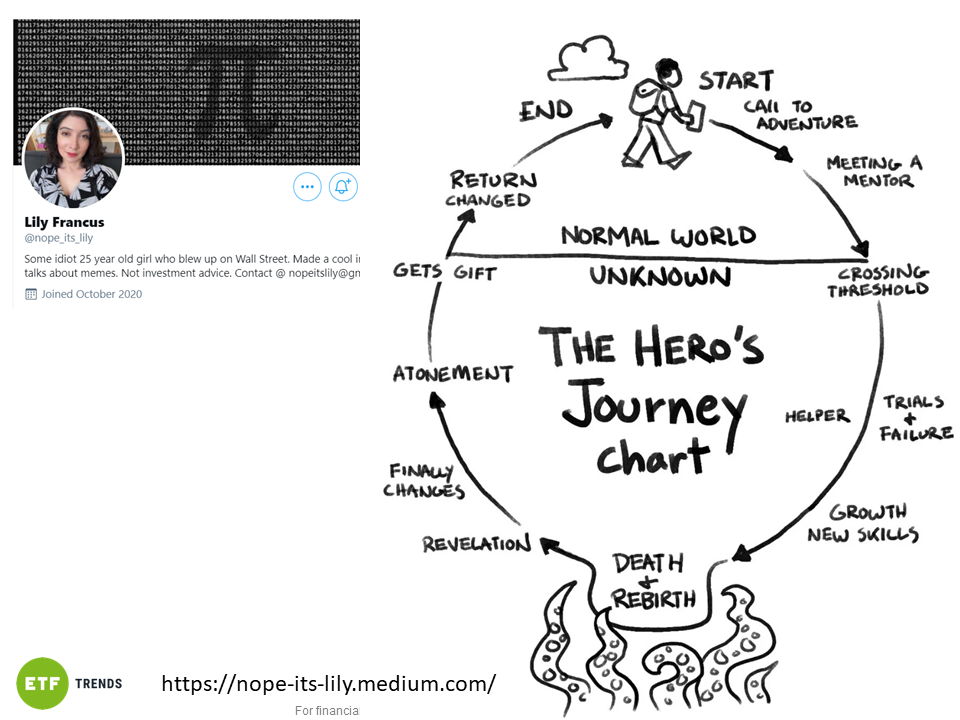

There’s a similar angle going around the punditosphere on the social dynamic here, and it comes from Lily Francus, a PhD student who maybe people knew about but I just started reading. She seems to have made a name for herself by digging into some options market dynamics (I haven’t read the math yet, I’m very tired). In part of her analysis she presents a kind of ‘hero’s journey’ explanation for what we just saw.

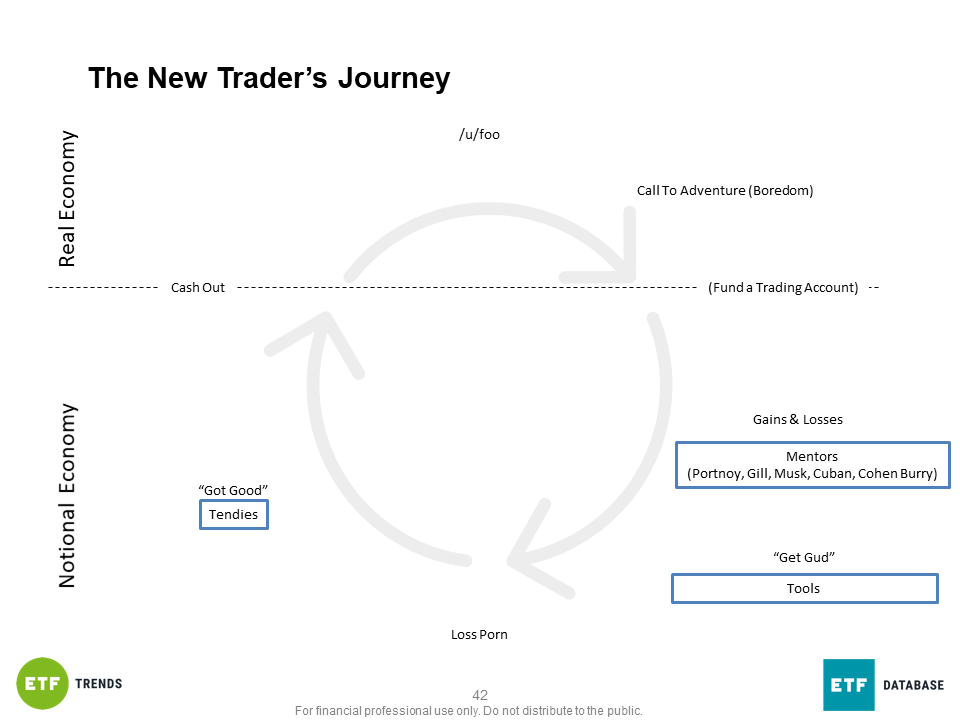

I found it striking how this idea of ‘crossing the threshold’ mirrored the actual experience of traders here:

She points out that we have all the key elements for really compelling monomyth stories – the juiciest ones we all want to secretly be the protagonist in. We have Villains in the shorts, we have Heroes in the narrative of “Keith Gill’s Reddit Army,” and we have all the mentors you could ask for: Portnoy, Gill, and so on. You’ve got many small trials to get the heroes battle tested, from Bitcoin to Tesla, and you’ve got narratives of crushing defeat and glorious rebirth. And all of that good stuff happens, explicitly, on the notional side of the economy.

Piecing It All Together

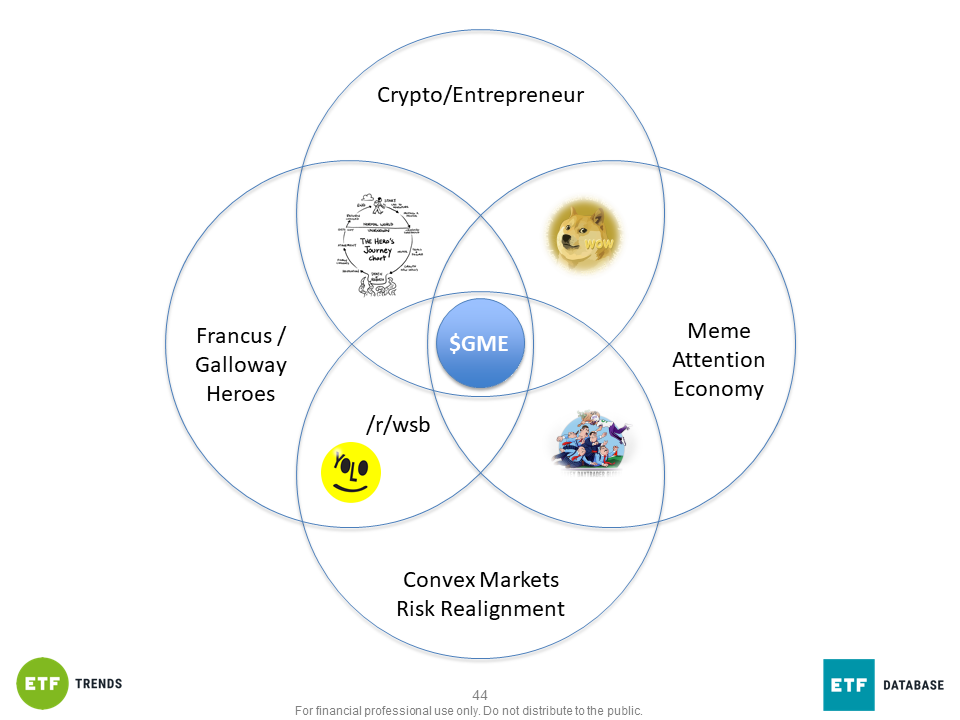

So, when you put all of this together, I think you see some pretty interesting interactions at work.

Each of these four forces interacts with the others in interesting ways. By itself, some combination of the Francus/Galloway Social Crisis mode and the nature of our markets set us up for a kind of yolo risk taking and the rise of WallStreetBets. Heck, even just the interaction of the meme economy and crypto gave us a laugh in Dogecoin. Portnoy clearly lives in the overlap between the attention economy and these hyperactive markets.

In the center we’ve got the focal point of the moment. The Thunderdome. But that focal point is really just like the victim of this denial-of-service attack on capital. This disorganized bolus has held up chunk of capital in the system. It’s at peak intensity because the overlap is at it’s highest. All the forces converge with white-hot heat.

The check on this being a problem, frankly, is the barrier between the real economy and the notional economy. Put simply, because value in the traditional system requires moving in and out of cash in the real economy, you create the ‘run for the exits’ problem. But what happens if this capital can move more quickly, or more surreptitiously, than we expect? That’s interesting. And problematic. The longer the bolus of capital stays on the notional side, the more power it has.

So What, Big Deal, Again

*IF* this bolus does not just dissolve, but moves to a target quickly enough, or hides in the real economy waiting to regroup, where exactly should we be worried? Off the top of my head, things I’d want to do more thinking about include:

- Out-of-the-money call options in junk/munis could cause premium spike in the ETFs, following buy gamma squeeze.

- Precious metals? I know this is the narrative of the moment, but I suspect this would be a fairly short term disruption if not timed to futures market deliveries.

- Index rebalance manipulation. Everyone knows the rules, but there might be gameable inclusion metrics.

- Unlock manipulation. (Jim Bianco was quick to point out how many execs have explicit stock price targets, a la GE’s Culp)

- Leverage and collateral issues in the secondary lending market/swaps market that are probably above my pay grade

- Procyclical leveraged ETPs

So what do you do? Well, first of all, remember that I’m probably wrong. The 98% outcome here is the “cohesion breaks, money runs home, last one out’s a rotten egg” version. But assuming I’m just a tiny bit onto something, I think the main implication is that it takes Corey Hoffstein’s liquidity cascade issues and the procyclical market vol problem and makes them both at least incrementally worse. It increases that feeling we all have that the market is always balanced on the head of a pin.

So again, what do you do? You probably have three choices, and some homework.

- You get very tactical and try and play the game (this seems like a bad idea)

- You get very strategic, stay invested, and ride it out (this is probably a better idea)

- You modify your portfolio to take advantage of convexity (at the expense of beta)

- Upside that increases with upside volatility

- Downside that either minimizes or inverts downside volatility

And here’s the homework. The one piece of this we know, with absolute certainty, is that there will be a realignment of risk. Even the very short term impact on the short market and hedge fund de-grossing will have implications for all risk assets. Now’s one of those times when we really need to pay attention.

Thanks for listening. If you’ve got ideas, send them to me at [email protected], or follow me on Twitter @DaveNadig.